BlackRock’s iShares Bitcoin Trust (IBIT) has made waves by surpassing Grayscale’s Bitcoin Trust (GBTC) in daily trading volumes. On Thursday, IBIT traded a whopping $303.4 million, edging past GBTC’s $291 million. This shift marked a pivotal moment as the first spot Bitcoin Exchange-Traded Fund (ETF) to outpace Grayscale since their January debut.

The rise of Bitcoin ETFs has become a focal point for investors. According to a recent report, the collective Bitcoin ETF applicants for the 11 available spots possess around 3.3% of the total current Bitcoin supply. As per the latest information provided by Ycharts, the circulating supply of Bitcoins stands at 19.61 million.

The Battle for Trading Supremacy

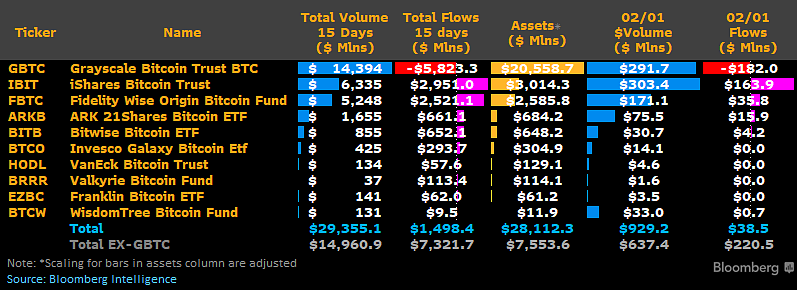

Recent weeks have seen a fierce competition between BlackRock’s IBIT and Grayscale’s GBTC for dominance in daily trading volumes. IBIT’s $12 million lead over GBTC has sparked industry discussions about the changing landscape and investor preferences in the market.

Grayscale’s GBTC, initially leading the market, has faced net outflows amounting to $5.8 billion. On February 1, Grayscale further reduce its Bitcoin holdings by 4,232 BTC, valued at approximately $182 million. However, recent reports indicate a decrease in outflows, potentially stabilizing GBTC and instilling hope for its investors.

Last week, John Hoffman, The Sales and Distribution Managing Director at Grayscale stated:

“GBTC has been dominating trading volume and has already solidified its role as a true capital markets tool for risk transfer in Bitcoin […] GBTC’s diverse shareholder base will continue to deploy strategies that impact inflows and outflows.”

BlackRock’s Continued Surge: IBIT’s Impressive Growth

BlackRock’s IBIT continues its remarkable surge in the market, boasting a daily trading volume of $303.4 million, outpacing GBTC, which recorded $291.7 million on Thursday. The consistent growth of IBIT, coupled with Fidelity’s FBTC securing the third position with a trading volume of $171.1 million, underscores the escalating interest in Bitcoin ETFs among institutional investors.

The landscape also witnessed significant contributions from other notable Bitcoin ETFs. The ARK 21Shares Bitcoin ETF (ARKB) recorded a total trading volume of $75.5 million, showcasing its traction in the market. Bitwise Bitcoin ETF (BITB) traded impressively at $30.7 million, followed by the Invesco Galaxy Bitcoin ETF (BTCO) at $14.1 million. These collective performances emphasize the growing prominence of Bitcoin ETFs within institutional investment portfolios.

Nate Geraci, the president of The ETF Store, shared the numbers on X highlighting the impressive milestone for BlackRock’s bitcoin ETF, as it achieved $3 billion in Assets Under Management (AUM) in just 3 weeks. He stated BlackRock’s IBIT is now in the top 10% of all ETFs by AUM.

Shifting focus to the asset holdings, Vaneck’s HODL ETF maintained stability with a balance of around 3,000 BTC over the 24-hour period. Valkyrie’s BRRR ETF experienced growth, witnesses a slight decline in its holdings from $114.9 million to $114.1 million.

The cumulative holdings of these nine new ETFs now stand at an impressive 173,977.55 BTC, valued at an estimated $7.48 billion. This collective portfolio size indicates a substantial commitment and interest from institutional investors in the Bitcoin market through the avenue of Bitcoin ETFs.

BlackRock Overtakes Grayscale in Daily Trading Volumes

After Grayscale’s initial dominance, BlackRock’s IBIT managed to overtake GBTC in daily trading volumes. Despite GBTC’s significant trading activity, IBIT’s higher numbers on Thursday, reaching $303.4 million compared to GBTC’s $291.7 million, signified a turning point in the competition between the two ETFs.

Bitcoin ETFs and Institutional Accumulation

Since the approval of Bitcoin ETFs, institutional entities have been actively accumulating the digital asset. BlackRock’s involvement, holding 70,005 BTC valued at nearly $3 billion, indicates growing institutional confidence in Bitcoin ETFs despite a 10% drop in BTC’s price post-ETF approval.

While Bitcoin’s value dropped post-ETF approval, discussions around the upcoming Bitcoin halving in April and more potential ETF listings suggest a possible catalyst for a significant bull run. Market sentiment is buoyed by the anticipation of increased retail investor engagement and a positive trajectory for bitcoin’s valuation.

What to Expect

In the dynamic landscape of Bitcoin ETFs, BlackRock’s IBIT and Grayscale’s GBTC have emerged as key players, each with its own unique journey and impact on the market. As institutional participation continues to grow and market dynamics shift, the Bitcoin landscape is poised for further developments that could shape the future of digital asset investments. Investors and enthusiasts alike are closely watching the evolving narrative of Bitcoin ETFs, hoping for a positive turn that propels the market to new heights.