In recent weeks, the Bitcoin market has been buzzing with news about the actions of so-called “whales”—large-scale holders of bitcoin. These whales have been on a buying spree, accumulating massive amounts of bitcoin despite the volatility and uncertainty that has gripped the market.

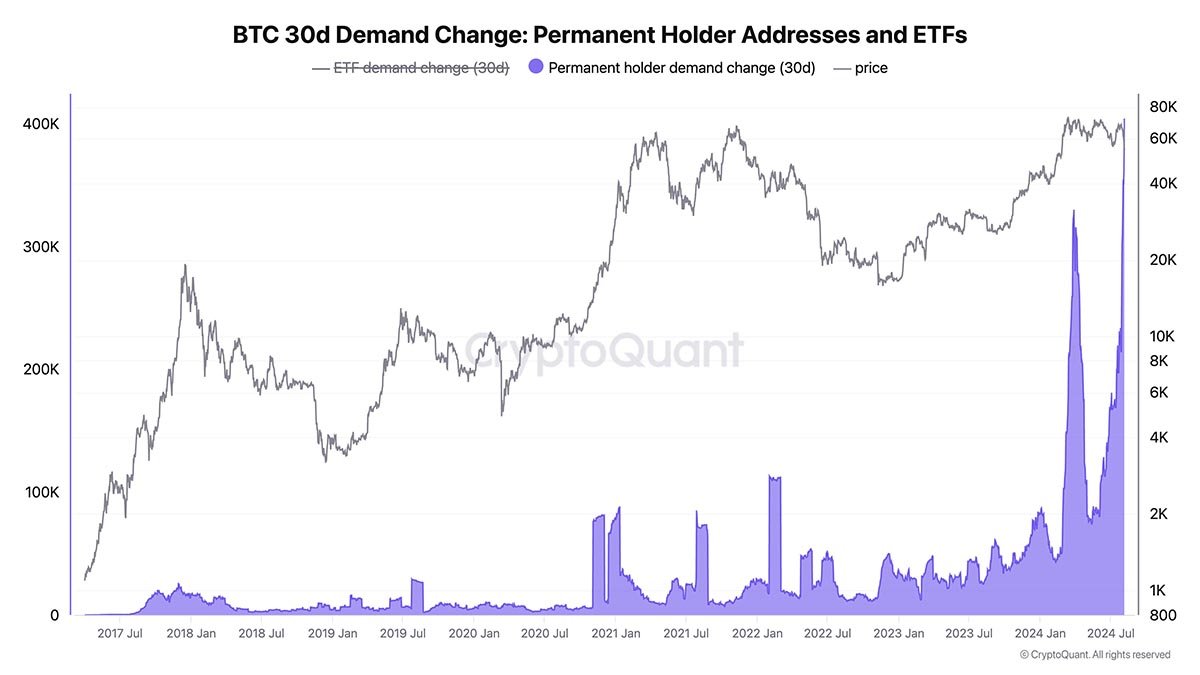

Over the past 30 days, Bitcoin whales have moved a staggering 404,448 BTC into permanent holder addresses.

This amounts to nearly $23 billion worth of bitcoin being accumulated during this period. This trend has caught the attention of many in the community, including Ki Young Ju, the founder and CEO of CryptoQuant, an on-chain data analytics platform.

Ki Young Ju has been vocal about this accumulation, suggesting that something big is happening behind the scenes. He noted:

“I’m pretty sure something is happening behind the scenes. 404,448 Bitcoin have moved to permanent holder addresses over the past 30 days, and it’s clearly accumulation. We’ll know within a year.”

This significant movement of bitcoin to permanent addresses, which are typically long-term holding wallets, suggests that these whales have strong confidence in bitcoin’s future, despite recent market downturns.

Several factors could be driving this accumulation. Ki Young Ju speculates that large entities such as traditional financial institutions, governments, or major corporations are preparing to announce their bitcoin acquisitions within the next year.

This prediction is significant because it suggests that the recent whale activity is not just a response to short-term market movements but part of a broader, strategic accumulation plan.

Related: Bitcoin Treasuries | A Growing Trend Among Corporations

These entities might be taking advantage of the current market conditions to build up their bitcoin reserves before making their acquisitions public. When these announcements are eventually made, it could lead to a surge in bitcoin demand, potentially driving the price even higher.

Young Ju’s observation is backed by the Accumulation/Distribution (A/D) indicator, which has steadily risen from late 2023 to mid-2024. This suggests stronger buying pressure over selling, despite price fluctuations.

The A/D line’s stability around 4.327 million indicates that long-term holders are not selling significantly, reflecting strong confidence in bitcoin’s future.

The recent accumulation by Bitcoin whales has occurred against a backdrop of significant market volatility. Over the past few weeks, bitcoin’s price has seen sharp declines, dropping below $50,000 at one point.

However, in the past few days, Bitcoin has rebounded, climbing back above $60,000. This 16% recovery suggests that the market is beginning to stabilize, although uncertainty remains.

Ki Young Ju has commented on the price movements, stating that as long as bitcoin’s price stays above $45,000, there is a strong possibility that it could recover to its all-time high within the next year.

However, he also warned that if bitcoin lingers below this level for an extended period, the risk of entering a bear market increases, making recovery more challenging. He stated:

“Some indicators are showing bearish signals. However, they could still recover with a rebound, so we need to watch if it stays at this level for a week or two. If it lingers longer, the risk of a bear market grows, and recovery may be difficult if it lasts over a month.”

While whales are busy accumulating bitcoin, many retail investors have remained on the sidelines, perhaps spooked by the recent market volatility and broader economic concerns.

Issues like the potential sale of bitcoin by the German government, the ongoing Mt. Gox situation, and fears of a U.S. recession have led some retail investors to adopt a cautious approach.

Ki Young Ju believes that retail investors might regret not taking advantage of the current dip in bitcoin’s price. His advice suggests that the long-term potential of bitcoin remains strong, and those who miss out now might look back with regret.

In another post on August 6, Ki Young observed several positive indicators for bitcoin. He noted that Bitcoin miner capitulation is almost over and the hash rate is nearing record levels.

He mentioned that U.S. mining costs are around $43,000 per bitcoin, implying the hash rate should remain stable unless bitcoin prices drop below this level.

He also pointed out that retail investors are largely absent, similar to mid-2020, and there has been reduced activity from long-term holders and old whales.

Based on these factors, he believes the bull market is still intact but is prepared to reassess if the market doesn’t recover within two weeks, attributing any potential misjudgment to new whales misunderstanding the macro environment.

Additionally, on August 6, on-chain analyst Ali Martinez reported that large investors had purchased more than 30,000 BTC, worth around $1.62 billion, within a span of just 48 hours.

Despite the recent volatility, many analysts and investors believe that bitcoin remains a solid long-term investment. Over the past decade, bitcoin has returned over 10,000%, and its adoption continues to grow.

More merchants are accepting bitcoin as a form of payment, and some companies are even holding bitcoin on their balance sheets as an alternative to cash.

As former President Donald Trump and Vice President Kamala Harris begin to mention Bitcoin in their political campaigns, it’s clear that the digital asset is becoming more mainstream. This growing acceptance bodes well for bitcoin’s long-term demand and price.

However, potential investors should also be aware of the risks.

Bitcoin has historically been volatile, with prices sometimes dropping by as much as 60%. This volatility means that investing in bitcoin requires a long-term perspective and a willingness to ride out the market’s ups and downs.

For those considering investing in bitcoin, the best approach may be to do so gradually through a strategy known as dollar-cost averaging. This involves making small, regular purchases of bitcoin over time, rather than trying to time the market.

By investing steadily, investors can reduce the risk of buying at a market peak and benefit from averaging out the cost of their investment over time.

Ki Young Ju’s insights and predictions suggest that bitcoin’s future remains bright, but timing the market can be tricky.

Instead of focusing on short-term price movements, it’s important to consider whether the fundamental reasons for investing in bitcoin—such as its potential as a hedge against inflation—remain valid.

The recent accumulation of bitcoin by whales and the predictions of significant future announcements make this a pivotal moment for the scarce digital asset. While there are risks, the potential rewards for long-term investors could be substantial.

As always, those looking to invest in bitcoin should do so with caution, keeping in mind the volatile nature of the market.

For retail investors, the message is clear: don’t let short-term fears prevent you from seeing the long-term potential of Bitcoin. As more institutions and governments potentially enter the market, the price of bitcoin could rise significantly.

Whether you’re a seasoned investor or just getting started, now might be the time to consider adding bitcoin to your portfolio—but remember to do so wisely and with a long-term perspective.