While the digital asset community eagerly awaits potential approval of a Spot Bitcoin Exchange-Traded Fund (ETF) by the U.S. Securities and Exchange Commission (SEC) in 2024, BlackRock delayed its anticipated $10 million worth of BTC purchase.

BlackRock Bitcoin ETF Seed

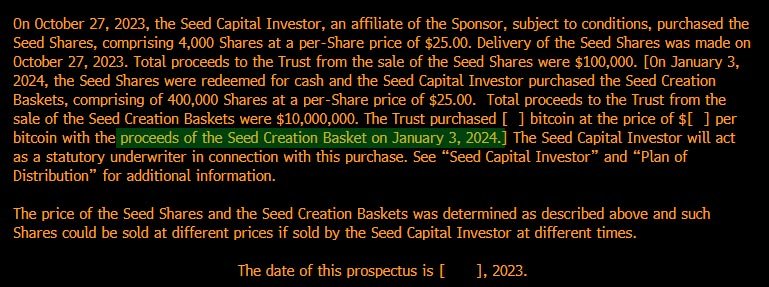

Among the applicants for a Spot Bitcoin ETF, BlackRock, the world’s largest asset manager, intended to make a significant $10 million Bitcoin purchase on January 3, 2024, to contribute to the seed creation basket. However, recent reports indicate that BlackRock has opted to postpone its purchase, raising questions about the reasons behind this decision.

While the exact motivations for BlackRock’s delay remain unclear, speculation suggests potential coordination with its Spot Bitcoin ETF plans. The SEC’s impending decision on the ETF approval could also be a contributing factor, prompting the asset manager to reschedule its BTC purchase.

It is important to note that the document mentioning the BTC purchase was not final or approved. Seyffart noted on December 23 that the inclusion of the January 3 date could be considered a “teasing” tactic.

Interestingly, the revised date for the asset manager’s Bitcoin purchase is now slated for January 5, 2024.

Notably, seed capital represents the initial funding, allowing an ETF to fund the creation units underlying the ETF so that shares could be offered and traded in the open market.

$100K Seed Funding

Notably, early in December, BlackRock announced that it had received $100,000 as “seed capital” for its proposed Spot Bitcoin ETF. The firm stated in a filing with the SEC:

“The seed capital investor agreed to purchase $100,000 in shares on October 27, 2023, and on October 27, 2023 took delivery of 4,000 shares at a per-share price of $25.00 (the “seed shares”).”

Anticipation Around the SEC Approval

The Bitcoin community is closely watching the SEC’s stance on Spot Bitcoin ETFs, with many analysts, including James Seyffart, anticipating one or more approvals by January 10, 2024. Some experts even suggest that a decision might be communicated earlier in January.

On January 3, Seyffart expressed his view, stating that the SEC might signal approvals to issuers, with official approvals expected between January 8 and 10. He stated:

“I think the SEC could begin signaling to issuers to expect approvals tho I’m still expecting official approvals Jan 8 – 10. I also think the gap between approval orders and actual trading will be measured in days — not weeks.”

However, uncertainties loom over the SEC’s decision timeline, with technical considerations and legal battles playing a role.

Regulatory Uncertainties

The SEC has been engaged in legal disputes with major digital asset firms, including Coinbase. In 2023, the SEC experienced setbacks, partially losing its case against Ripple, which centered around allegations of selling unregistered securities.

The SEC’s track record of postponing deadlines for a Spot BTC ETF in 2023 adds another layer of uncertainty to the regulatory landscape. As the Bitcoin community remains on the edge of its seat, it remains to be seen whether the SEC will adopt a similar approach in 2024.