As Bitcoin struggles to regain its footing after reaching record highs, large investors, known as bitcoin whales, are quietly accumulating significant amounts of the digital asset.

Since late March, one particular Bitcoin whale has purchased over $282 million worth of BTC from Binance, while another has deposited over $77.67 million onto Kraken.

Bitcoin Whale: A Big Shopping Bag

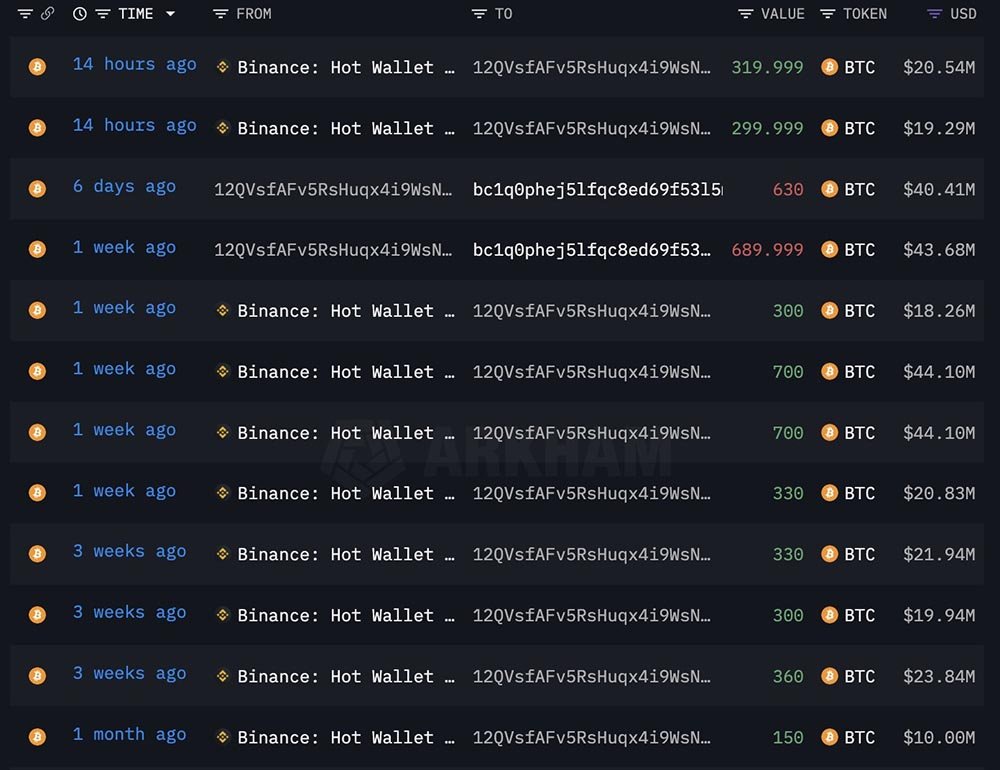

The first whale, identified by blockchain tracking firm Lookonchain, initiated its buying spree with an address beginning with “12QVsfA”. This entity bought 4,380 BTC, valued at $282.38 million, at an average price of $64,471.

According to the latest data, this whale didn’t stop there. After a price drop, it acquired an additional 620 BTC, worth $39.8 million, at the market bottom. In total, since March 21, this massive investor has purchased a staggering $282.38 million in BTC at an average price of $64,471 from the digital asset exchange Binance.

Possible Selling Plan

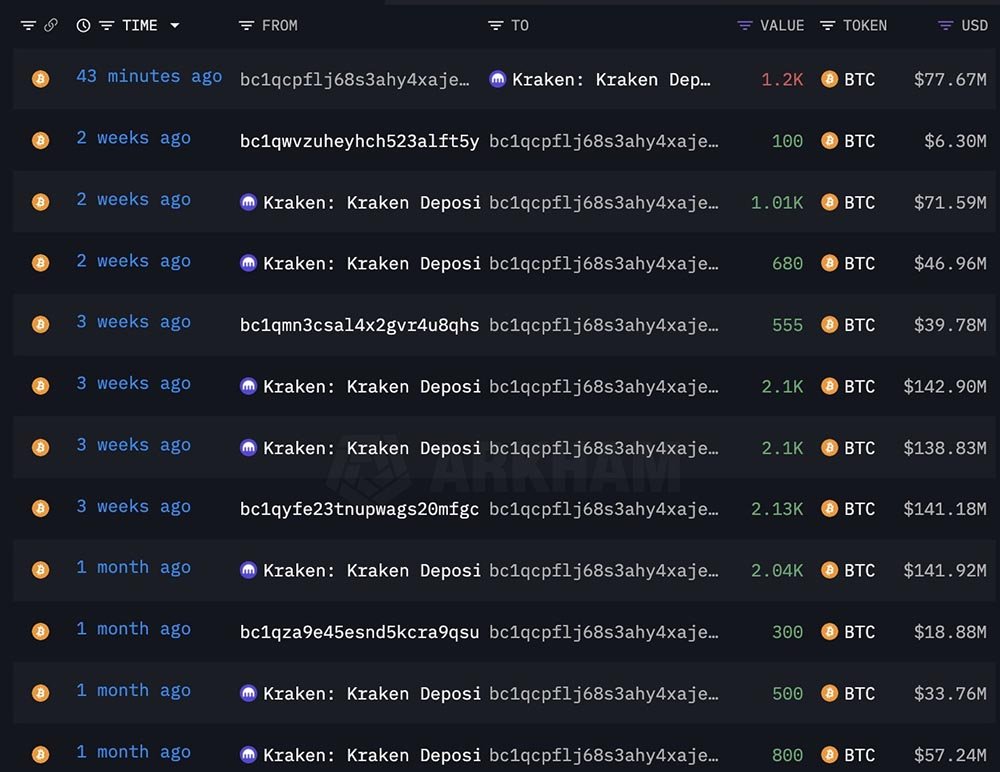

Meanwhile, Lookonchain also detected another whale depositing $77.67 million worth of bitcoin onto the Kraken exchange. Though the intentions behind this move remain unclear, depositing BTC on an exchange suggests a potential plan to sell on the open market.

Interestingly, the latest data reveals that this whale has accumulated a jaw-dropping 23,554 BTC, worth approximately $1.5 billion at the current price, for an average price of $68,051 from March 1 to April 15, further emphasizing the scale of their investment.

A Smart Strategy Amid Market Volatility

This surge in whale activity comes amid significant market volatility for bitcoin. Since reaching its peak, bitcoin has struggled to maintain stability, leading to uncertainty among investors. Bitcoin’s journey from all-time highs to its current trading price of $63,700, reflects a 13.5% decline.

This volatility, while concerning for some investors, is precisely what attracts whales seeking to increase their holdings at lower prices. By strategically buying during price dips, they aim to capitalize on potential future gains.

Related reading: Kiyosaki Says He Will Be Happy If Bitcoin Crashes

Bitcoin’s Unrealized Profits by Whales

This isn’t the first time Bitcoin whales have made headlines.

Over the past year, several whales have been observed making significant purchases or movements of BTC, often signaling confidence in the digital asset. One notable example is the awakening of a Bitcoin address that had been dormant for a decade, coming to life on April 6 with a transaction involving 1,701 BTC.

Ki Young Ju, CEO of CryptoQuant, recently provided insights into Bitcoin’s unrealized profits across different on-chain cohorts. His findings revealed a staggering 223% surge in unrealized profits among longstanding Bitcoin investors, known as “ancient whales.”

This contrasts the modest 1.6% increase observed among new whales, who mainly represent traditional finance sector and ETF investors.

While Bitcoin’s journey may be fraught with volatility, the actions of whales like those observed recently indicate a strong belief in BTC’s long-term potential. As the digital asset continues to navigate through uncertain waters, these whales remain key players in shaping its future trajectory.