Bitcoin exchange-traded funds (ETFs) in the United States witnessed significant inflows in the past few days.

These ETFs, which allow investors to gain exposure to bitcoin without directly holding the asset itself, have seen a wave of investments, with BlackRock Bitcoin ETF (IBIT) leading the charge.

Despite the impressive inflows, bitcoin’s price has been under pressure, raising questions about the future direction of the market.

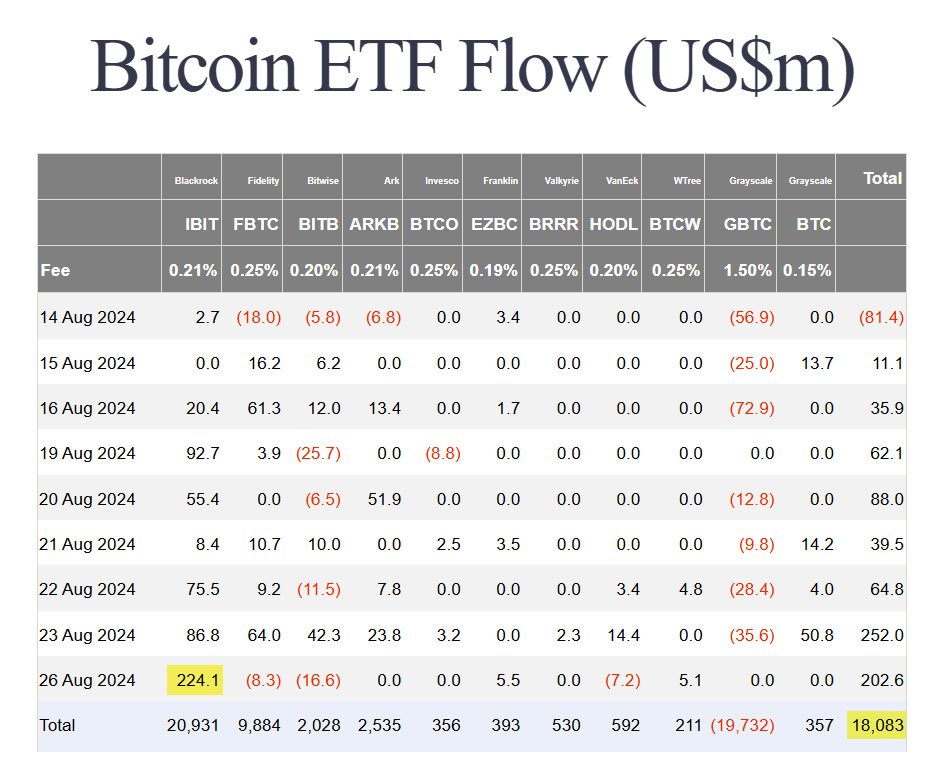

On August 26, BlackRock’s IBIT recorded a staggering $224 million in net inflows, marking its largest single-day inflow in over a month. This influx of capital was part of a broader trend, with U.S. Bitcoin ETFs posting eight consecutive days of net inflows, totaling $202 million on that Monday alone.

Notably, Monday’s inflows pushed the bitcoin ETFs’ assets under management to over $18 billion.

The eight consecutive days of net inflows suggest that investors are increasingly recognizing Bitcoin ETFs as a valuable component of their investment strategies.

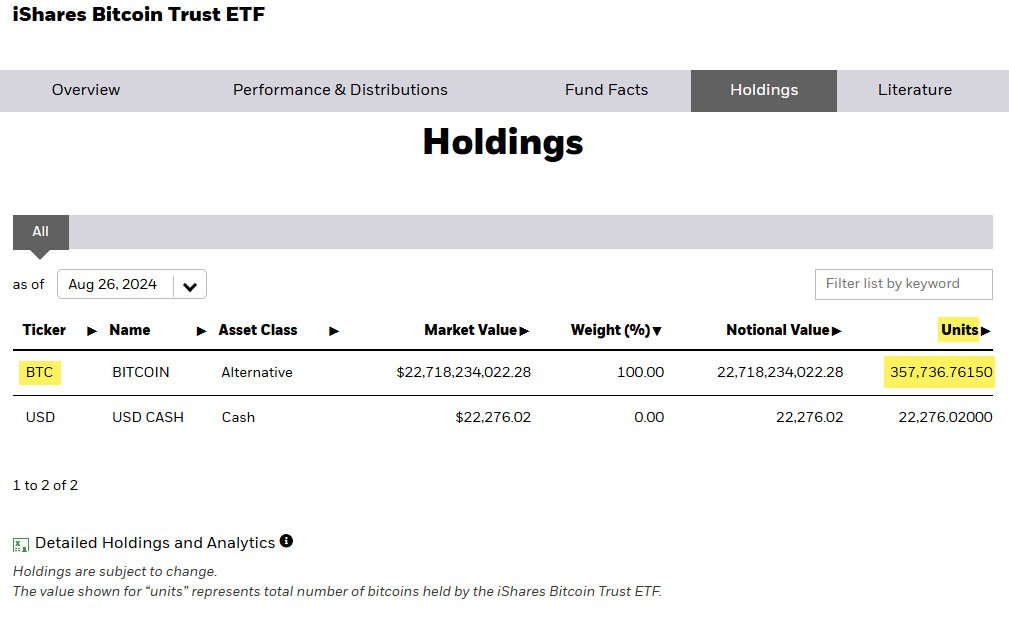

This sentiment is echoed by the fact that BlackRock’s IBIT has now accumulated over 350,000 BTC, solidifying its position as the dominant player in the Bitcoin ETF market.

BlackRock, one of the world’s largest asset managers, has been at the forefront of the Bitcoin ETF market.

The company’s iShares Bitcoin Trust has consistently outperformed its peers, attracting significant capital from investors. On August 26, IBIT not only led the market with its $224 million inflow but also accounted for the majority of the total inflows into U.S. Bitcoin ETFs that day.

This trend is not new. BlackRock’s IBIT has been a major force in the Bitcoin ETF market since its launch, consistently drawing in more capital than its competitors.

The fund’s success is partly attributed to the trust and confidence that investors have in BlackRock’s management.

It’s worth mentioning that the asset manager recently added 4,000 shares of IBIT to its Strategic Global Bond Fund, further underscoring its commitment to the Bitcoin market.

Other Bitcoin ETFs, such as Franklin Templeton’s EZBC and WisdomTree’s BTCW, also saw positive inflows on August 26, though on a much smaller scale, with each fund capturing only around $5 million.

In contrast, ETFs managed by Fidelity, Bitwise, and VanEck reported negative flows, highlighting the varied investor preferences and strategies within the market.

Despite the massive inflows into Bitcoin ETFs, the price of bitcoin has remained under bearish pressure. On August 26, bitcoin was trading at around $63,191, but has since dropped to below the $60,000 mark.

This decline came after a strong weekly rally that saw bitcoin rise from a seven-day low of $58,756 to a high of $64,475 on August 25. However, the subsequent pullback raised concerns about the sustainability of the rally.

Related: Bitcoin’s 7% Rise | Fed’s Rate Cut Hint and Kennedy Backing Trump

The drop in bitcoin’s price is particularly noteworthy given the substantial inflows into ETFs like BlackRock’s IBIT. Typically, such inflows are seen as a positive sign for the asset, as they indicate strong demand and confidence among investors.

However, in this case, the price of bitcoin has struggled to maintain its upward momentum, leading some analysts to question whether the current rally has reached its peak.

One of the reasons for the price dip could be the broader market dynamics. According to analytics platform Santiment, the bitcoin price dip caused a 7.5% plunge in open interest, which refers to the total value of all outstanding derivatives contracts.

This decline in open interest suggests that traders might be shifting their focus away from bitcoin and towards other assets, such as altcoins.

The recent performance of Bitcoin ETFs also highlights the divergent strategies and outlooks among investors.

While funds like BlackRock’s IBIT and Franklin Templeton’s EZBC have seen positive inflows, others, such as Fidelity’s Bitcoin ETF and Bitwise’s Bitcoin ETF, have experienced outflows.

These mixed results reflect the uncertainty in the market and the different approaches that investors are taking in response to the current environment.

Some investors may be taking profits after the recent rally, while others might be reallocating their capital to other assets or waiting for more favorable conditions to re-enter the market.

Despite the short-term volatility, the long-term outlook for bitcoin and Bitcoin ETFs remains positive.

Many analysts believe that the recent inflows into Bitcoin ETFs are a sign of growing institutional interest in the digital asset. This trend is expected to continue as more traditional finance companies and asset managers enter the space.

The recent Bitcoin halving event, which occurred in April, is also seen as a potential catalyst for future price appreciation.

The halving, which occurs approximately every four years, reduces the reward that miners receive for validating blocks on the blockchain, effectively reducing the supply of new bitcoin entering the market.

This supply reduction could lead to a price increase, as it has in previous cycles.

Veteran investor Peter Brandt predicted in February that bitcoin could peak at $200,000 by September 2025, up from his previous target of $120,000. Brandt posted on social media platform X:

“With the thrust above the upper boundary of the 15-month channel, the target for the current bull market cycle scheduled to end in Aug/Sep 2025 is being raised from $120,000 to $200,000.”

BlackRock’s increasing involvement in the Bitcoin ETF market is significant not only for the company itself but also for the broader digital asset market.

As one of the largest asset managers in the world, BlackRock’s actions are closely watched by other institutional investors, and its success in the Bitcoin ETF space could encourage more companies to explore similar opportunities.

The fact that BlackRock has now accumulated over 350,000 BTC in its IBIT fund, worth nearly $22 billion, underscores the investors’ confidence in the long-term potential of bitcoin.

This confidence is shared by many in the financial industry, who see Bitcoin as a viable asset class that offers diversification benefits and the potential for significant returns.

Moreover, the stabilization of inflows and outflows in Bitcoin ETFs suggests that the market is maturing. In the early days of Bitcoin ETFs, there was significant volatility as investors adjusted to the new products.

However, as the market has developed, we are seeing more consistent and stable investment patterns, which is a positive sign for the future.