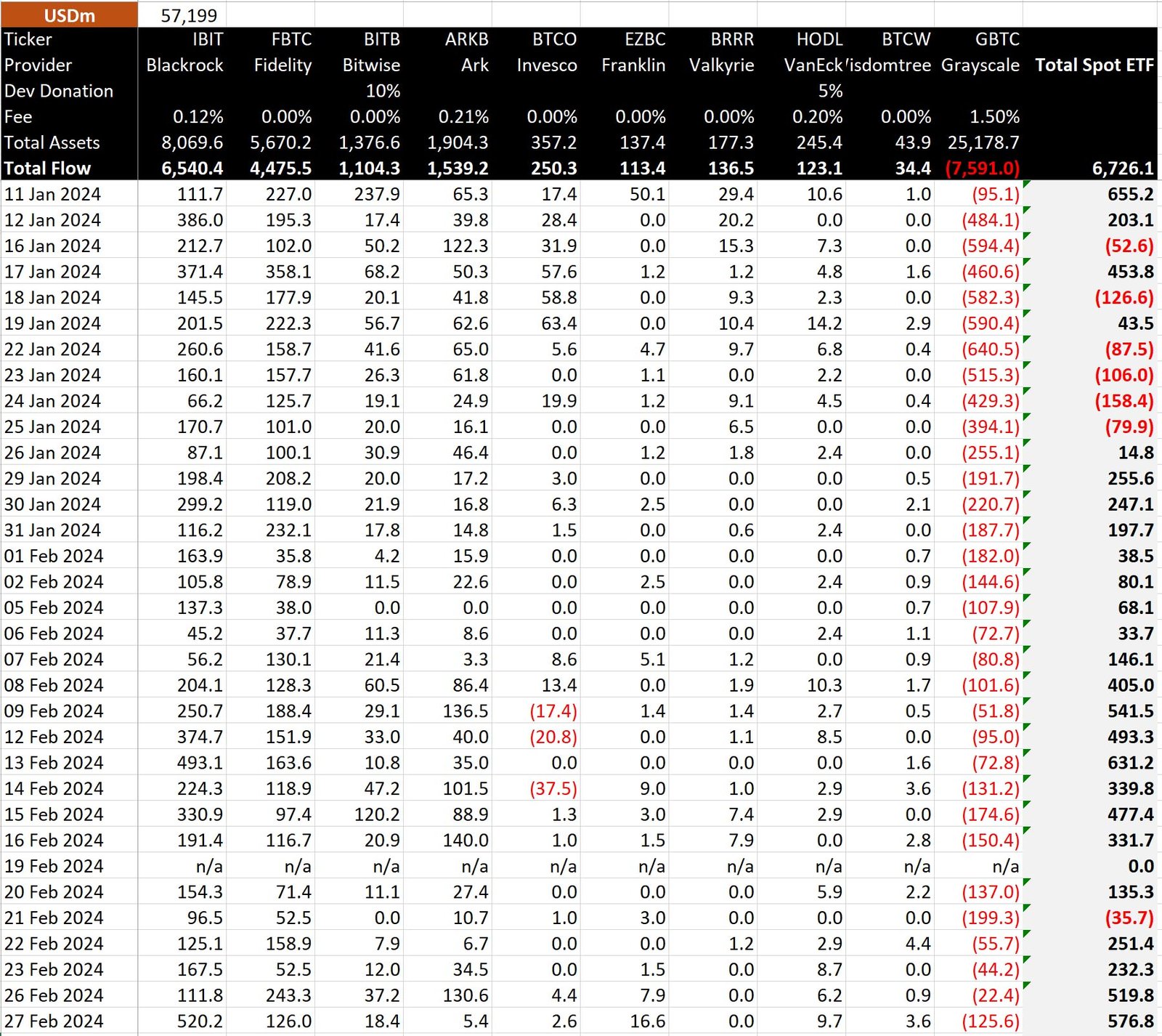

Just ahead of Bitcoin’s massive surge past the $60,000 milestone, BlackRock’s bitcoin Exchange-Traded Fund (ETF), iShares Bitcoin Trust (IBIT), achieved a noteworthy record in net inflows. It amassed $520 million on February 27, marking a pinnacle for any of the 10 US bitcoin funds.

IBIT Breaking Records

With this milestone, the ETF has broken its own previous daily net inflow high of $493 million on February 13. Notably, IBIT majorly outpaced its competitors, with the Fidelity Wise Origin Bitcoin Fund (FBTC) securing the second-highest daily inflow at $126 million. Digital asset hedge fund Capriole Investments’ founder, Charles Edwards, noted IBIT’s achievement, stating:

“Another monster ETF day. Over half-a-billy in IBIT alone. We now have a new reflexivity wheel at play. The more Bitcoin goes up, the more tradfi asset managers have to allocate to the ETFs, because they now no longer have the excuse of ‘inaccessibility’ and ‘regulatory risk’.”

In contrast, the higher-priced Grayscale Bitcoin Trust ETF (GBTC) experienced roughly $126 million in outflows. GBTC has faced substantial net outflows of $7.6 billion, partly attributed to its 1.5% fee, significantly higher than competitors priced between 0.18% and 0.30%.

Net Inflow

It is important to note that the combined net inflows for the 10 US spot bitcoin funds reached $577 million on February 27, ranking third, following the $655 million on January 11 and the $631 million on February 13. Aggregate net inflows for the sector now exceed $6.7 billion, according to BitMEX Research.

Industry experts anticipate a potential second wave of flows into bitcoin ETFs once the funds are incorporated into national account platforms, expecting wealth management entities such as Registered Investment Advisers (RIAs) and wirehouses to gradually allocate client assets to these funds.

It is important to note that leading RIA firm Carson Group recently approved four ETFs, including IBIT, for its clients.

Bitcoin’s Upward Rally

BlackRock’s remarkable net inflow achievement coincided with the broader digital asset market rally. Bitcoin’s price impressively surpassed the $60,000 level on Wednesday, marking an almost 18% increase from the previous week.

Notably, BTC last surged above $60,000 in November 2021, when it attained its all-time high at $69,000.

Furthermore, Bitcoin’s dominance over alternative coins has also seen a recent uptick, surpassing 55%, rebounding from a brief dip to 52% the previous week.

Currently trading at over $61,000, bitcoin has prompted a significant shift in market sentiment as investors display extreme greed. With the impending halving approaching and considering Bitcoin’s historical performance following each previous occurrence, the community is engaged in speculation about the potential heights BTC may reach in the ongoing bull run.

Notably, SkyBridge Capital founder Anthony Scaramucci recently projected $200,000 for the digital asset in the coming 18 months after the halving.

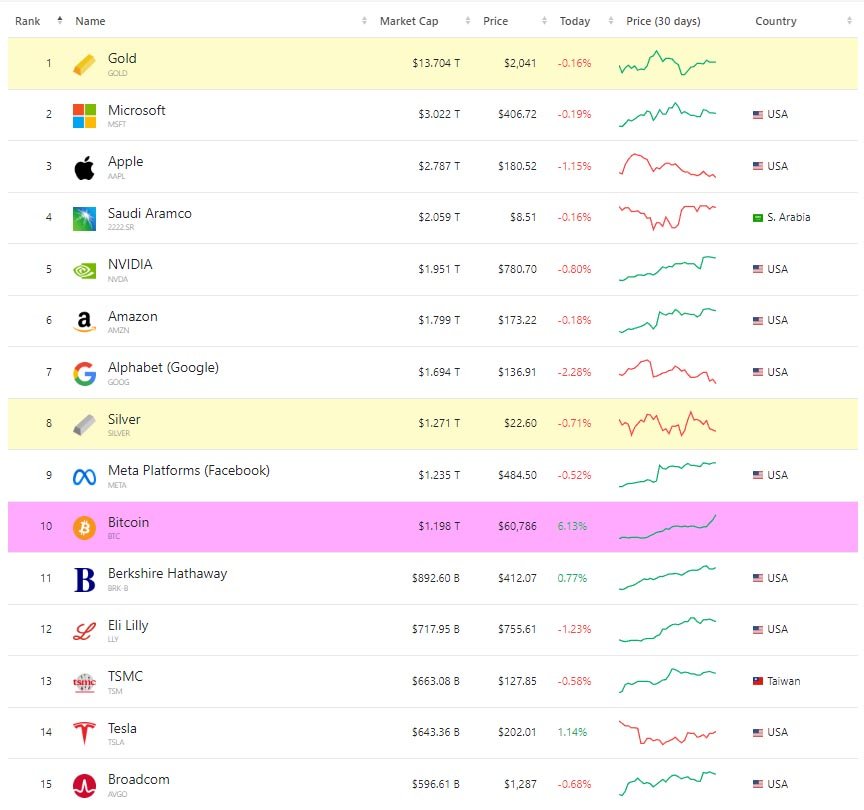

It is interesting to note that bitcoin recently attained trillion-dollar asset status. With its latest rally, BTC’s market capitalization has rocketed to a staggering $1.2 trillion, propelling it into the celestial ranks of financial prowess.

It has surpassed entities such as Berkshire and TSMC and left industry giants like Tesla, Visa, and JPM considerably behind.