In a groundbreaking event, BlackRock’s spot Bitcoin Exchange-Traded Fund (ETF) has taken the market by storm, hitting the $1 billion assets under management (AUM) milestone within its first week of trading. Let’s delve into the key highlights and market dynamics surrounding BlackRock Bitcoin ETF and this monumental achievement.

BlackRock Bitcoin ETF Takes The Lead

BlackRock’s iShares Bitcoin Trust (IBIT), which commenced trading on January 12, has become the first among its peers to cross the $1 billion AUM mark. IBIT’s success is attributed to its strategic focus on providing investors with quality access to Bitcoin, and the asset manager’s fame and strength, reflecting a robust demand for bitcoin investments.

Robert Mitchnick, who serves as the Head of Digital Assets at BlackRock, stated:

“We are excited to see IBIT reach this milestone in its first week, reflecting strong investor demand […] This is just the beginning. We have a long-term commitment focused on providing investors access to an iShares quality ETF.”

AUM Breakdown and Composition

IBIT’s holdings comprise a whopping 99% Bitcoin, showcasing a strong commitment to the leading digital asset. Notably, the fund also holds nearly $60,000 in fiat. With 25,067 BTC in its portfolio, IBIT closed Wednesday trading at $24.41, trading at a slight premium of 0.42% relative to spot Bitcoin.

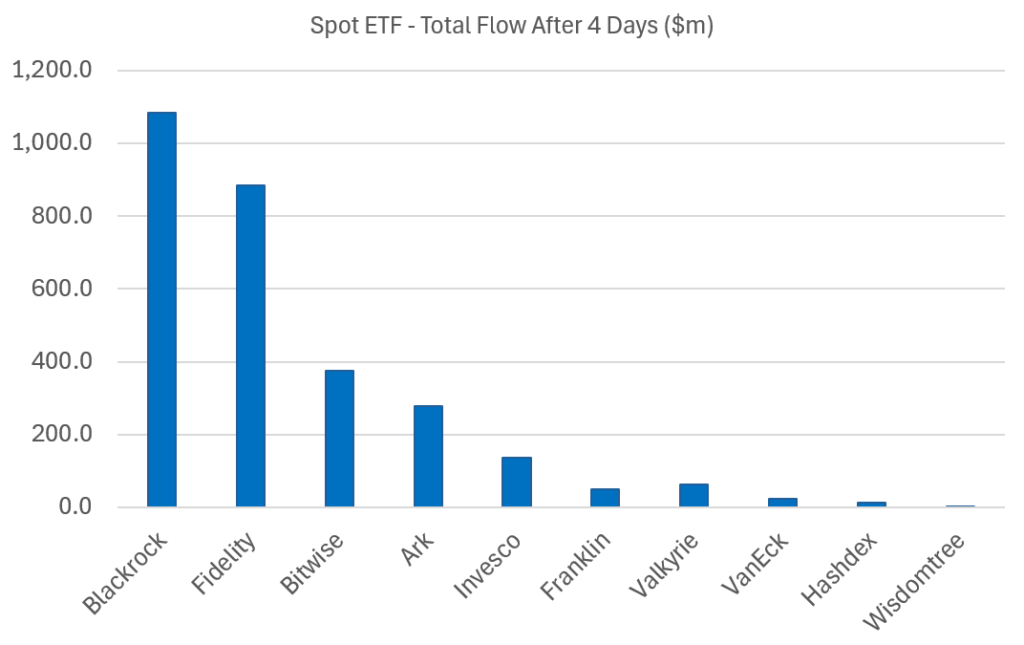

The success of BlackRock’s Bitcoin ETF extends beyond AUM, as it emerges as a front-runner in net flows within the first three days of trading. According to information provided by Bloomberg Intelligence analyst Eric Balchunas, with $710 million in net flows, BlackRock outpaced competitors like Fidelity and Bitwise. Fidelity secured the second spot with net inflows of $524 million, while Bitwise followed with $305 million.

Industry-Wide Impact of Bitcoin ETFs

The impact of Bitcoin ETFs on the digital asset market is undeniable. Net inflows into spot Bitcoin ETFs, excluding Grayscale’s GBTC, approached $3 billion within four days. Market charts reveal a surge in ETF popularity coinciding with a drop in overall digital asset market capitalization.

Outlook and Future Trends

BlackRock’s Head of U.S. iShares Product, Rachel Aguirre, emphasized the diverse investor base showing interest in the firm’s spot Bitcoin ETF. The ETF landscape, dominated by BlackRock, Fidelity, and Grayscale, collectively accounting for about 90% of the total volume, indicates a strong institutional and retail appetite for bitcoin investments.

Aguirre stated that the company is observing “interest from both retail and self-directed investors,” mentioning that there were individuals interested in the investment “who were ready to invest on day one.”

She added:

“But we’re also focused on those investors who are just now beginning to look at this new asset class. And we’re very excited about that […] What I will say is we’re focused on, again for our clients, understanding what education needs there are supporting them along their investing journey and empowering them to make the financial decisions that are right for them,”

BlackRock’s Bitcoin ETF has not only demonstrated remarkable growth in AUM but has also set the tone for the evolving landscape of bitcoin investments. As institutional and retail investors flock to these innovative investment vehicles, the Bitcoin market is witnessing a transformative period with the potential for continued growth and mainstream acceptance.