Bitcoin’s price has been a hot topic lately, with experts forecasting a surge to $250,000. In recent statements, industry leaders have expressed optimism about bitcoin’s future trajectory. Hunter Horsley, CEO of Bitwise Asset Management, is among those foreseeing a significant rise in bitcoin’s value. He believes that bitcoin could hit $250,000 much sooner than expected, citing recent price actions as indicators of this possibility.

Bitcoin’s Accessibility Through ETFs

Horsley points out that Bitcoin’s accessibility through Exchange-Traded Funds (ETFs) has been a game-changer. With the introduction of Bitcoin ETFs, investors can now easily gain exposure to Bitcoin with a simple click. This increased accessibility, akin to an Initial Public Offering (IPO) moment for Bitcoin, has significantly expanded its investor base, potentially propelling it to surpass gold’s market share faster than anticipated.

Related reading: Bitcoin ETFs Provide Convenient Price Exposure, But At What Cost?

The chief executive of Bitwise Asset Management said:

“Bitcoin is going to eat into gold’s TAM [total addressable market] faster than people expect. $250k bitcoin could happen much sooner than most who’ve followed the space for years would imagine.”

He attributes this potential shift to Bitcoin’s 15-year track record of demonstrating its value, which was previously accessible to only a select few. He stated that as a result of bitcoin ETFs, the market has experienced a significant tenfold increase.

Analyst BitcoinMunger on X has the same idea, drawing comparison between Bitcoin ETFs and gold’s, stating that the markets are witnessing a “flippening.”

Other users seconded this view, believing this is the beginning of the “transfer of generational wealth.”

Hunter Horsley’s Bullish Predictions

Horsley’s optimism is echoed by other prominent figures in the bitcoin space. Peter Brandt, a veteran trader, has raised his BTC price target to $200,000 for the current bull market cycle. Pantera Capital foresees a robust bitcoin bull market over the next 18-24 months, while Tom Lee of Fundstrat anticipates bitcoin hitting $150,000 this year. Venture capitalist Tim Draper maintains his $250,000 prediction for 2024, and Cathie Wood’s Ark Invest envisions BTC reaching $1.5 million by 2030.

Bitwise’s Outlook: Bitcoin’s Rise to $250,000

Bitwise’s December 2023 predictions align with this bullish sentiment, forecasting bitcoin trading above $80,000 this year. The firm also envisions spot Bitcoin ETFs capturing 1% of the $7.2 trillion U.S. ETF market within five years, amounting to $72 billion in assets under management. Bitwise Bitcoin Fund (BITB), one of the 11 spot Bitcoin ETFs approved by the U.S. Securities and Exchange Commission (SEC), began trading alongside nine others on January 10.

Horsley emphasizes that Bitcoin’s 15-year journey has laid the groundwork for its potential to reach $250,000. He notes that while Bitcoin has proven its merits over the years, its accessibility through ETFs marks a significant milestone. This increased accessibility, coupled with growing institutional interest, could accelerate bitcoin’s ascent to new heights.

Horsley mentioned:

“Bitcoin has been around for 15 years. It’s going to accelerate now, not slow down. With bitcoin ETFs, the entire tonnage of U.S. capital markets can easily invest for the first time. The market has grown massively. There are no new features to wait for. Price discovery is underway. It can move quickly.”

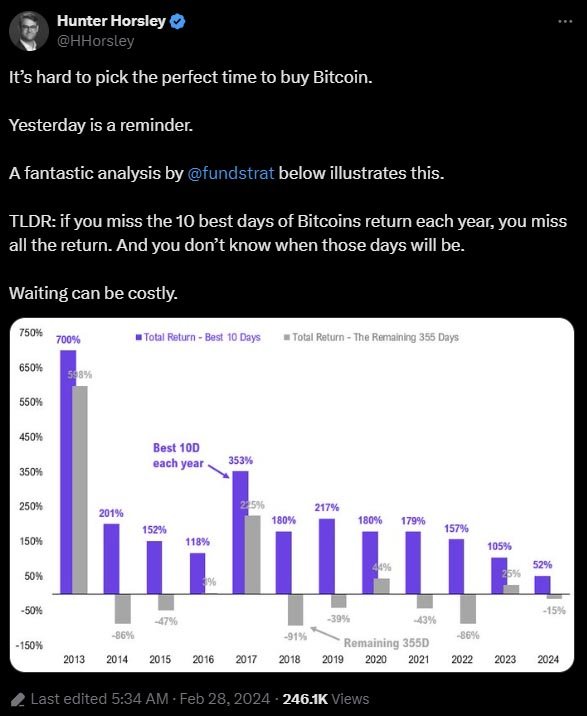

He also stressed the importance of investing in bitcoin, cautioning against waiting and urging action, highlighting yesterday’s price as a valuable buying opportunity.

Market Dynamics

Despite the optimism, some caution is warranted. Bitcoin’s history involves periods of rapid appreciation followed by corrections, highlighting the volatile nature of bitcoin markets. The comparison of Bitcoin ETFs to an IPO moment underscores their transformative potential but also raises questions about their impact on price discovery and market volatility.

Experts in the Bitcoin space are bullish about its prospects, with predictions of a surge to $250,000 gaining traction. The increased accessibility through ETFs, coupled with growing institutional adoption, could fuel bitcoin’s ascent to new all-time highs. However, investors should remain vigilant and consider the inherent risks associated with bitcoin’s price fluctuation.