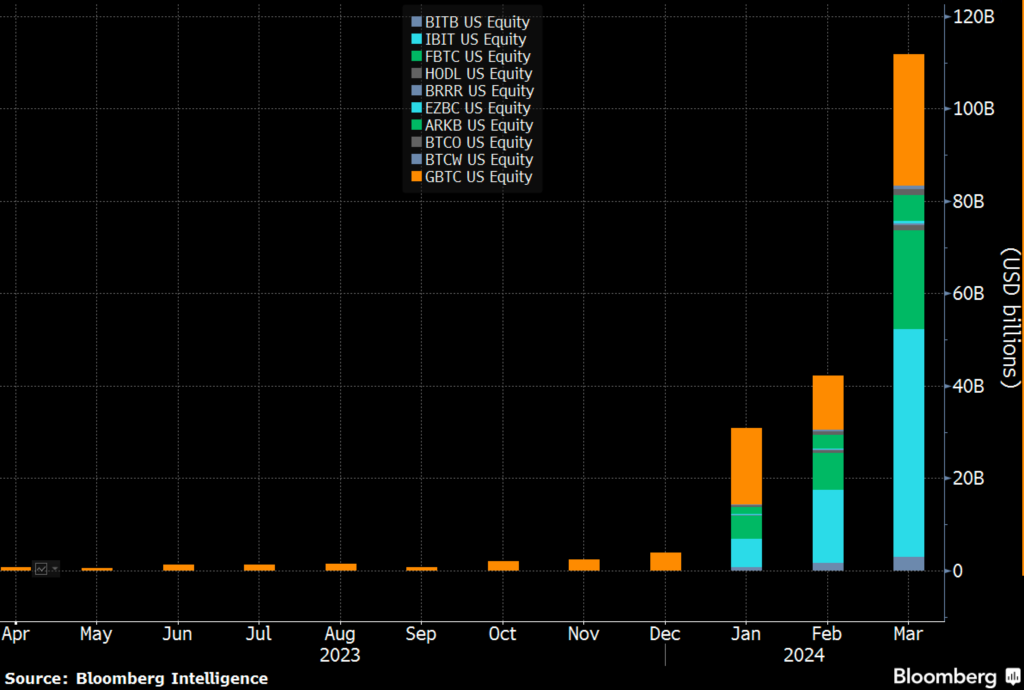

March was a remarkable period for spot bitcoin Exchange-Traded Funds (ETFs), with trading volume reaching an impressive $111 billion, nearly tripling the figures from February. This surge in bitcoin spot ETFs volume reflects a growing interest in these relatively new financial instruments within the digital asset market.

Eric Balchunas, a senior ETF analyst at Bloomberg, shared the significance of March’s trading volume on social media platform X, calling it “March Madness.” He noted that it was almost triple the combined volume of January and February.

However, the analyst remained cautious about predicting future trends, stating:

“I can’t imagine April will be bigger, but who knows.”

However, recent trends indicate a cooling down of spot Bitcoin ETFs’ popularity, with daily trading volume dropping to $5.4 billion, down 36% from its peak in early March. Despite positive net inflows into bitcoin investment products last week, GBTC’s outflows persist, impacting bitcoin prices, which experienced a $5,000 correction, trading at around $65,000.

GBTC Outflows in March

Despite the overall success of spot bitcoin ETFs, Grayscale’s GBTC fund faced considerable challenges. Since its launch in January, GBTC has experienced total outflows surpassing $15 billion, indicating significant selling pressure. This selling pressure intensified earlier in March following reports of Genesis Global Holdco LLC’s potential sale of 35.9 million GBTC shares, valued at around $2 billion.

Analysts observed fluctuations in GBTC’s outflows, with a drop from $642.5 million on March 18 to $104.9 million on March 28, suggesting a potential slowdown in selling pressure. However, recent data showed a resurgence, with outflows surpassing daily averages, reaching $302.6 million. James Seyffart writes:

“$302.6 million outflow for GBTC today — honestly higher than I expected. I thought this would have slowed down by now.”

These outflows have contributed to a 46% decrease in GBTC’s bitcoin holdings since January.

Bitcoin Spot ETFs: Market Leaders

Meanwhile, BlackRock’s IBIT and Fidelity’s FBTC emerged as leaders in bitcoin holdings among spot bitcoin ETFs, collectively amassing over $27 billion worth of BTC. Despite Grayscale’s struggles, BlackRock and Fidelity’s ETFs continue to attract significant inflows, with assets under management reaching around $18 billion and $10 billion, respectively.

According to recent data by James Seyffart, IBIT has just taken over the volume market share from GBTC. Balchunas comments on this achievement, stating:

“While all of the ETFs won in terms of being profitable hits, IBIT won the volume race and is officially the GLD of bitcoin. It’s basically a wrap.”

Bitcoin Price Trends

The recent correction saw nearly $500 million in liquidations and a surge in bearish sentiment in the options market. Additionally, spot bitcoin ETFs returned to net outflows after a week of net inflows, with Monday’s outflows totaling $85.7 million, primarily driven by Grayscale’s fund shedding $302.6 million.

As the digital asset market braces for the Bitcoin halving event scheduled for April 20, investors remain vigilant amid market uncertainties and the evolving landscape of spot bitcoin ETFs.