As Bitcoin’s supply on exchanges hits a four-year low, investors are eyeing a potential bullish trend in the bitcoin market. This significant development amid bitcoin price fluctuations signals the strength of the bull market currently underway.

The Decline in Bitcoin Supply

Recent data from digital asset analytics firms has revealed a notable decline in the supply of Bitcoin (BTC) held on exchanges over the past four years. This decline, amounting to nearly 40% since 2020, has sparked optimism among investors and suggests a new trend in the Bitcoin landscape.

According to reports, Bitcoin’s inflow in the last two quarters has triggered massive bullish sentiment in the market, resulting in increased activity around the leading digital asset.

Implications of the Exodus

The decreasing supply of bitcoin on exchanges signals investors’ growing confidence in holding the asset for the long term. This trend reflects a collective move towards a ‘hodl’ mentality, where investors hold onto bitcoin through market cycles, anticipating future value appreciation.

CQ analyst PAPI noted in a report:

“More Bitcoin is being bought and HODL’d than is being mined, and this has been the prevailing trend since 2020. As we know with commodities, scarcity boosts perceived value. The new trend suggests that we won’t see a pronounced rise in supply towards the end of the cycle.”

The Role of Bitcoin ETFs

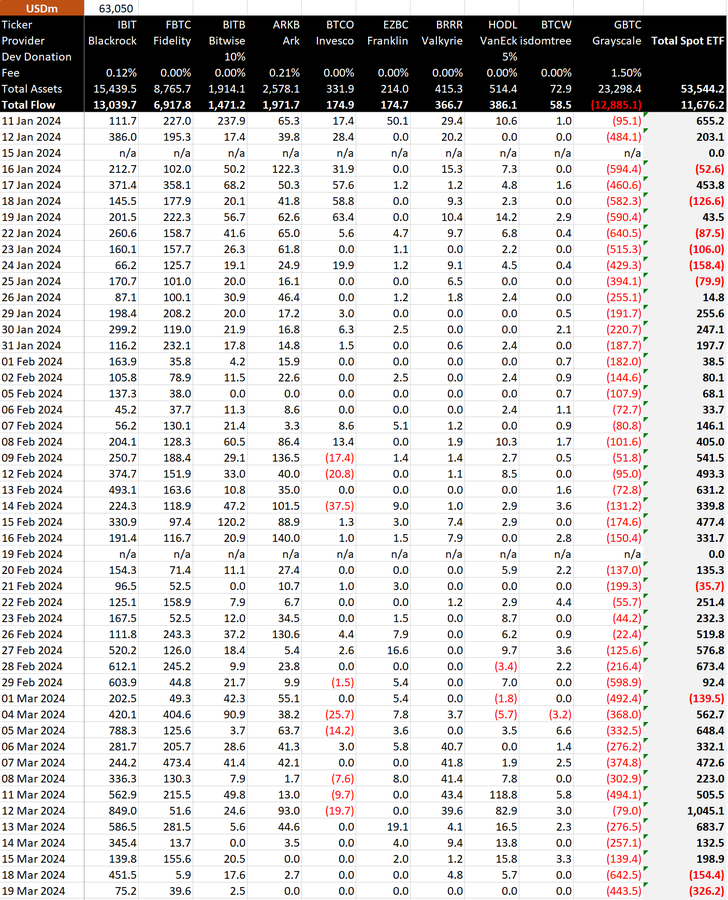

The approval of spot Bitcoin ETFs remains a significant catalyst for recent flows in the market. These ETFs provide traditional finance players with new investment opportunities, increasing their exposure to bitcoin. BitMEX Research disclosed on March 19th that these Exchange-Traded Funds experienced an unprecedented net withdrawal of $326 million.

Analysts suggest that the anticipation of Bitcoin ETFs has sparked investor interest and confidence in the future of Bitcoin, encouraging them to hold onto their coins with the expectation of increased value down the line.

Market Evolution and Institutional Adoption

The decline in bitcoin supply on exchanges is concurrent with a broader evolution of the bitcoin market. Institutional adoption is on the rise, leading to the need for secure, long-term storage solutions. This institutional foray, coupled with growing awareness and acceptance of bitcoin as a legitimate investment, is reshaping market dynamics.

Moreover, the introduction of new financial products such as Bitcoin ETFs and futures contracts provides investors with more avenues to gain exposure to bitcoin, reducing reliance on exchanges for direct purchase and storage.

Bullish Horizon and Halving Anticipation

Historically, the movement of assets off exchanges has signaled bullish sentiment in the market. As supply on exchanges decreases, available liquidity tightens, potentially leading to significant price increases. This scenario sets the stage for a potential bullish run, as seen in previous cycles.

The anticipation of the next Bitcoin halving event, expected to occur in April 2024, adds to the bullish sentiment. Halving events, which reduce the rate at which new bitcoin are created, have historically preceded substantial price increases as the reduced supply meets growing demand.

Reasons Behind Price Volatility

Despite the positive indicators, bitcoin’s recent price decline has raised concerns. Analysts suggest several reasons behind this downturn, including overleveraged positions in the derivatives market and decreasing interest in Bitcoin ETFs, leading investors to take profits instead.

Additionally, uncertainty surrounding the approval of Spot Ethereum ETFs and the looming Bitcoin halving event may contribute to market volatility.

Conclusion

The decline in bitcoin supply on exchanges is a significant indicator of a potential bullish trend in the market. Investors’ growing confidence in holding bitcoin for the long term, coupled with institutional adoption and anticipation of new financial products, suggests a maturing market with optimistic prospects.

As the market evolves and adapts to changing dynamics, investors should remain vigilant of potential volatility while keeping an eye on long-term trends and developments within the Bitcoin ecosystem.

In summary, while short-term fluctuations may occur, the overall outlook for Bitcoin remains positive, driven by increasing demand, institutional adoption, and anticipation of future market developments.