BlackRock’s iShares Bitcoin Trust (IBIT) has set the bar in the investment world. It is now recognized as the most extraordinary exchange traded fund (ETF) on the market.

IBIT managed to gather over $50 billion of assets in just 11 months since its January quarter, which is an astonishing record for any fund in ETF history. BlackRock’s Bitcoin fund was the fastest to reach this mark.

This has left almost everyone in the sector in shock. “IBIT’s growth is unprecedented,” says James Seyffart, an analyst at Bloomberg Intelligence.

“It’s the fastest ETF to reach most milestones, faster than any other ETF in any asset class.”

Assuming it were the size it is now through the year, the ETF alone could have raked in $112 million in fees factoring in 0.25 % expense ratio.

IBIT was part of further evolution in the Bitcoin space. The world’s first and largest digital asset passed the bar of $100,000 for the first time in 2024. Many believe this development is a direct result of spot-Bitcoin ETFs like IBIT among others.

BlackRock’s tremendous size within the finance industry—over $11 trillion in assets—gave Bitcoin a credibility that it has been lacking in the traditional finance sector.

Before this, BlackRock’s CEO, Larry Fink, believed bitcoin was a means for money laundering. Now he calls it “digital gold”. That was crucial in the metamorphosis which caused bitcoin to boost into the realm of legitimate investments.

BlackRock’s iShares division manages over 1,400 ETFs across the globe, but none has been like iShares Bitcoin Trust. The president of The ETF Store, Nate Geraci, referred to it as the greatest launch in the history of Exchange Traded Funds.

Eric Balchunas, another senior Bloomberg ETF analyst noted that the ETF has an asset base nearly equal to the cumulation of over fifty European ETFs that have existed for several decades.

More than just the speed of its launch, the success of IBIT can also be attributed to the trading volume. In terms of daily trading transactions, the IBIT has accounted for over half of all bitcoin ETFs, and has done so from the inception of the fund.

Recently, the total volume of options linked to it has grown to $1.7 billion on average daily basis, with a huge concentration on exchange traded fund derivatives.

Related: BlackRock’s IBIT Sees Record Trading Volume of $4.1 Billion in One Day

Getting approval for a spot-Bitcoin ETF in the US market has proven to be a tedious journey.

Some of the proposals such as Winklevoss twins’ application back in 2013 was shot down by the ruling body—the Securities and Exchange Commission (SEC).

But a legal win by Grayscale Investments in 2023 proved to be instrumental in creating the conditions that were necessary for this approval.

When BlackRock entered the market in 2024, it brought its ETF expertise. Along with Fidelity, VanEck and others, BlackRock launched the first US spot-Bitcoin ETFs. Together, these funds now manage over $107 billion in assets.

Despite the competition, IBIT is the clear winner. It’s grown so fast it’s even passed BlackRock’s gold ETF, which is the 2nd largest gold fund in the world. Some think IBIT will surpass SPDR Gold Shares, the largest gold ETF, by 2025.

Beyond the numbers, IBIT stock has helped to legitimize bitcoin as an asset class.

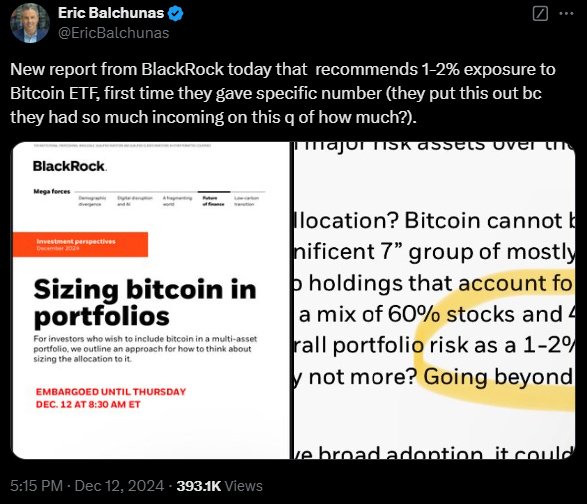

According to Balchunas, BlackRock is recommending a 1-2% allocation to bitcoin in diversified portfolios. This is music to the ears of institutional investors and retail traders alike, many of whom were previously skeptics, but are now more eager to gain exposure to the scarce digital asset.

Analysts believe the fund has had profound impact on the price of bitcoin. Since IBIT launched, bitcoin has risen 118%. There is evidence that suggests the price has been driven by steady inflows into IBIT which has seen outflows on only 9 days since launch.

IBIT has changed the ETF game and set the bar for future funds. Balchunas said IBIT reached $50 billion in 5 years faster than BlackRock’s previous record holder, the iShares Core MSCI EAFE ETF.

Behind the ETF’s success is a bright future in options too. Since options trading started in November, IBIT’s options have been beating the industry benchmarks and Fidelity’s and Grayscale’s Bitcoin ETFs hands down.