In a significant move to broaden Brazil’s digital asset market, BlackRock, the global investment management giant, is poised to introduce the country’s first spot Bitcoin Exchange-Traded Fund (ETF) on March 1.

BlackRock Bitcoin ETF in Brazil: Launch on March 1

Following the triumph in the United States Bitcoin spot ETF arena, BlackRock is all set to launch its iShares Bitcoin Trust Brazilian Depositary Receipts (BDR), known as IBIT39 on the country’s primary stock exchange, B3. Initially catering to qualified investors, plans are underway to extend accessibility to retail investors, contingent on regulatory approval.

IBIT39, structured to mimic Bitcoin’s price performance, carries a management fee of 0.25%. Notably, this will be dropped to 0.12% for the first year on the first $5 billion in Assets Under Management (AUM).

A Strategic Expansion

BlackRock’s strategic vision for IBIT39 aligns with the belief in the potential of technology, allowing all investors, including individuals, to construct a portfolio exclusively with ETFs. Karina Saade, BlackRock Brazil Country Manager, disclosed the ETF launch, highlighting its objective to provide investors with regulated access to Bitcoin. Describing the strategic expansion of digital asset investments in the country, Saade stated:

“Our digital asset journey was underpinned by the goal of providing high-quality access vehicles to investors. IBIT39 is a natural progression of our efforts over many years and builds on the fundamental resources we have established so far in the digital asset market.”

Saade made it clear that BlackRock’s recent ventures into the digital asset markets in both the United States and Brazil should not be interpreted as an explicit endorsement of digital assets. Rather, she recognized the increasing interest among investors in this asset class.

Thriving Digital Asset ETF Market

The digital asset ETF market in Brazil has seen substantial growth, with 13 ETFs listed in 2021, accumulating assets of R$2.5 billion. Felipe Gonçalves, B3’s Interest and Currency Products Superintendent, noted the market’s evolution by stating:

“It is a recent market, but it has assets of R$2.5 billion. It started with strong volumes, fluctuated a little in two years and, at the end of last year, it reached R$30 million per day.”

The burgeoning interest in digital asset ETFs is mirrored in the United States, where nine recently launched spot Bitcoin ETFs amassed over 300,000 BTC, valued at $17 billion, within a mere two months of their public launch.

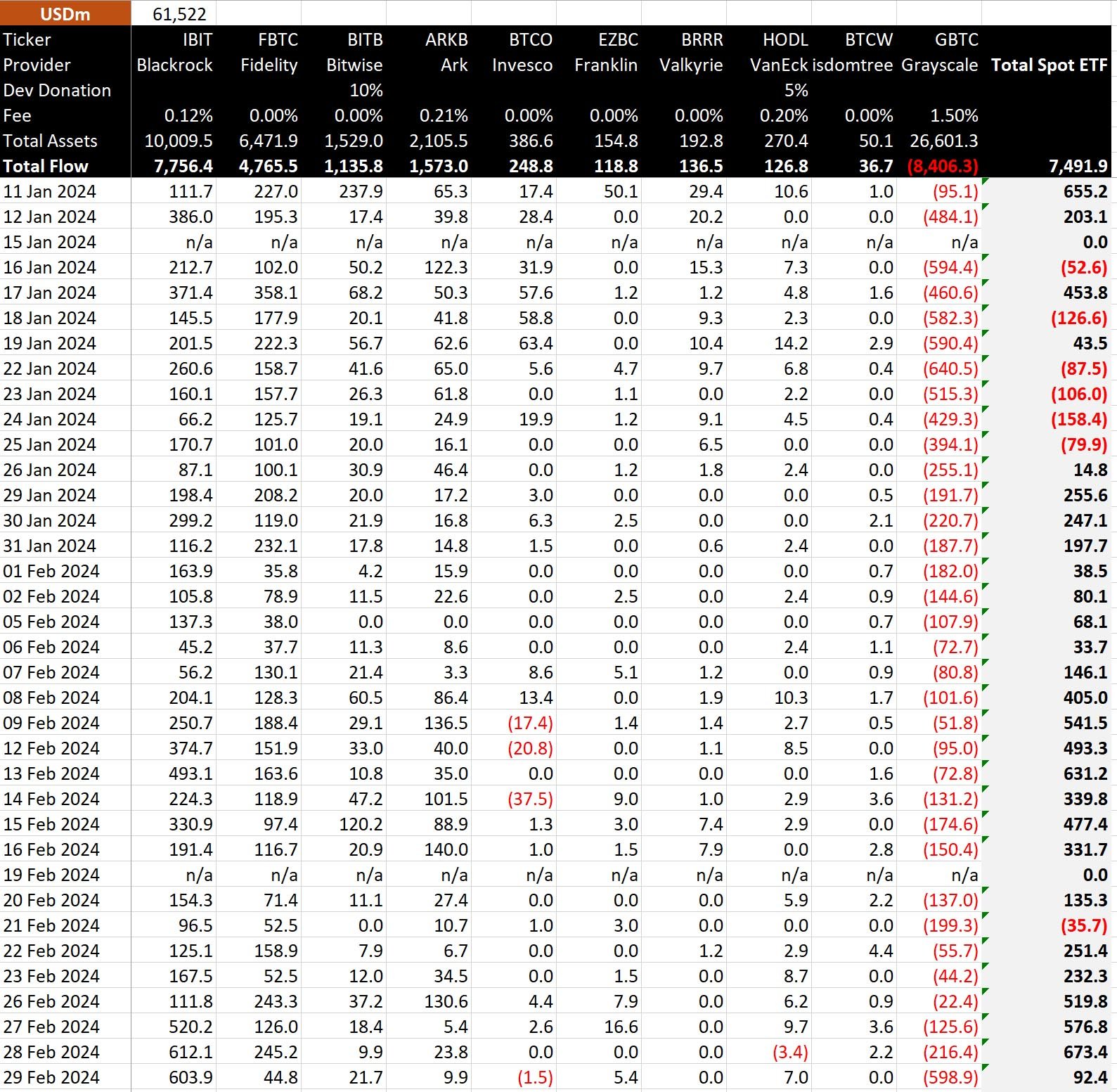

BlackRock’s IBIT ETF leads the pack, managing over $10 billion in total assets, according to BitMEX Research’s latest data. Fidelity’s FBTC closely follows, overseeing nearly $6.5 billion in total assets.

The success and growing demand for bitcoin ETFs signify a paradigm shift in investor sentiment, indicating an increased acceptance and integration of digital assets into traditional investment portfolios. As BlackRock pioneers Brazil’s first Bitcoin ETF, it marks an important moment in the country’s financial landscape, opening new avenues for investors seeking regulated exposure to the world of digital assets. Additionally, the firm stated it has bigger plans for Bitcoin in the near future.