In a significant development, all 11 Spot Bitcoin Exchange-Traded Funds (ETFs) applicants have submitted amended 19b-4 forms with the U.S. Securities and Exchange Commission (SEC).

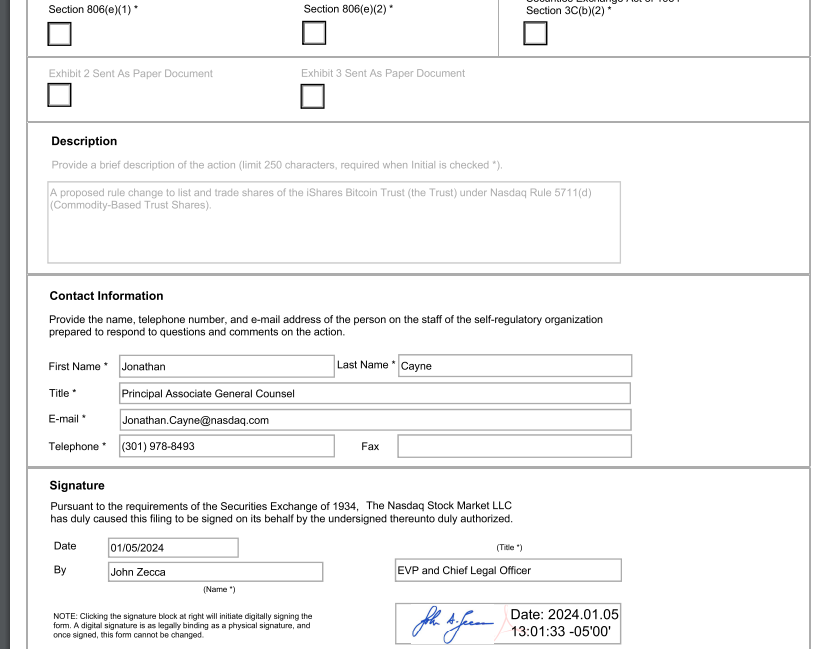

On Friday, Nasdaq filed amended 19b-4 forms for BlackRock and Valkyrie Bitcoin Spot ETFs, signaling a crucial step towards the anticipated approval of their ETFs.

Notably, for Spot Bitcoin ETFs to become operational, the SEC must greenlight the 19b-4 forms for each fund, which are expected to be published on the SEC’s website. Additionally, the S-1 forms must gain effectiveness.

Renowned Bloomberg ETF analyst Eric Balchunas commented on the matter, stating it’s basically a done deal at this point. He also suggests that the SEC’s request for amendments indicates informal approval, with official approvals expected on Monday. He stated:

“Latest I’m hearing (from multiple sources) is that final S-1s are due 8am on Monday as the SEC is trying to line everyone up for the Jan 11th launch.”

It is important to note that the SEC has asked the ETF issuers to file the amendments because “staff had no additional feedback on the paperwork for several of the firms after the latest amendments.”

If these amendments are successful, trading for these ETFs could commence on Thursday.

Bitcoin Spot ETF: Accelerated Discussions Between the SEC and Issuers

On a similar note, investment management firms, stock exchanges, and the SEC are constantly in talks about final wording changes on Spot Bitcoin ETF filings. While the SEC sought minor changes, issuers may update filings to disclose fees or market-maker identities by Monday, anticipating final approval by late Tuesday or Wednesday.

According to a recent report by Reuters, which cited anonymous executives and representatives of five firms, issuers have recently held meetings with SEC officials about the S-1 prospectus documents that every ETF is required to submit for approval.

In a departure from usual procedures, the SEC is also seeking written requests from issuers to accelerate the effective date for ETFs launching next week, a potential indication of the regulator’s commitment to expediting the approval process. The report states:

“People familiar with the filing process have said issuers that met end-of-year filing revision deadlines may be approved to launch by Jan. 10, the date when the SEC must either approve or reject the Ark/21Shares ETF, the fund that is first in line.”

Is BlackRock Buying $2B Worth of BTC?

Amidst discussions about potential approvals, rumors circulate that BlackRock could purchase $2 billion worth of bitcoin, with Ark Invest also considering a substantial investment of $130 million.

Balchunas notes:

“It would be on brand for BlackRock. They’ve lined up and injected big cash into new ETFs on the first day of trading, so it registers as volume/flows. If it’s true, $2b would blow away all first day/week volume/aum records for an ETF.”

Despite these significant developments, Bitcoin’s price has exhibited a muted response, trading around $44,000.

This series of developments positions the digital asset market on the brink of a transformative moment, with the potential approval of Spot Bitcoin ETFs paving the way for broader institutional and retail participation.