The spot Bitcoin Exchange-Traded Fund (ETF) provided by BlackRock, the largest asset management firm in the world, is currently among the top 0.2% of all exchange-traded products (ETPs) issued in the United States so far in 2024.

BlackRock Bitcoin ETF Making Waves

The BlackRock spot Bitcoin ETF, approved along with ten other ETFs by the United States Securities and Exchange Commission (SEC) on January 10, is currently one of the hottest ETPs in the U.S. market, noted senior Bloomberg ETF analyst Eric Balchunas in a post on social media platform X.

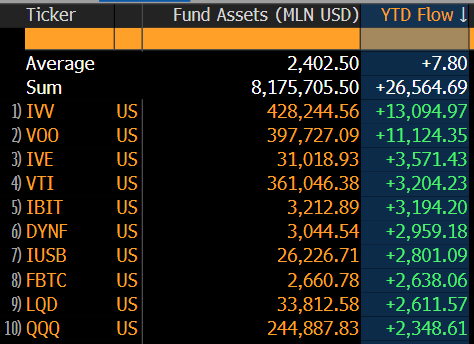

Recent data indicates that the iShares Bitcoin Trust (IBIT) has experienced significant inflows amounting to $3.2 billion. According to YCharts, the flows into the BlackRock spot Bitcoin ETF have propelled it into the upper echelon and secured a position within the top 0.16% among the 3,109 active ETFs in the US market.

On the other hand, Balchunas’ calculations also painted a slightly different picture when estimating BlackRock’s performance against a broader scope of around 10,000 ETFs globally, resulting in a figure closer to 0.02%.

Fidelity’s Bitcoin ETF is Not Far Behind

While BlackRock’s IBIT sits in the fifth spot, the Fidelity Wise Origin Bitcoin ETF has landed eighth in the list of top ETPs in the United States, securing $2.66 billion in flows. BlackRock and Fidelity’s ETFs are currently the top two performing ETPs among the eleven approved by the SEC in early January.

According to a previous report published on February 3 by Morningstar research analyst Lan Anh Tran, the two ETFs by BlackRock and Fidelity totaled around $4.8 billion in net flows by January end, as visible from the data approximated from the issuer’s websites.

Another important factor to mention here is that while the inflows in other ETPs are being counted starting January 1, 2024, the data from spot Bitcoin ETFs is being considered starting January 11. This means that the offerings from BlackRock and Fidelity are at a seven-trading-day handicap when compared to the others.

Overtaking Grayscale’s Trading Volume

As per the data shared by Bloomberg Intelligence analyst James Seyffart on February 1, the spot Bitcoin ETFs from BlackRock and ProShares surpassed the trading volume of Grayscale’s GBTC, which has dominated the market since January 11.

“BlackRock’s IBIT is the first ETF to trade more than Grayscale’s GBTC in a single day,” Seyffart said, while adding:

“Total trading today was kind of a dud though, at $924 million—the first day below $1 billion in dollar volume for the group since launch.”

Furthermore, as part of the industry’s proactive promotion, advertisements for spot Bitcoin ETFs, including those from BlackRock, Fidelity, Grayscale, Invesco, and Bitwise, have gone live on Google.

This development follows Google’s recent policy shift regarding the advertising of digital assets, with asset managers leveraging the platform for an extensive online advertising campaign to amplify awareness around their newly approved offerings.