Bitcoin’s recent dip to around $56,500 has attracted substantial buying activity from high-profile investors—known as Bitcoin whales—as revealed by the data shared by CryptoQuant CEO Ki Young Ju.

In less than 24 hours alone, whales have accumulated a staggering 47,000 BTC, worth more than $2.8 billion at current prices, indicating a shift towards a bullish sentiment in the market.

According to Ki Young Ju, this significant increase in whale holdings marks the beginning of “a new era” for Bitcoin.

The accumulation of such a substantial amount of BTC may signal growing confidence in the digital asset’s future trajectory among institutional investors or high-net-worth entities.

Mr. 100’s Heavy Shopping

In particular, one of the prominent whales, known as “Mr. 100,” made a substantial purchase of over 4,100 BTC at around $58,000 on May 2. This marked this whale’s first bitcoin purchase since April 19, just before the 2024 halving event.

Mr. 100, currently the 12th-largest bitcoin holder, has been steadily accumulating BTC since November 2022, with an average daily addition of at least 100 BTC. Despite the recent correction, Mr. 100’s wallet is sitting on $1.4 billion in unrealized profits.

Direct Investment from Bitcoin Whales

Notably, the whales involved in this accumulation are predominantly custodial ones, including Exchange-Traded Funds (ETFs). However, Ki Young Ju clarified that this spike in accumulation is not ETF-related, suggesting a more direct investment from large investors rather than through ETFs.

Notably, long-term Bitcoin whales have been seeing a significant increase in their unrealized profits. Despite the rise in profits, these whales refrained from cashing out, indicating their commitment to holding onto their positions.

This reluctance coincided with a significant increase in bitcoin exchange inflows, mostly attributed to whales, which contributed to a market-wide slump.

However, amid the latest accumulation by whales, Bitcoin experienced a price surge of over 8.6%, climbing back above $64,000 on Saturday, signaling a relief rally in the market.

Analysts Bullish

Bitcoin’s current correction, according to popular Bitcoin analyst Rekt Capital, is the longest and deepest retracement of the current cycle.

However, Rekt Capital remains optimistic, suggesting that bitcoin’s price action historically rebounds strongly after a 20% downside. Aligning with whales’ recent accumulation during the low price opportunity, he stated:

“So if we’re deeper than 20%, it is an even better opportunity than we had this cycle, because the deeper we go the closer we get to a bottoming in Bitcoin’s price action.”

Based on historical chart patterns, the analyst doesn’t anticipate much more downside action for bitcoin, indicating a price surge in the near future.

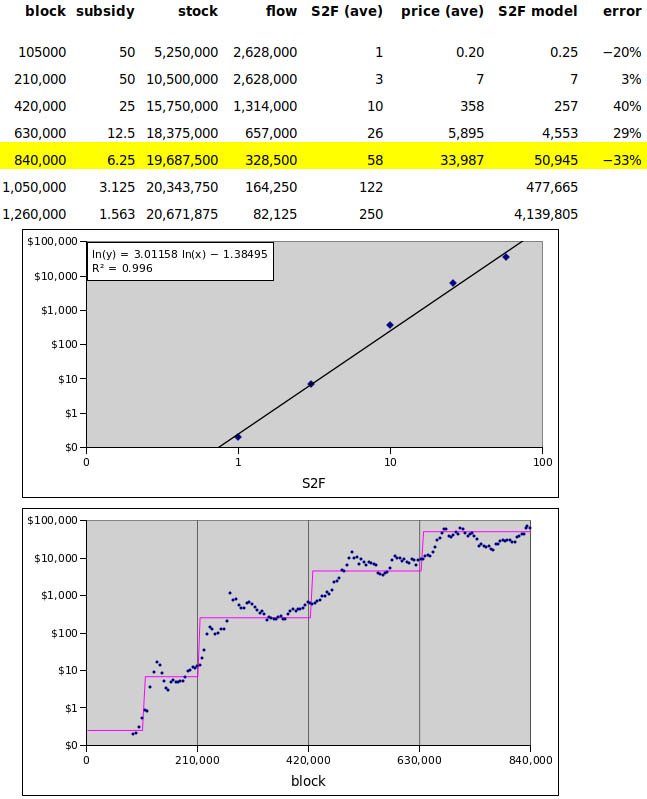

Additionally, renowned analyst Plan B expressed bullish sentiments for the long-term prospects of bitcoin. In a recent update on X, Plan B shared that he has refitted the 2019 Stock-to-Flow model with new five-year data.

Despite this adjustment, he reiterated his previous forecasts: between 2024 and 2028, he predicts an average bitcoin price of $500,000, and between 2028 and 2032, it should soar to over $4 million.