BlackRock, the world’s largest asset manager, has taken a significant step to address rising investor concerns about the transparency and security of its Bitcoin exchange-traded fund (ETF).

The firm has amended its agreement with Coinbase, the custodian of its Bitcoin ETF (IBIT) assets, requiring that bitcoin withdrawals be processed within 12 hours. This move is aimed at reassuring investors that their assets are being properly managed and are readily accessible.

The changes, which were submitted to the U.S. Securities and Exchange Commission (SEC) on September 16, have been seen as a direct response to growing skepticism surrounding Coinbase’s custodial practices.

Investors have become increasingly worried about how Coinbase handles the bitcoin linked to ETFs, with some even questioning whether Coinbase is dealing with “real” bitcoin or potentially using “paper BTC”—a term referring to Bitcoin IOUs, rather than actual assets on the blockchain.

A clause in the new SEC filing by BlackRock reads:

“Coinbase Custody shall process a withdrawal of Digital Assets from the Custodial Account to a public blockchain address within 12 hours of obtaining an instruction from Client or Client’s Authorized Representatives.”

This amendment is intended to boost confidence among investors and ensure that the assets underlying BlackRock’s Bitcoin ETF are fully backed by actual bitcoin.

Several issues have been raised in recent months regarding Coinbase’s custodial practices, particularly its on-chain settlement processes. This has led to speculation that Coinbase may not be fully transparent with the way it manages Bitcoin ETFs.

Rumors have circulated within the Bitcoin community about Coinbase using “paper BTC,” and these suspicions have only intensified as bitcoin’s price has stagnated over the past few months.

Concerns were further fueled in August when Coinbase introduced a new form of Wrapped Bitcoin, called Coinbase BTC (cbBTC).

Some investors feared that cbBTC could be tied to a system of IOUs rather than representing actual bitcoin. Coinbase CEO Brian Armstrong has since come forward to clarify the situation. He defended the firm’s practices in an X post, stating:

“If you want audits, Deloitte audits us annually, we’re a public company. I doubt our institutional clients want people dusting all their addresses, and it’s not our place to share for them. This is what it looks like if you want a bunch of institutional money to flow into Bitcoin.”

He also emphasized that all ETF transactions are settled on-chain, although not all ETF wallet addresses are made public, citing confidentiality agreements with institutional clients.

Armstrong added that Coinbase undergoes regular audits by the global accounting firm Deloitte, which should reassure investors that the platform’s custodial practices are sound.

Many in the Bitcoin community were skeptical of his Deloitte audit claims, pointing out that Coinbase relies on investor trust without external verification. While some trust Coinbase’s public status, others remain unconvinced it’s secure.

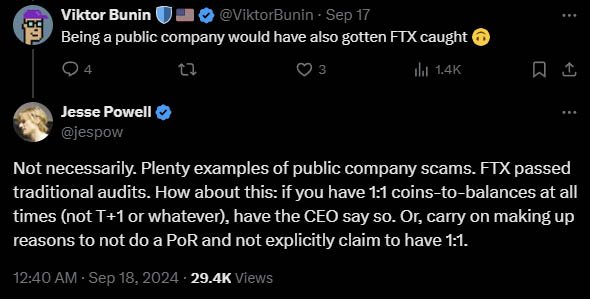

Those skeptical called for more transparency and publicly available proof of reserves. Kraken exchange founder Jesse Powell has been particularly vocal, noting that being a public company alone does not guarantee that issues like those seen with FTX couldn’t arise again.

BlackRock’s Bitcoin ETF, known as IBIT, holds over $22.5 billion worth of bitcoin, accounting for 38% of the Bitcoin ETF market. This makes Coinbase a critical player, as it serves as the custodian for 10 of the 11 spot Bitcoin ETFs in the U.S., including BlackRock’s IBIT.

Related: Custody Centralized? Coinbase Holds Keys to 90% of Bitcoin ETFs

In addition to reassuring current investors, BlackRock’s move may also prompt other ETF issuers to follow suit.

With Coinbase acting as the custodian for most of these ETFs, similar amendments could become industry standard, further shortening withdrawal timelines and increasing pressure for greater transparency across the board.

Despite concerns about custodial practices, some market experts believe Bitcoin ETFs, like those offered by BlackRock, have provided stability to the market.

Bloomberg’s senior ETF analyst, Eric Balchunas, has said that the introduction of ETFs has actually “saved Bitcoin’s price from the abyss repeatedly.”

According to Balchunas, native bitcoin holders—often referred to as “HODLers”—have been the primary sellers during bitcoin’s recent price dips, not ETF investors.

Balchunas explains that BlackRock operates its own blockchain node and nightly checks its bitcoin (BTC) balances via Coinbase Prime to validate the holdings of its Bitcoin ETF.

While BlackRock shares these balances with institutional clients upon request, it does not make them public to avoid attracting spam. He emphasizes that BlackRock is experienced in managing ETFs, having done so for decades without issues.

This reliability is why BlackRock and other ETF issuers are trusted by financial advisors, ensuring clients won’t experience fraud or collapse, like the FTX case involving Sam Bankman-Fried (SBF).

Investor reactions to the new withdrawal rules have been mixed. While some believe the 12-hour withdrawal window will help mitigate fears of mismanagement, others still want more transparency.

According to recent ETF flow data, BlackRock’s IBIT fund experienced a relatively quiet month, with only one major inflow of $15.8 million on September 16, following the filing of the amendment.

However, prior to that, there were four consecutive days of zero flows, reflecting ongoing hesitancy among investors.

The changes BlackRock has made may help soothe these concerns, especially as the firm emphasizes that the goal is to ensure the bitcoin backing its ETF is fully accessible and properly handled.

The SEC filing highlights that the amendment aims to confirm that all assets in Coinbase’s custody are securely managed and immediately available for withdrawal.

In a statement to the SEC, BlackRock said that the amendment is “subject to confirmation of the foregoing required minimum balance,” ensuring that bitcoin withdrawals are always supported by sufficient on-chain reserves.

As the world’s largest asset manager, BlackRock’s moves in the Bitcoin ETF market are closely watched, and the firm’s recent amendments to its custody agreement with Coinbase are no exception.

By demanding faster withdrawals and addressing concerns over transparency, BlackRock hopes to calm fears and ensure that investor confidence remains intact.

However, as skepticism lingers over custodial practices in the broader digital asset space, more companies may be forced to follow BlackRock’s lead, tightening their withdrawal policies and increasing the level of transparency around bitcoin holdings.

For now, BlackRock’s 12-hour withdrawal rule is a significant step toward addressing the concerns of a growing number of investors, who want to ensure that their bitcoin is not just safe but also readily available.

Whether other asset managers will follow suit remains to be seen, but it’s clear that the debate over bitcoin’s custody and transparency is far from over.