BlackRock, the world’s largest asset management firm, has once again made history with its iShares Bitcoin Trust (IBIT).

The Bitcoin Exchange-Traded Fund (ETF) surpassed $50 billion in assets under management (AUM) in just 228 days, making it the fastest-growing ETF in history. This achievement has cemented BlackRock’s dominance in both traditional and emerging financial markets.

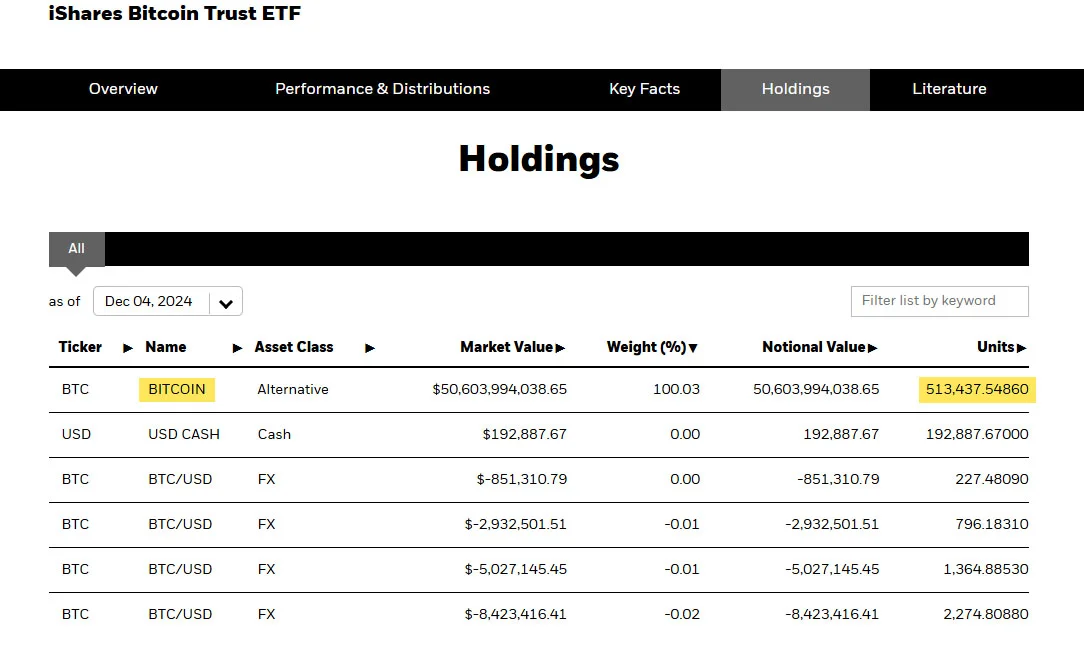

Launched in January 2024, the BlackRock Bitcoin ETF has reached an impressive milestone by amassing more than 500,000 bitcoin.

This accounts for 2.44% of bitcoin’s total supply of 21 million coins. With bitcoin breaking new all-time highs and surpassing the $100,000 mark, the fund’s AUM now stands at around $52.8 billion.

Eric Balchunas, Senior ETF Analyst at Bloomberg, highlighted the ETF’s unprecedented growth, stating:

“IBIT is now over $50b. It took it 228 days to reach this milestone, the next fastest ETF to reach 50b was IEFA in 1,329 days. So over 5x faster than any ETF ever launched.”

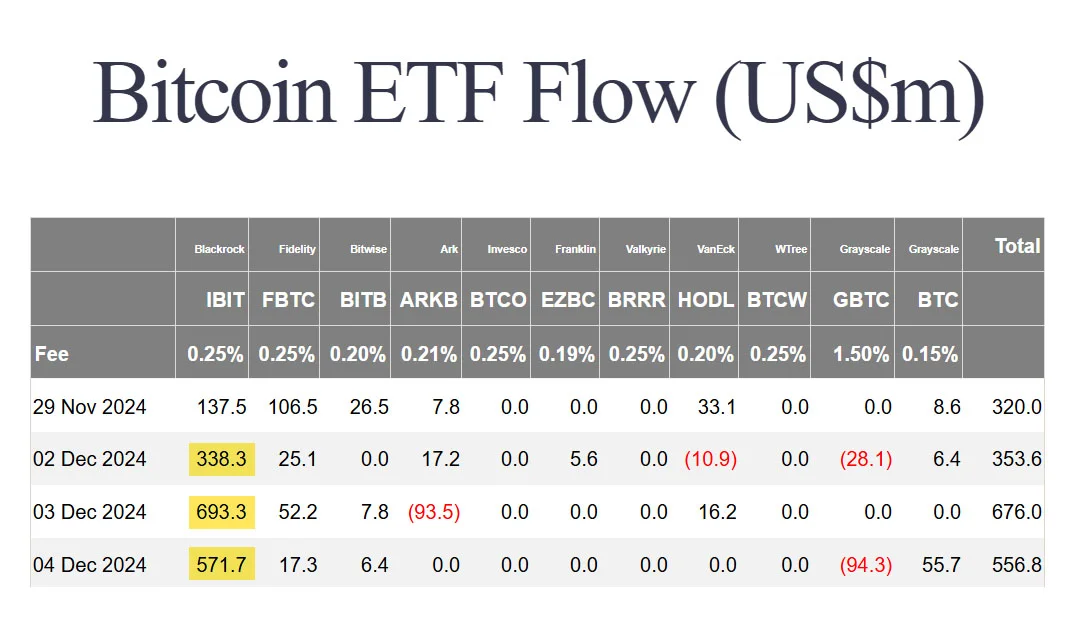

The ETF’s remarkable rise has also been attributed to the performance of bitcoin itself, which has surged by over 160% this year, reaching new all-time highs. By Wednesday’s market close, BlackRock’s IBIT attracted $570.7 million in inflows, based on data provided by Farside Investors.

The data shows IBIT has had a successful week so far, attracting over $1.6 billion in just three days.

Spot Bitcoin ETFs like IBIT offer investors a way to gain exposure to bitcoin without dealing with the complexities of buying, holding, or securing the digital asset.

This innovation has been a game-changer, drawing in billions of dollars from institutional investors who were previously hesitant to enter the Bitcoin space.

Nate Geraci, President of The ETF Store, stated that BlackRock’s IBIT is helping position bitcoin as an institutional-grade asset, serving as a bridge for traditional investors. He noted that “If IBIT were BlackRock’s only ETF, they would be a top 15 issuer.”

Geraci stated that Bitcoin, a digital asset less than 15 years old, has become more significant in BlackRock’s portfolio than gold.

Bitcoin’s price has played a major role in IBIT’s success.

The scarce digital asset recently surged past $100,000 for the first time, reaching as high as $103,000 before settling slightly lower, possibly due to profit-taking by holders.

Analysts attribute the price rise to increasing demand from institutional investors and the growing adoption of Bitcoin ETFs.

Ki Young Ju, founder of CryptoQuant, explained:

“Fresh capital is fueling Bitcoin. As the realized cap grew, the ceiling price increased from $129K to $146K in 30 days. At $102K, it’s far from a bubble—it would need a 43% surge to hit the threshold often considered a bubble.”

Vetle Lunde, Head of Research at K33, highlighted this achievement by BlackRock, remarking, “BlackRock surpassing 500,000 BTC is yet another huge milestone after a tremendous launch year.”

Lunde highlighted that IBIT ranks as the third most robust ETF product in the United States “measured by year-to-date (YTD) flow, ahead of Invesco’s $314 billion behemoth QQQ.”

The analyst predicted that bitcoin-related investment vehicles will become standard portfolio diversifiers, with large funds allocating 1-3% of their capital to them because bitcoin improves risk-adjusted returns.

BlackRock Bitcoin ETF has already surpassed the iShares Gold ETF (IAU), a fund launched in 2005, in terms of growth. This shift signals a growing preference for bitcoin as a modern alternative to traditional stores of value like gold.

Additionally, the fund’s holdings of over 500,000 BTC now exceed those of MicroStrategy, which holds approximately 402,100 BTC as part of its corporate treasury.

Related: $1.5B Purchase Pushes MicroStrategy’s Bitcoin Holdings Past 400k BTC

The ETF market has also benefited from favorable political and regulatory changes.

President-elect Donald Trump has pledged to support the domestic Bitcoin industry, including the creation of a U.S. bitcoin reserve. His administration is expected to appoint Paul Atkins, a pro-market former SEC commissioner, as the new SEC Chair.

Analysts from Bitfinex stated that they believe these developments could lead to a more collaborative regulatory framework, further boosting demand for Bitcoin and ETFs like IBIT.

The analysts added, “The ability of BTC to make new ATHs every week, despite profit-taking, is due to the fresh demand coming into the market from new investors. Any selling has been absorbed and outpaced by strong ETF inflows and subsequent buying from institutions.”

BlackRock’s success in the Bitcoin ETF market is part of a broader strategy to dominate both traditional and emerging financial sectors.

Recently, the company announced a $12 billion acquisition of HPS Investment Partners, a private credit firm. This move reflects BlackRock’s push to diversify into high-growth markets.

The firm has also expanded internationally, securing a commercial license in Abu Dhabi to strengthen its global presence.

The explosive growth of BlackRock’s Bitcoin ETF has proven skeptics wrong and demonstrated the growing institutional appetite for bitcoin. Analysts predict that IBIT’s rapid adoption will continue, potentially bringing its AUM to new heights.

With Bitcoin ETFs now holding over $104 billion collectively and bitcoin itself becoming a mainstream asset, the future looks bright for both the digital asset and the financial products tied to it.