The world’s largest asset management firm, BlackRock, currently offering a Bitcoin Exchange-Traded Fund (ETF) has plans to increase the firm’s exposure to the leading digital asset following a surge in institutional interest in Bitcoin.

BlackRock Spot Bitcoin ETF was recently approved by the United States Securities and Exchange Commission (SEC) on January 10 along with ten other applications from firms like Fidelity and Bitwise. Apparently, the asset management giant has bigger plans for Bitcoin, as per a report from The Wall Street Journal.

BlackRock Spot Bitcoin ETF: Time to Go Deeper

BlackRock is all set to go deeper into the digital asset ecosystem, as per the firm’s Chief Investment Officer, Rick Rieder, who acknowledged the potential of Bitcoin for adoption on a wider scale.

As per the WSJ, Rieder also acknowledged the asset management firm’s decent investment in bitcoin while indicating that BlackRock might allocate a more prominent role to the digital asset within its portfolios as investor comfort rises.

“Time will tell whether it’s going to be a big part of the asset allocation framework,” Rieder said while, adding:

“I think over time, people become more and more comfortable with it.”

‘Real’ Upside Potential

Rieder also underscored the critical necessity of establishing user-friendly channels for investors to participate in the Bitcoin market. He emphasized that as both individual enthusiasts and institutional players adopt BTC as a bona fide asset, its exponential growth trajectory will become more palpable and undeniable.

“As you get more and more people that adopt it as an asset, we think the upside potential is real,” Rieder noted.

As reported earlier by Bitcoinnews, BlackRock’s iShares Bitcoin Trust (IBIT) recently surpassed Grayscale’s Bitcoin Trust (GBTC) in daily trading volumes, sending waves across the digital asset ecosystem.

Rieder added:

“If there is more and more receptivity, now we have more vehicles that people can utilize to get more comfortable with owning it and buying it and selling it and liquidating it.”

$10B Milestone

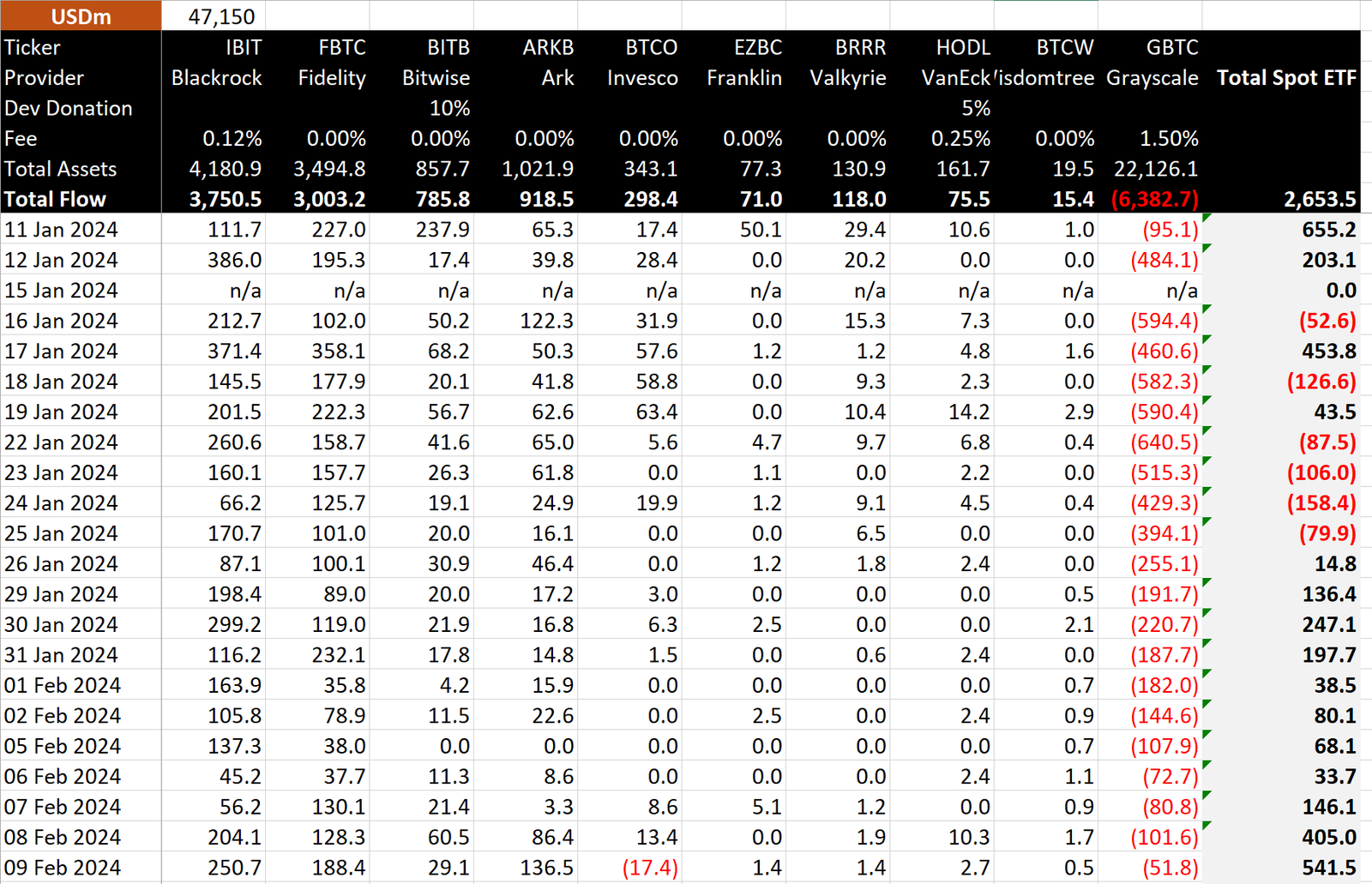

It is important to note that the recently approved eleven spot Bitcoin ETFs completed their first twenty sessions and secured $10 billion in assets under management (AUM). The data from BitMEX Research shows that the net flows for the ETFs reached $2.7 billion on January 9, led by BlackRock’s IBIT.

In the second position was Fidelity’s Wise Origin Bitcoin Fund, as it currently has $3.4 billion in BTC under management while IBIT has $4 billion in AUM. The two have gained dominance in the category and remain untouchable.

According to a previous report, these robust flows in IBIT have propelled the BlackRock spot Bitcoin ETF into an elite tier, securing its position within the top 0.16% among the 3,109 active ETFs in the competitive US market landscape.

Notably, the spot Bitcoin ETF from ARK 21Shares also reached the $1 billion mark. In contrast, the Grayscale Bitcoin Trust (GBTC) witnessed substantial outflows totaling $6.3 billion over the preceding 30 days. On February 9th, the fund experienced a comparatively modest daily outflow of $51.8 million, marking its lowest volume of capital withdrawals since its conversion.

“I thought the Nine would get a bit weaker as GBTC outflows subsided but they’re getting stronger,” said Bloomberg ETF analyst Eric Balchunas on X.