As bitcoin’s price inches toward its all-time highs, interest in Bitcoin exchange-traded funds (ETFs) is at an unprecedented level.

In recent days, U.S.-based Bitcoin ETFs have seen massive inflows, with BlackRock’s iShares Bitcoin Trust (IBIT) leading the charge. Investors appear to be jumping on the Bitcoin train, fearing they might miss out on the potential for even greater gains.

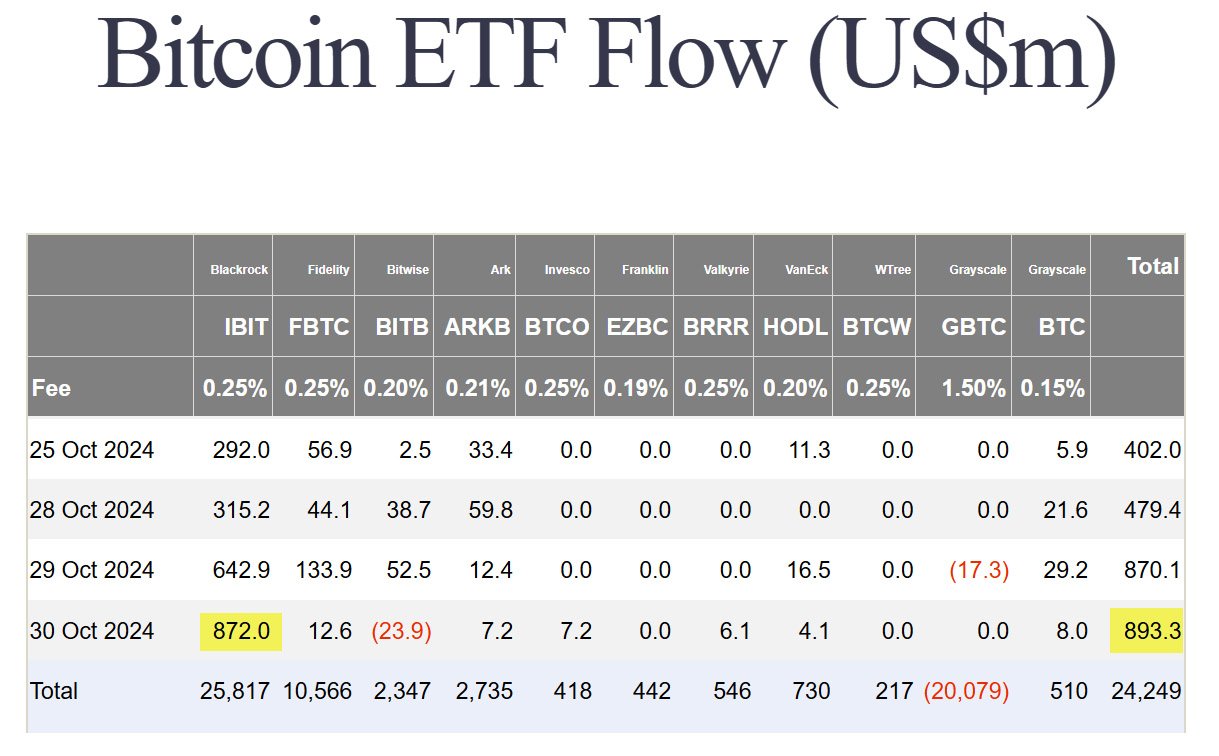

According to recent data, on October 30th, spot Bitcoin ETFs saw $893.3 million in inflows in a single day, with BlackRock Bitcoin ETF alone recording over $872 million of that figure. This is the largest inflow IBIT has seen since its debut in January.

This demand came as bitcoin’s price approached a lifetime high, fueled by market anticipation leading up to next week’s U.S. elections. With traders expecting volatility around the election results, both bitcoin and Bitcoin-related ETFs are attracting strong buying interest.

In just one day, trading volumes for U.S. Bitcoin ETFs surpassed $4.75 billion, the highest since March. This figure, driven mostly by IBIT, is a clear signal of the heightened interest from both retail and institutional investors.

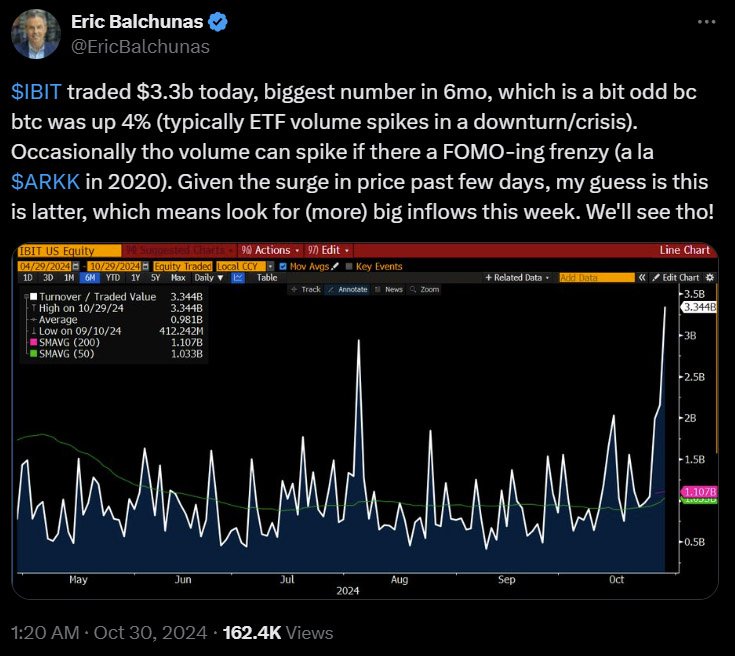

Eric Balchunas, Senior ETF Analyst at Bloomberg, noted that this level of volume is unusual for a day when bitcoin’s price rose, rather than dropped. “Typically ETF volume spikes in a downturn/crisis,” Balchunas said on social media.

He added that the recent trading activity “feels like a FOMO-ing frenzy,” as investors seem eager to secure their positions before a potential price rally. He mentioned, “Pretty apropos that the biggest daily inflow ever for $IBIT is what pushed the U.S. spot ETFs over the 1 million Bitcoin held mark.”

Besides IBIT’s significant contribution, other Bitcoin ETFs have experienced substantial inflows. Fidelity’s FBTC attracted $133 million on October29, while Bitwise’s BITB and Grayscale’s mini Bitcoin trust logged $52 million and $29 million, respectively.

However, Grayscale’s main Bitcoin trust (GBTC) saw outflows of $17 million, showing that some investors might be shifting from the more established fund to the newer ETFs, possibly seeking greater exposure and flexibility in the evolving ETF market.

“There’s a lot of demand coming into these ETFs, for sure,” said James Seyffart, an ETF analyst with Bloomberg Intelligence, during an appearance on Bloomberg Television.

The surge in demand for Bitcoin ETFs can be largely attributed to a mix of market confidence and a fear of missing out (FOMO) as bitcoin prices rise. For months, analysts have anticipated an ETF-fueled rally, and the recent inflows suggest that institutional and retail investors alike are taking note.

BlackRock’s IBIT, which has become a key player in the Bitcoin ETF space, reported a massive trading volume of $3.36 billion on one day alone — a record-breaking figure for the past six months.

On the next day, IBIT saw inflows totaling $872 million, the highest single-day inflow for any Bitcoin ETF since introduction.

Investor interest in Bitcoin ETFs has risen dramatically since BlackRock’s ETF launched.

The fund has seen consistent growth, now representing a $23 billion market. BlackRock CEO Larry Fink recently highlighted IBIT’s rapid growth, calling it a testament to the firm’s commitment to the Bitcoin space.

The cumulative inflows into U.S. Bitcoin ETFs have now reached $24.18 billion, demonstrating a continued demand for digital asset funds.

According to market research firm Ecoinometrics, this demand is putting pressure on bitcoin’s price. Ecoinometrics reported:

“The only thing that matters with the ETFs is how many bitcoins they accumulate over a fixed period of time. It is about demand pressure. Right now the pressure is the strongest it has been since March. Over the past 12 months, ETFs have been the main driver of Bitcoin’s uptrend.”

In addition to the ETF surge, bitcoin’s price action has attracted significant attention. Earlier this week, Bitcoin crossed the $72,000 mark, just shy of its all-time high of around $73,500.

Notably, prominent analyst Rekt Capital pointed out that bitcoin’s recent price movements could signal an extended rally. He called the recent jump a “phenomenal bull flag breakout,” explaining that if bitcoin sustains these levels, it could soon breach its next resistance at $80,000.

However, not all experts are convinced that bitcoin is heading for a new high. Some analysts see the current surge as a “Trump hedge,” suggesting it’s a speculative response to possible political changes rather than being fueled by broader economic factors.

The ETF inflows have created a wave of optimism among investors, with some targeting higher prices in November. Options bets for a bitcoin price of $80,000 have also surged, signaling the growing belief in continued gains regardless of political developments in the U.S.

Analysts say upcoming political events in the U.S., including the presidential election and Federal Reserve decisions, are also adding to the current momentum for bitcoin.

With political uncertainty in the air, many investors see bitcoin as a hedge against potential economic shifts. This environment has further boosted ETF inflows, with investors drawn to bitcoin’s perceived stability.

With an estimated 983,000 BTC currently held by U.S. ETFs, these funds could soon collectively hold more Bitcoin than any other single entity. Balchunas noted that by November’s end, Bitcoin spot ETFs could hold more Bitcoin than Satoshi, underscoring the shift in bitcoin ownership dynamics.

The recent surge in Bitcoin ETF inflows marks a milestone moment for both bitcoin and the ETF market. As BlackRock’s IBIT and other ETFs continue to attract record-breaking investments, Bitcoin’s role in the financial world is reaching new heights.

With bitcoin nearing its lifetime highs and analysts forecasting an extended rally, the demand for Bitcoin ETFs shows no signs of slowing down.

Whether bitcoin will break its all-time high in the coming weeks remains uncertain, but the impact of these ETFs on bitcoin’s price and adoption is undeniable.

As investors increasingly turn to ETFs for exposure to bitcoin, these funds are proving to be a powerful force driving the bitcoin market forward.