In a remarkable display of investor confidence, BlackRock’s spot Bitcoin exchange-traded fund (ETF) has continued to attract substantial investments, as bitcoin’s price makes a rebound from its lowest point in 5 months.

This surge in investment activity underscores the growing institutional interest in the scarce digital asset, and highlights BlackRock Bitcoin ETF’s dominant role in this burgeoning market.

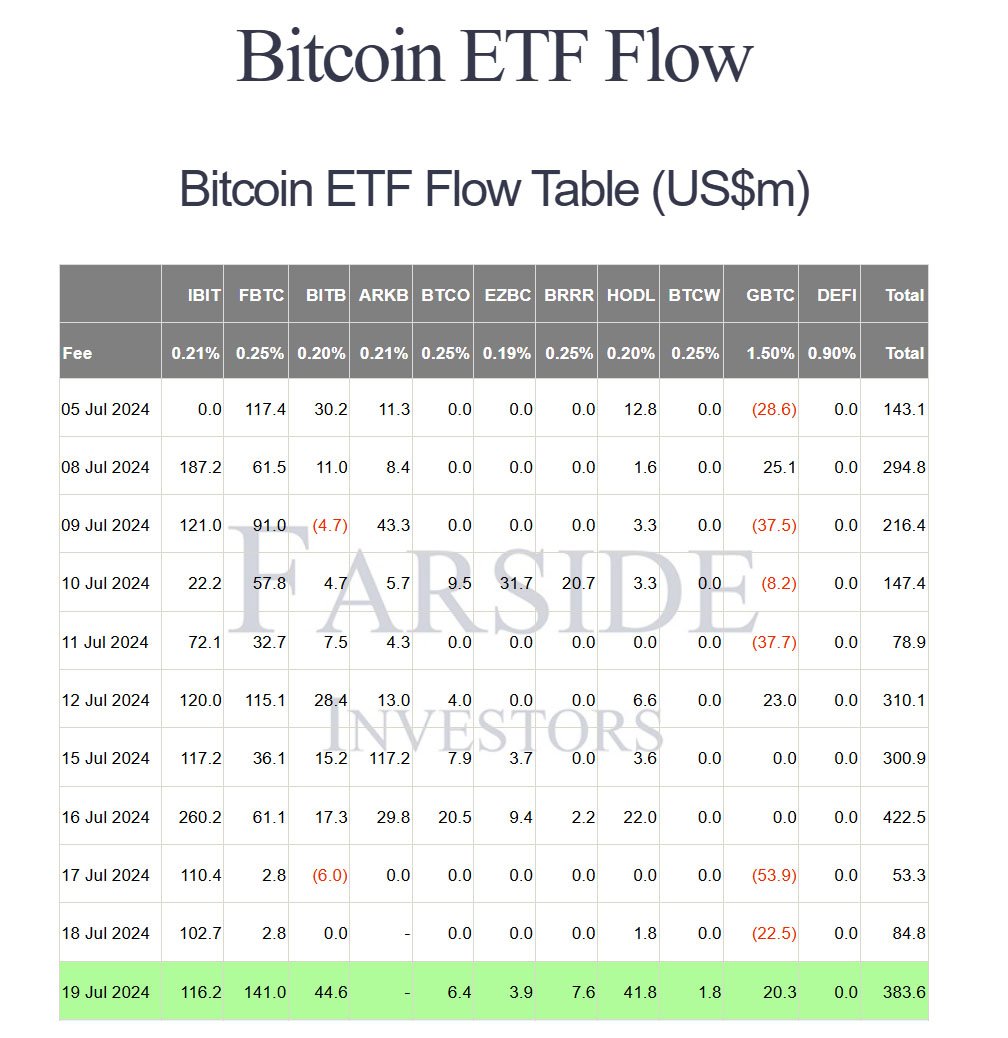

Since the start of July, Bitcoin ETFs have seen a significant influx of capital.

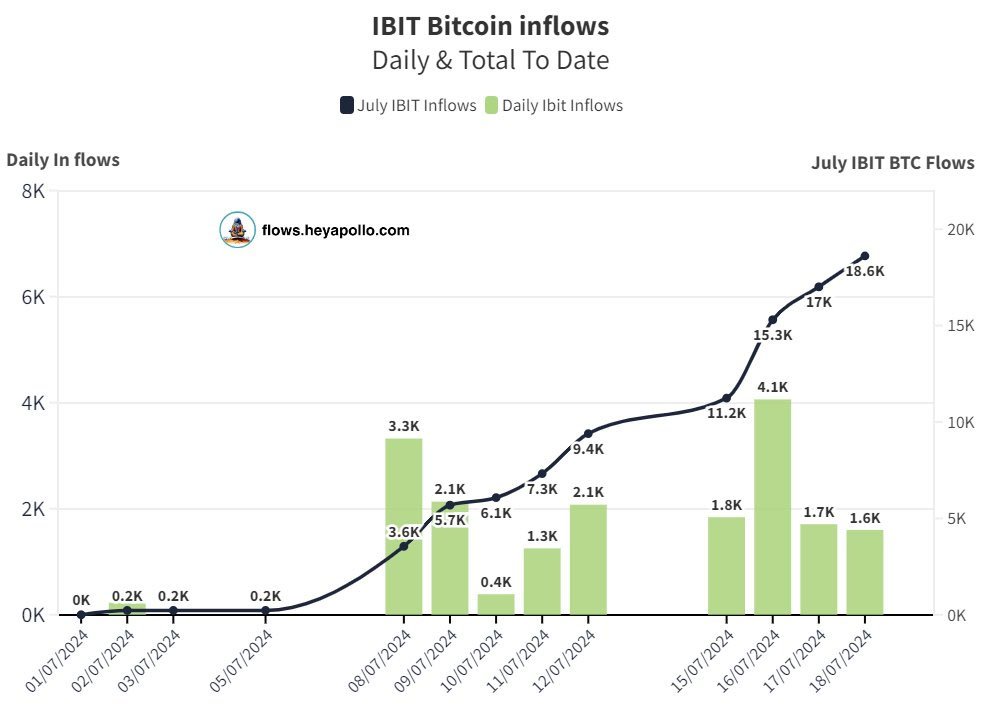

On Friday, July 19, BlackRock’s iShares Bitcoin Trust (IBIT) alone accounted for an impressive $116.2 million in inflows, marking the tenth consecutive day of substantial investments.

Over the past ten days, eight days witnessed inflows exceeding $100 million, a rare feat in the ETF industry.

This robust performance has pushed BlackRock’s total bitcoin acquisitions in July to over $1 billion, with the firm adding 1,730 BTC on July 18 alone. BlackRock, the world’s largest asset manager, has been at the forefront of this investment surge since the introduction of Bitcoin ETFs.

The firm has amassed significant bitcoin holdings, bolstering its position as a leading liquidity provider in the market. By July 16, BlackRock’s IBIT had accumulated $18.8 billion in assets under management (AUM), demonstrating the company’s substantial influence in the Bitcoin space.

Thomas Fahrer, co-founder of digital assets analytics platform Apollo, commented on the trend, stating, “This is a total acceleration of inflows.” The consistent inflows into BlackRock’s Bitcoin ETF highlight the growing institutional confidence in Bitcoin as a valuable asset.

Other Bitcoin ETFs have also experienced notable inflows. July 19 marks one of the rare days in which BlackRock came out second in terms of inflows. Fidelity’s FBTC recorded $141 million in inflows, almost $25 million more than BlackRock’s IBIT.

Ark Invest’s ARKB saw steady investments too, contributing to the overall positive trend. On July 16, U.S. Bitcoin ETFs recorded greater total inflows of $429 million, with BlackRock’s IBIT alone accounting for $260 million.

Grayscale’s GBTC showed exceptional performance too, with the ETF seeing a positive inflow of $20.3 million in a single day.

Nevertheless, the overall trend has been positive, with U.S. Bitcoin ETFs amassing a total of $1.96 billion since July 5. While the inflows into Bitcoin ETFs have been robust, market sentiment among digital asset traders has been more cautious.

According to blockchain market intelligence firm Santiment, positive commentary on bitcoin across social media platforms has declined significantly compared to four months ago.

This drop in positive sentiment is reflected in the increasing number of traders taking short positions on bitcoin, anticipating potential price declines.

Interestingly, despite the decline in positive social media commentary, the broader market sentiment remains relatively optimistic.

The Fear and Greed Index, which measures market’s attitude, currently places the market in the “Greed” zone with a score of 60 out of 100. This represents a significant rebound from the “Extreme Fear” zone, where the score was 25 out of 100 on July 12, the lowest since January 2023.

The sustained inflows into Bitcoin ETFs, particularly by institutional giants like BlackRock, underscore the growing acceptance of Bitcoin as a mainstream investment.

Michael Saylor, chairman of MicroStrategy, emphasized Bitcoin’s evolving role, stating, “Bitcoin has emerged as a political force.” This sentiment is echoed by the consistent investments from institutional players, signaling long-term confidence in bitcoin.

In addition to the U.S. market, demand for spot Bitcoin ETFs remains high in other regions, such as Australia and Hong Kong. The Monochrome Bitcoin ETF IBTC in Australia, for instance, has accumulated 85 BTC valued at $7.99 million, indicating global interest in these investment vehicles.