What started as a proactive step towards transparency took an unexpected turn when Bitwise’s recently-disclosed wallet address started receiving unsolicited contributions from the community. The firm has assured that any asset sent to Bitwise Bitcoin ETF address by unrelated individuals will be factored into the Net Asset Value (NAV) for the benefit of the fund’s shareholders.

Bitwise Bitcoin ETF Wallet Address Receives Unexpected Assets

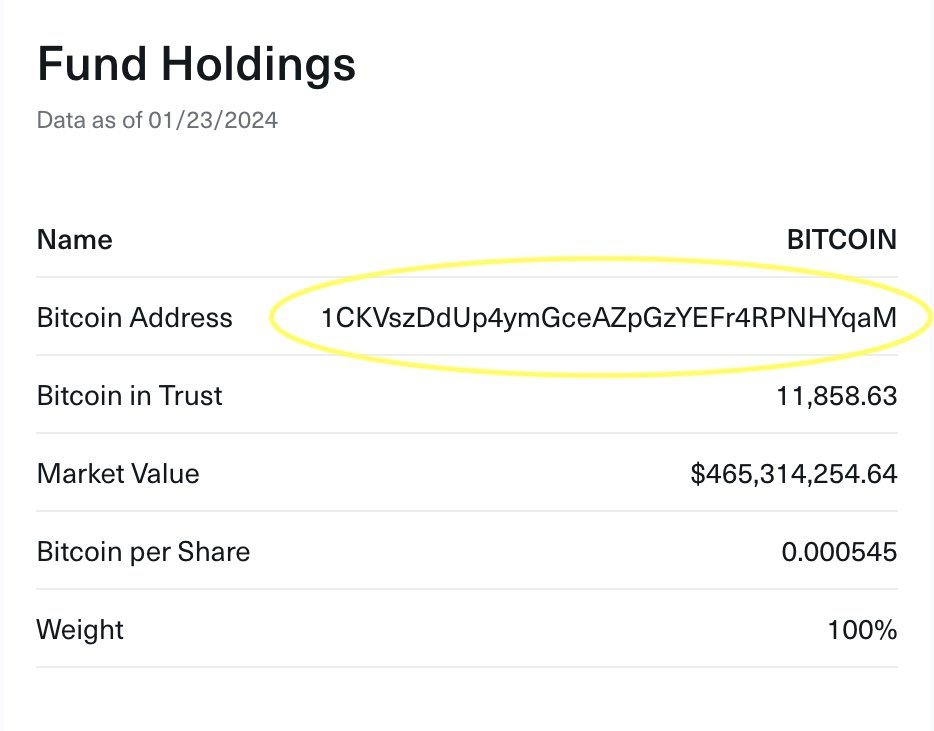

Notably, Bitwise, a renowned digital asset manager, recently became the first issuer of a spot Bitcoin ETF to publicly disclose its wallet address for the fund. The initiative to share the digital wallet address was marked by a Wednesday’s tweet from Bitwise, showcasing a screenshot of the Bitwise Bitcoin ETF’s (BITB) Bitcoin address along with its holdings of 11,858 bitcoin as of January 23.

According to Bitwise Chief Investment Officer Matt Hougan, this move allows anyone to verify the fund’s holdings and flows directly on the blockchain, setting a precedent for increased accountability within the industry.

However, soon after the announcement, small quantities of Bitcoin, including peculiar sums like 0.00042069 BTC, along with various BRC-20 tokens and a collection of Bitcoin NFTs, started flowing into the ETF wallet. The cumulative value of these assets were estimated to be around $5,000.

What Will Happen With These Donations?

Bitwise’s Chief Technology Officer (CTO), Hong Kim, addressed this unforeseen situation in a recent tweet, assuring the community that any bitcoin sent to the ETF address by unrelated individuals would be included in the NAV for the benefit of the fund’s shareholders.

Bitwise’s policy, as outlined in its S-1 filing, stipulates that involuntarily received assets may be converted into cash and distributed proportionally among shareholders.

While previous iterations of the S-1 filing hinted at the possibility of in-kind distributions, this option was ultimately omitted in the final version approved by the Securities and Exchange Commission (SEC).

Handling Funds from OFAC-Sanctioned Addresses

One critical concern arising from the community revolves around the handling of funds received from addresses sanctioned by the Office of Foreign Assets Control (OFAC). In response, Kim clarified that this issue would be handled at the custodian level.

Interestingly, if any assets are sent from such addresses, Coinbase, the San Francisco-based firm’s custodian, will flag them. Kim writes:

“if any sats are sent to us from OFAC sanctioned addresses coinbase custody will flag it and those utxos will be left untouched and not be added to NAV.”

Coinbase has affirmed its commitment to actively blocking and reporting transactions from OFAC-sanctioned addresses in accordance with U.S. Treasury requirements, ensuring compliance and regulatory adherence.

Notably, the exchange clarifies that any attempt to send or receive funds to or from a sanctioned address will lead to the transfer of such funds into a Coinbase internal holding account. These funds will be released only after the owner “obtains a specific license by completing the Release of Blocked Funds license application.”

Bitwise’s venture into unprecedented transparency sets a new standard within the Bitcoin ETF space. As the community continues to scrutinize and engage with Bitwise’s innovative approach, the broader implications for the industry remain a subject of keen interest.