In a startling development, a dormant Bitcoin whale has reawakened after a staggering 14-year slumber, sending shockwaves through the bitcoin world. The whale, a long-term holder of bitcoin, made a monumental move by apparently selling a significant portion of its holdings, causing a dramatic drop in bitcoin’s price and triggering panic among traders.

Dormant Bitcoin Whale Springs to Life

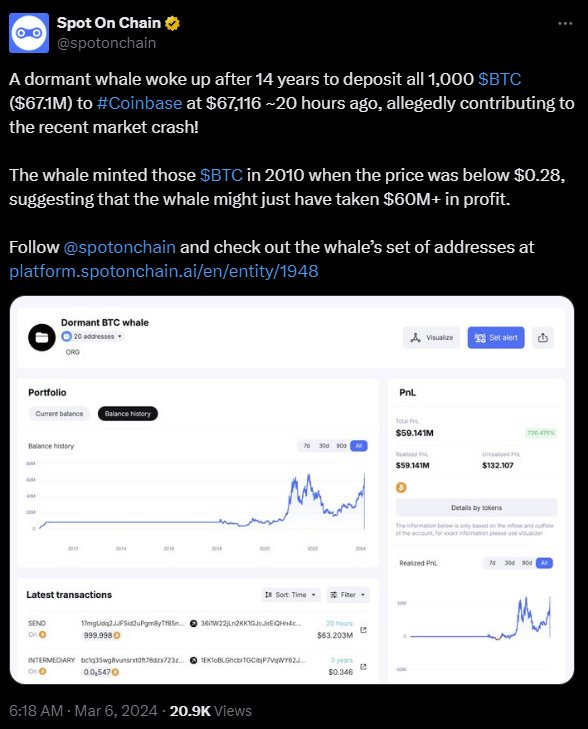

According to reports from various analytics platforms, including Spot On Chain and CoinGlass, the dormant Bitcoin addresses, which had remained inactive since 2010, suddenly sprang to life. This wallet, holding a staggering 1,000 BTC, worth around $67.1 million, had remained untouched for over a decade before deciding to make its move.

The sum of 1,000 BTC consisted of rewards for blocks mined in 2010.

Massive Sell-Off and Market Turmoil

The awakening of this long-dormant whale coincided with bitcoin reaching a historic high of $69,000, only to be followed by a sudden and sharp decline in its price. The subsequent market crash saw bitcoin’s value plummet by 14% to around $59,000, leading to widespread panic among investors and traders alike.

Some experienced traders expected this “correction”, saying bitcoin needed to retreat before making another record high.

CoinGlass data revealed that positions worth over $1 billion were liquidated within just 24 hours, with long positions accounting for nearly $797 million of that total. This mass sell-off caused by the actions of the dormant whale raised concerns about the stability of the current bull market and highlighted the unpredictable nature of the bitcoin market.

Impact on Market Dynamics

The sudden resurgence of the Satoshi-era whale had far-reaching implications for Bitcoin’s market dynamics. Analysts noted that the whale’s actions, coupled with those of other potential sellers, contributed to a 14% slip in Bitcoin’s price.

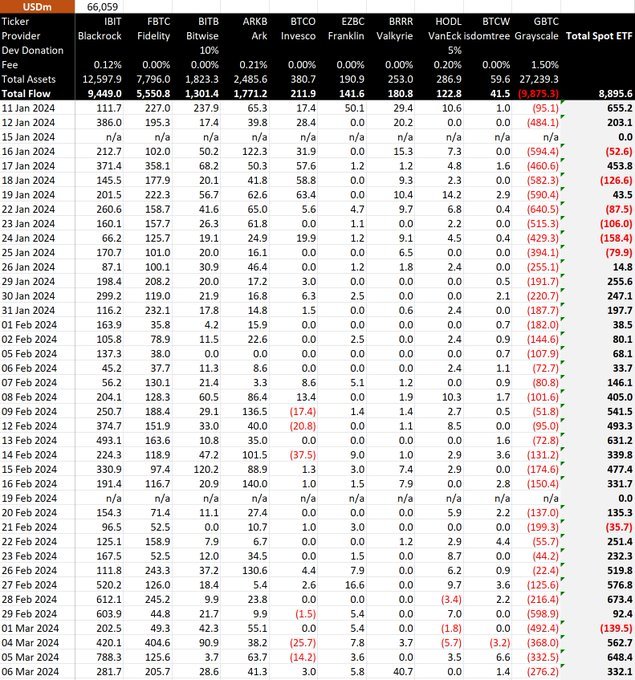

The recent surge however, seems to be mainly due to significant buying by traders and institutions into Spot Bitcoin ETFs. Although Grayscale’s ETF saw outflows, total net inflow reached $332 million yesterday, totaling over $8.895 billion since January 11.

Bitcoin transactions involving large amounts, valued at a minimum of $100,000, have reached a staggering $187 billion over the past week. These whale accounts played a significant role in intensifying the volatility of bitcoin’s price amid the ongoing market rally.

Profits Amidst Turmoil

Despite the market turmoil caused by the whale’s sell-off, it reportedly reaped substantial profits from its transactions. The whale sold off 1,000 BTC for an average price of $67,116, resulting in an estimated profit of around $60 million. This profit was made possible by the whale’s acquisition of the bitcoin back in 2010 through mining, when the network difficulty was very low, and BTC’s value was a fraction of what it is today.

Unpredictable Forces at Play

The sudden awakening of the dormant Bitcoin whale serves as a stark reminder of the unpredictable forces at play in the bitcoin market. As the market has grown from its humble beginnings to a multi-trillion-dollar industry, the actions of early adopters like this whale have continued to shape its trajectory.

Analysts and traders are left questioning whether there are more bitcoin holders lurking in the shadows of history, waiting to make their move. The resurgence of the Satoshi-era whale underscores the need for vigilance and caution in navigating the volatile waters of the bitcoin market.

Conclusion

The awakening of the dormant Bitcoin whale has sent shockwaves through the bitcoin world, causing a significant market downturn and raising doubts about the stability of the current bull market. As traders brace for further volatility, the episode serves as a stark reminder of the unpredictable nature of the bitcoin market and the significant impact of early adopters on its dynamics.