Bitcoin has been making headlines with new record highs and bold predictions. Renowned analyst PlanB has set a striking forecast for bitcoin, projecting that its price could soar to $500,000 within the current four-year halving cycle.

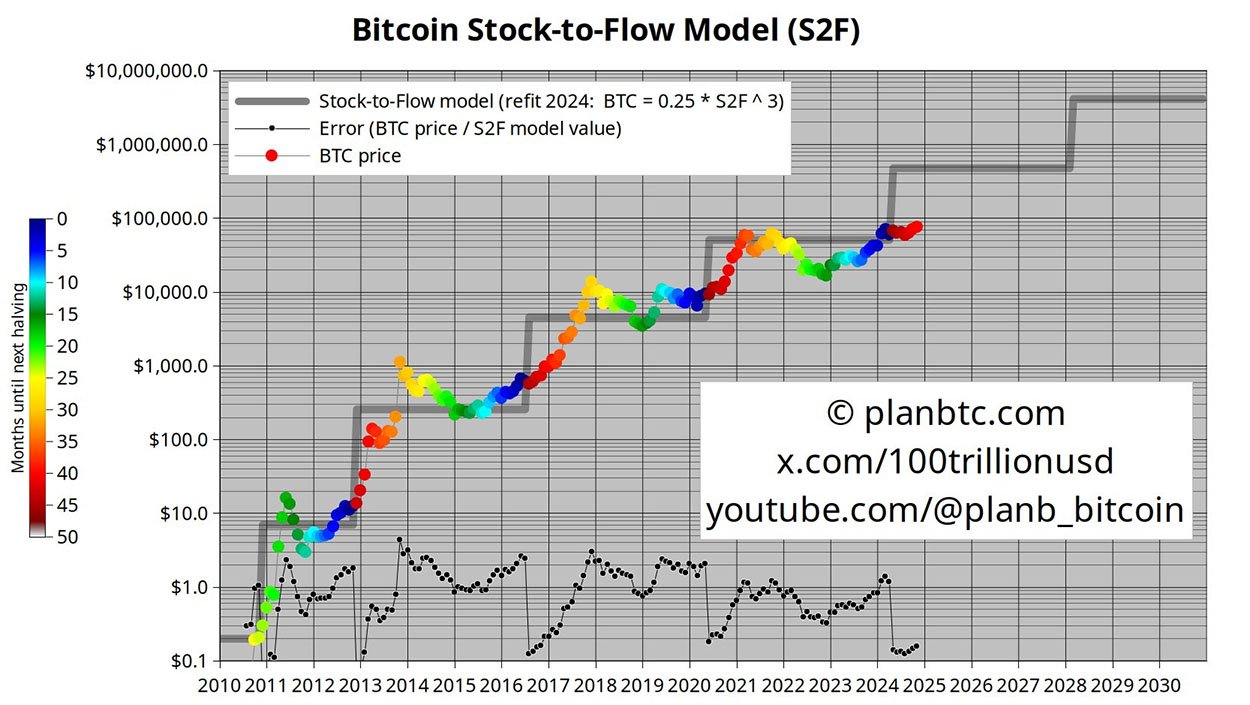

This ambitious outlook is built on both PlanB’s well-known stock-to-flow model and favorable political developments in the United States.

Recently, bitcoin surged to an all-time high of over $80,000, fueled in part by market enthusiasm following Donald Trump’s presidential re-election and supportive economic policies. But can bitcoin realistically reach PlanB’s predicted heights?

Bitcoin’s recent rise to a record-breaking $80,000 has sparked renewed interest and optimism in the Bitcoin world. Trump’s win has been associated with a renewed push for pro-Bitcoin policies, including a potential U.S. national bitcoin reserve.

During his campaign, Trump proposed establishing a national bitcoin reserve, a move that analysts say could drastically increase institutional demand for bitcoin.

If implemented, this national reserve could add an estimated 200,000 BTC to U.S. reserves annually. This would create consistent buying pressure and help bitcoin maintain upward momentum.

With influential voices like pro-Bitcoin Senator Cynthia Lummis also supporting such a reserve, this policy has the potential to redefine the financial landscape and make bitcoin an essential part of the U.S. economic strategy.

Related: Bitcoin Reserve Bill Referred to Banking Committee

PlanB has called this surge “the beginning of a significant bull run,” indicating that bitcoin may be on the brink of a historic price rise. As he explained to his followers:

“So basically, we broke the month-long trading range where bitcoin moved between $60,000 and $70,000… If history is any guide, if the stock-to-flow model is any guide, then we’ll see sharp price increases from here.”

This stock-to-flow model measures bitcoin’s value based on its scarcity and the effects of halving cycles, which reduce the supply of new bitcoin every four years.

PlanB’s predictions are not without precedent. His stock-to-flow model, which projects bitcoin’s value through scarcity, has held up during previous market cycles, and his forecasts are respected across the Bitcoin community.

According to PlanB, bitcoin could reach $500,000 within this halving cycle, which will conclude in roughly four years.

PlanB sees bitcoin’s price landing somewhere between $250,000 and $1 million in this period. He explains, “The stock-to-flow is just a compass, but it has proven effective in the past.”

For bitcoin to reach his high-end target, though, several factors must align. Key drivers include increasing institutional interest and supportive economic policies, such as Trump’s bitcoin reserve proposal and the involvement of major companies like MicroStrategy.

Bitcoin’s ascent is further buoyed by large institutional investors such as MicroStrategy, a company led by Michael Saylor. MicroStrategy has announced plans to increase its bitcoin holdings to 200,000 BTC annually, echoing Trump’s proposed reserve strategy.

MicroStrategy’s steady accumulation of bitcoin signals confidence in its long-term value, and large-scale purchases like these are anticipated to support the digital asset’s upward trajectory.

Institutional enthusiasm for bitcoin has also reached new highs with the approval of several U.S.-listed spot Bitcoin exchange-traded funds (ETFs) earlier this year.

These ETFs have seen impressive inflows since Trump’s election, indicating renewed confidence in Bitcoin’s future. This influx of institutional capital not only helps stabilize the price but also demonstrates bitcoin’s increasing acceptance as a mainstream asset.

As Jan Van Eck, CEO of Van Eck Associates, explained, Bitcoin’s potential lies in its growing role as “digital gold.” He believes that bitcoin’s value could one day reach half that of all the gold outstanding, setting his own target for bitcoin around $300,000.

He emphasized the asset’s potential as a store of value amid economic uncertainty, and added:

“It’s a reasonable base assumption. My basic premise is ultimately Bitcoin’s value will be half of that of all the gold outstanding so you’re talking about something like $300,000 for bitcoin.”

Despite the optimism, there are concerns that could pose challenges to bitcoin’s meteoric rise. Some experts caution against the dangers of speculative behavior in the bitcoin market.

Practices like “spoofing,” where large buy or sell orders are placed to manipulate market prices, can lead to artificial volatility. These activities are a cause for concern for analysts wary of sudden market swings.

Additionally, some investors worry about the risks associated with a potential overreliance on institutional interest. If market sentiment shifts or institutional investors reduce their exposure to bitcoin, prices could experience sharp corrections.

Critics argue that while bitcoin’s scarcity supports its value, any speculative surge could lead to a bubble, especially if buying pressure outweighs organic growth in demand.

Bitcoin’s rise to $80,000 and the ambitious forecasts surrounding it come at a pivotal time.

Trump’s proposals could position bitcoin as a central component of the U.S. financial system, potentially even allowing it to serve a role akin to gold reserves.

The establishment of a bitcoin reserve would signify a historic shift, reinforcing the scarce digital asset’s standing on the global stage.

PlanB’s $500,000 target for bitcoin remains speculative, yet the factors driving his prediction—institutional demand, political support, and bitcoin’s scarcity—make it a possibility.

While reaching this milestone would require sustained momentum and regulatory clarity, the groundwork is being laid.

PlanB emphasizes that his stock-to-flow model is a “compass” rather than an absolute guarantee, yet its past success suggests that bitcoin’s trajectory could indeed reach new heights in the years to come.

Whether bitcoin reaches PlanB’s lofty target of $500,000 or settles at a more conservative price point, its role as a key asset in a rapidly evolving digital economy is clear.

As the world watches the next phase of Bitcoin’s journey unfold, it’s evident that it is not just a speculative asset—it’s a potential pillar of modern financial systems and a symbol of innovation in a changing world.