Bitcoin investors are making significant moves ahead of the highly anticipated halving event, with recent reports indicating a substantial bitcoin withdrawal from centralized exchanges. This trend reflects a broader shift in investor sentiment and could potentially impact the future trajectory of the world’s leading digital asset.

Bitcoin Withdrawal: Decrease in Exchange Balances

Recent data reveals a steady decline in the supply of bitcoin on exchanges over the past few months. According to a report by prominent analyst Ali Martinez, approximately 111,000 BTC, valued at around $7.55 billion, have been moved out of known exchange wallets in the last month alone.

This significant withdrawal suggests a shift towards holding bitcoin in private wallets rather than on centralized exchanges. Glassnode’s Balance on Exchanges, a key indicator, monitors the total bitcoin held in exchange addresses. Declining exchange balances, as depicted by Glassnode, suggest reduced selling pressure and may drive price up with sustained or increased demand.

Growing Confidence in Long-Term Holding

The movement of such a substantial amount of bitcoin out of exchanges indicates a growing confidence among investors in holding their assets for the long term. Ali Martinez notes that this trend may be driven by increasing institutional adoption of Bitcoin, with institutional investors preferring to secure their holdings in private wallets or cold storage for long-term purposes.

Martinez further emphasizes that a large-scale withdrawal of funds often signals a major change in Bitcoin investor sentiment, indicating a preference for long-term asset retention over short-term profit-taking.

This trend could potentially cause a supply crunch, where the demand for BTC surpasses its available supply. This scenario has historically led to bullish rallies in the price of bitcoin.

With the upcoming halving event expected to occur on April 18, 2024, the reduction in miners’ rewards and the slowing production of bitcoin could further contribute to a positive outlook for its price.

Increased Whale Activity

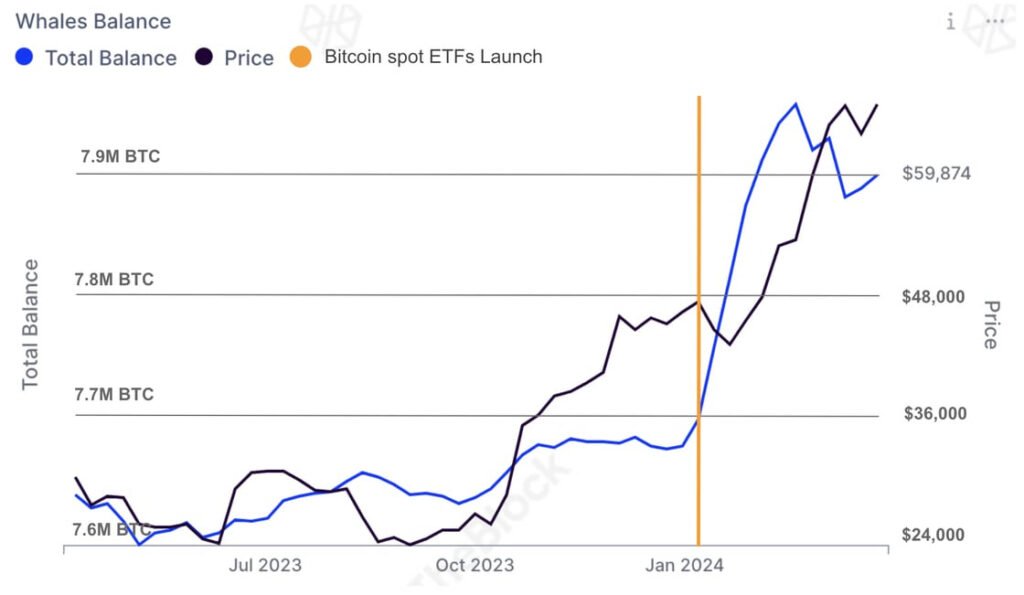

IntoTheBlock data shows Bitcoin ETFs have grown to hold over 4% of BTC supply in under 3 months. Additionally, there has been a significant increase in whale activity in the Bitcoin market. Addresses holding 1,000 BTC or more, known as “whales,” have seen a surge in their balances, with an increase of 220,000 BTC totaling $14.2 billion this year alone.

This influx of funds into whale addresses and the huge success of Bitcoin ETFs, has propelled bitcoin to fresh all-time highs and contributed to increased demand for bitcoin as a safe haven assets.

Conlusion

The recent movement of 111,000 BTC off exchanges, coupled with the increase in whale activity and the upcoming halving event, indicates a significant shift in investor sentiment towards Bitcoin. As investors show a preference for holding their assets for the long term, the stage is set for potential bullish rallies in the price of bitcoin in the coming weeks and months.

As Bitcoin continues to solidify its position as a store of value and hedge against traditional financial assets, investors are closely monitoring developments in the market, with anticipation building for the impact of the halving event and institutional adoption on the future of the digital asset.