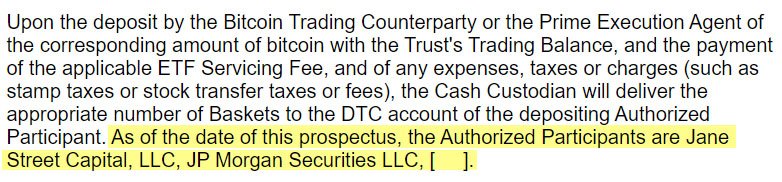

In a controversial move, renowned investment firm BlackRock has submitted its fifth amendment to the United States Securities and Exchange Commission (SEC) for its Spot Bitcoin ETF application, designating JPMorgan Chase and Jane Street as authorized participants (APs). This decision on BlackRock Bitcoin ETF seems odd, following JPMorgan CEO Jamie Dimon’s recent critique of Bitcoin, and his statement that he would “shut it down” if he had government role.

Asset manager Valkyrie, in a separate filing, has also engaged Jane Street Capital and Cantor Fitzgerald & Co. for a similar role.

BlackRock Bitcoin ETF: Jamie Dimon’s Anti-Bitcoin Stance

Notably, Jamie Dimon generally voices criticism against Bitcoin and the broader digital asset sector. On December 6, speaking at Capitol Hill during a hearing of the United States Senate Banking Committee on oversight of Wall Street firms, Dimon stated:

“I’ve always been deeply opposed to crypto, bitcoin, etc. The only true use case for it is criminals, drug traffickers, money laundering, and tax avoidance. If I was the government, I’d close it down.”

Despite Dimon’s public opposition to bitcoin, BlackRock’s updated filing on December 29 names JPMorgan Securities as an authorized participant. The Bitcoin community, particularly on X, criticizes Dimon’s involvement in light of his negative comments.

For instance, Bloomberg ETF analyst Eric Balchunas notes the irony in BlackRock’s choice of authorized participants. However, he emphasizes the significance of this step, highlighting BlackRock as the first issuer to meet SEC requirements for potential inclusion in the initial wave of Spot-Bitcoin ETF approvals.

The Role of Authorized Participants

Authorized participants play a crucial role in the creation and redemption of ETF shares. These designated entities possess the privilege to generate or redeem shares as needed. To execute this process, authorized participants have two options:

- Exchange for Securities Basket: Authorized participants can swap ETF shares for a meticulously crafted basket of securities. This basket mirrors the holdings of the ETF, ensuring a direct representation of its portfolio.

- Exchange for Cash: Alternatively, authorized participants can opt to exchange ETF shares for cash. This provides flexibility in the transaction process, allowing for a straightforward liquidation of the ETF shares.

Related reading: Bitcoin ETF: Discussions over Cash Redemption vs In-Kind Model

Nate Geraci, president of The ETF Store, underscored the importance of lining up authorized participants. He stated:

“Lining up APs won’t exactly be a layup for every prospective issuer, so this was an important step. Based on everything we know at this point, BlackRock is the first issuer to complete the SEC’s requirements in order to be considered for inclusion in the first wave of spot-Bitcoin ETF approvals.”

The SEC has until January 10 to decide on Spot Bitcoin ETF applications from other entities like ARK Invest and 21Shares.

JPMorgan’s Moves Adds to Confusion

It is important to note that despite JPMorgan‘s historical reluctance and Dimon’s vocal opposition to the Bitcoin sector, the bank actively embraced digital asset initiatives.

Notably, JPMorgan recently launched its digital asset token, JPM Coin. This move adds to the ambiguity surrounding the bank’s position on digital assets.

Renowned lawyer John Deaton questioned the sincerity of JPMorgan’s involvement with Bitcoin, emphasizing the incongruity between Dimon’s negative comments and the bank’s willingness to engage in the space. He raised concerns about potential attempts to mislead the public or engage in gaslighting.