BlackRock, the world’s largest asset management firm, has officially filed a revised Spot Bitcoin Exchange-Traded Fund (ETF) application with the United States Securities and Exchange Commission (SEC), which offers “superior resistance to market manipulation.” Interestingly, this BlackRock BTC ETF revision will allow Wall Street banks to have easier access to the firm’s funds.

As per a Forbes report, the new model was first presented to the SEC in November. It aims to allow banks like JPMorgan Chase and Goldman Sachs to participate more easily in the Bitcoin market despite the strict regulations that hold them back from holding BTC on their balance sheets.

BlackRock BTC ETF Plan: ‘Prepay’ Model

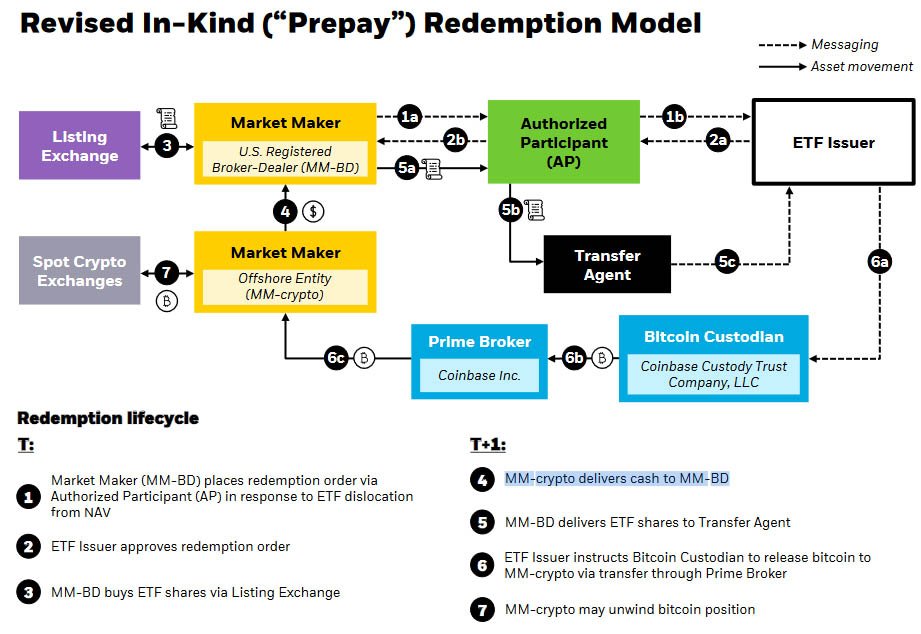

The report stated that BlackRock’s new in-kind redemption “prepay” model will allow leading American banks to act as authorized participants for the iShares Bitcoin Trust, enabling them to bypass the restrictions imposed by authorities that prevent them from holding BTC.

Notably, six members of BlackRock and three from Nasdaq presented the revised model in a November 28 meeting with the SEC. If the revised ETF is approved, banks with assets worth trillions of dollars on their balance sheets could gain access to Bitcoin.

The filing states:

“This model appears to address the staff’s concern with in-kind, addressing the critical dimension on which the in-kind model would otherwise not be preferred to the cash model. In so doing, it preserves the many significant benefits to investors of the in-kind model over certain cash models in the context of Bitcoin.”

BlackRock stated that under the new model, the Authorized Participants (APs) would transfer cash to a broker-dealer, which would convert it into Bitcoin and store it with the ETF’s custody provider, Coinbase Custody.

Benefits of the Revised Model

According to BlackRock, the new ‘prepay’ model would lower transaction costs while providing superior resistance to market manipulation. Also, the execution risks will be borne by digital asset market makers instead of investors, removing the need for issuers to finance or pre-fund sell trades.

Additionally, the new model would also provide “simplicity and harmonization across the ecosystem given significantly lower variance on how in-kind models can be executed vs. cash models,” the filing said.

As of December 12, BlackRock has met with the SEC for the third time regarding this revised application. The initial presentation of the model on November 20 was followed by a critical follow-up meeting on November 28. These meetings signify BlackRock’s commitment to transparent communication with regulatory authorities.

Bitcoin Spot ETFs Roadmap

Notably, on October 23, the firm listed its iShares Spot Bitcoin ETF on the Depository Trust & Clearing Corporation (DTCC) with the ticker IBTC.

This year, multiple asset management firms, including BlackRock and Fidelity, submitted Spot Bitcoin ETF applications to the SEC. The regulator has been closely reviewing these applications, with key decision dates approaching in January 2024.

While some models, like BlackRock’s, introduce innovative features such as the ‘prepay’ redemption model, the SEC’s final decision on these applications is awaited, impacting the landscape of Bitcoin investment options.