Bitcoin Spot Exchange-Traded Funds (ETFs) achieved a historic milestone by accumulating over $6 billion in assets within their first month of trading, surpassing any ETF launched in the United States in the past three decades. This accomplishment occurred as Bitcoin rose above $47,000, making Bitcoin Spot ETFs the only ones among over 5,500 ETFs to reach such a significant milestone within the initial 17 trading days.

Bitcoin ETFs Inflows

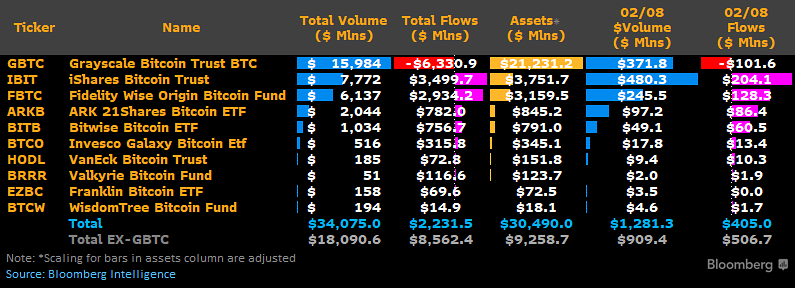

Spot Bitcoin ETFs in the United States just recorded their third-largest inflow day, raking in $403 million. This significant influx of money was recorded despite outflows worth over $100 million from the Grayscale Bitcoin Trust (GBTC).

In just under a month since their debut on January 11, spot Bitcoin ETFs have demonstrated impressive performance, surpassing the $2.1 billion mark, including the GBTC outflows. This robust investment flow underscores the prevailing appetite for BTC within the market.

Notably, the third-largest day of inflows for spot BTC ETFs coincided with Bitcoin’s surge past $47,000, marking a significant milestone just $2,000 shy of breaching new yearly highs.

BlackRock Leading the Industry

As per the data, the spot Bitcoin ETF by BlackRock, iShares Bitcoin Trust (IBIT), is currently leading the industry with an inflow of $204 million on February 8. In comparison, Fidelity, the asset management firm, recorded $128 million in inflows, ARK 21Shares had $86 million, and Bitwise received $60 million. The remaining seven ETFs collectively amassed inflows worth $27 million.

Trading Volume and Major Milestones

On February 8, the Grayscale spot Bitcoin ETF recorded another $102 million in outflows with a trading volume of $371 million.

Notably, IBIT has not only demonstrated superiority in inflows but has again surpassed the trading volume of GBTC, reaching $480 million. This is a significant milestone in outpacing the industry’s “liquidity king.”

Bloomberg senior ETF analyst Eric Balchunas highlighted the uniqueness of BlackRock’s ETF exceeding the Grayscale in terms of trading volume. He noted that it usually takes around five to ten years for a few funds to overtake the industry “liquidity king.”

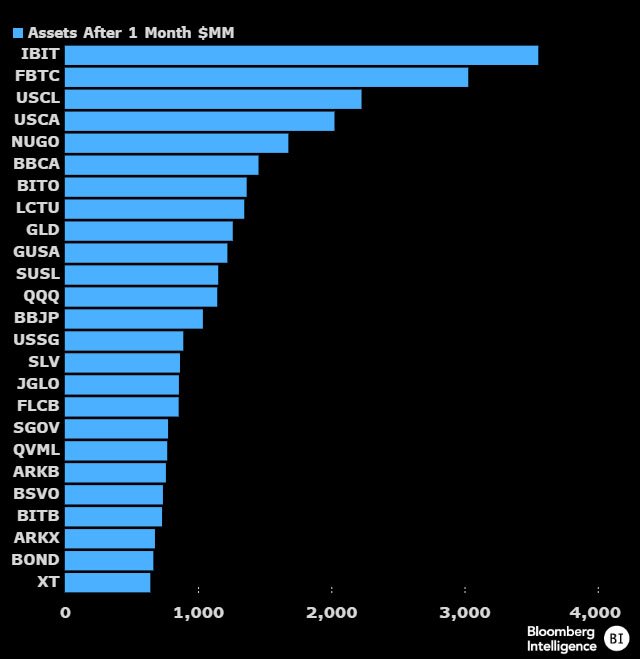

Bitcoin Spot ETFs: Largest Debut Month in 30 Years

On the day when Bitcoin rose above $47,000, BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC) made history by amassing over $6 billion in assets within their inaugural month of trading.

This remarkable achievement positions them ahead of any ETF launched in the United States over the past three decades, according to data from Bloomberg Intelligence. Out of a pool of more than 5,500 ETFs, these two funds stand as the sole entities to surpass this impressive milestone within the initial 17 trading days.

Balchunas said that the offerings from the two ETF issuers are in a “league of [their] own.” However, he also added that the data does not include Grayscale’s inflows since “they bring over pre-existing assets.”

Prior to the debut of the two ETFs, BlackRock’s iShares Climate Conscious & Transition MSCI USA ETF had the most assets under management in its debut month at $2.2 billion. The offerings from BlackRock and Fidelity have seen inflows every single day since their start, which Balchunas described as “literally unprecedented.”

The success of BlackRock’s IBIT is further exemplified by its positioning among the top 0.2% of all Exchange-Traded Products (ETPs) issued in the United States in 2024.

The recent performance of spot Bitcoin ETFs, especially BlackRock’s iShares Bitcoin Trust, has set new standards in the digital asset world. As these ETFs continue to shape the market, their influence on the broader financial landscape is poised to become even more pronounced in the coming months.