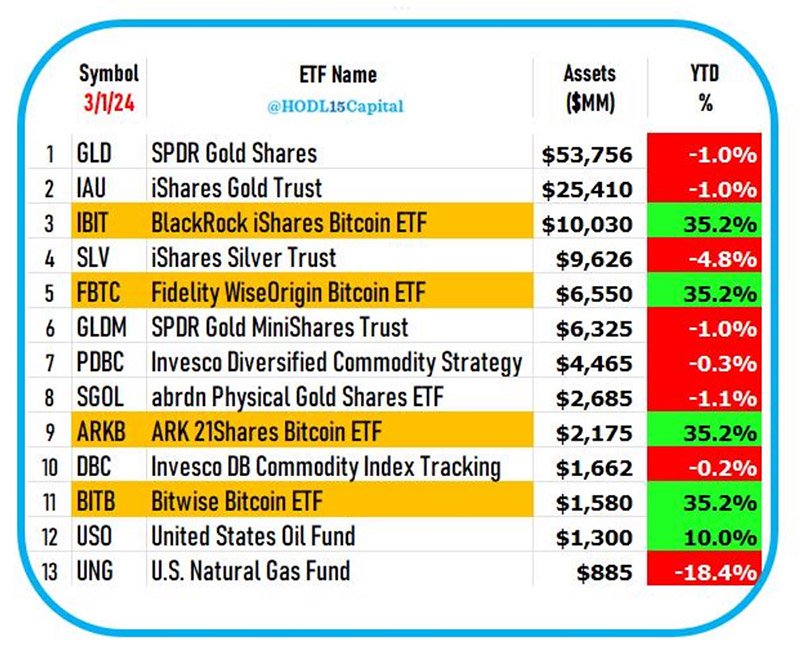

Amid the burgeoning success of spot Bitcoin Exchange-Traded Funds (ETFs), the latest data from renowned asset allocator and analyst Hold15Capital reveals that within just two months of their launch, these financial instruments now claim four spots among the 11 largest spot commodity ETFs.

BlackRock IBIT Bitcoin ETF

The analysis spotlights BlackRock’s IBIT as a standout performer, securing the third position among commodity ETFs with an impressive $10 billion in assets under management (AUM). Only surpassed by SPDR Gold Shares with $53.6 billion and BlackRock’s Ishares Gold Trust with $25.4 billion, IBIT has rapidly established itself as a formidable player in the market.

Moreover, Fidelity’s FBTC fund now secures the fifth position at $6.55 billion, trailing behind BlackRock’s iShares Silver Trust with $9.63 billion. On a similar note, the Ark 21Shares Bitcoin ETF and the Bitwise Bitcoin ETF secure the ninth and eleventh spots, boasting $2.17 billion and $1.58 billion in AUM, respectively.

Strong Week for Spot Bitcoin ETFs

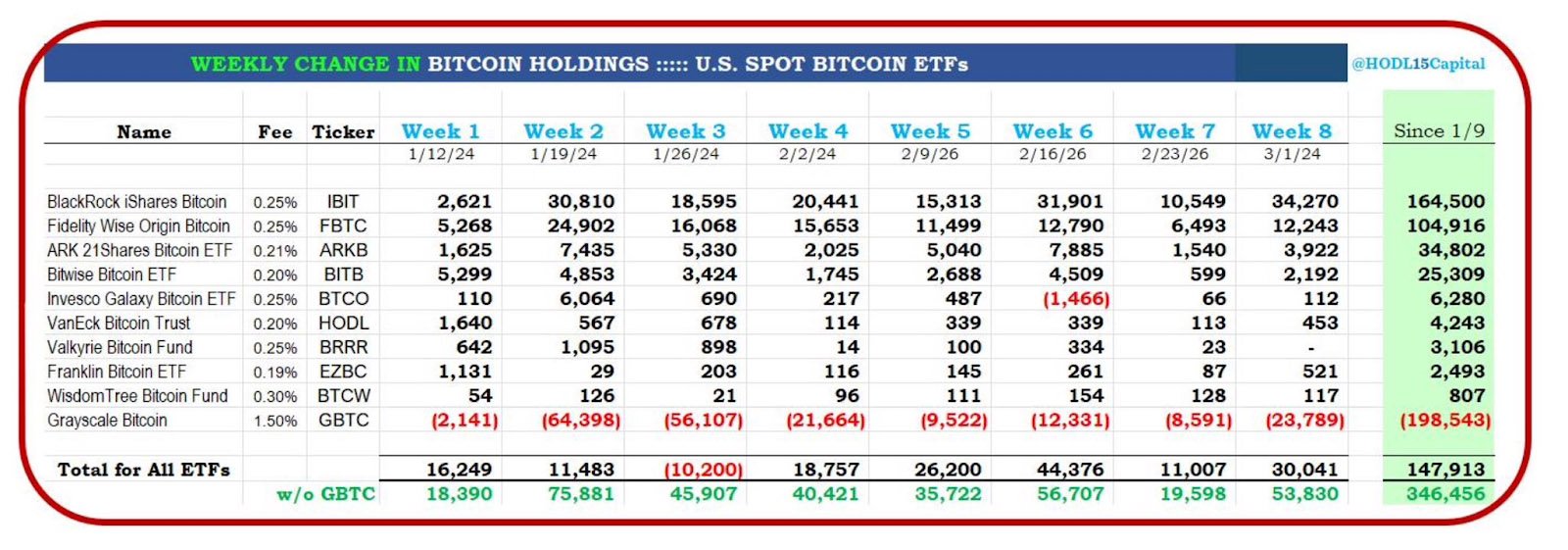

This development follows one of the strongest weeks on record for spot Bitcoin ETFs, marked by unprecedented daily trade volumes and inflows. BlackRock’s IBIT has emerged as a leader in accumulated bitcoin, amassing an impressive 164,500 BTC in its portfolio. Week 8 marked a pinnacle for IBIT, with an accumulation of 34,270 bitcoin.

Since the Securities and Exchange Commission’s (SEC) approval, the cumulative net amount of BTC acquired by all running ETFs is 147,913 BTC. Excluding the 198,543 bitcoin withdrawn from Grayscale’s GBTC during this period, the nine newly launched ETFs collectively amassed 346,456 bitcoin in the past eight weeks.

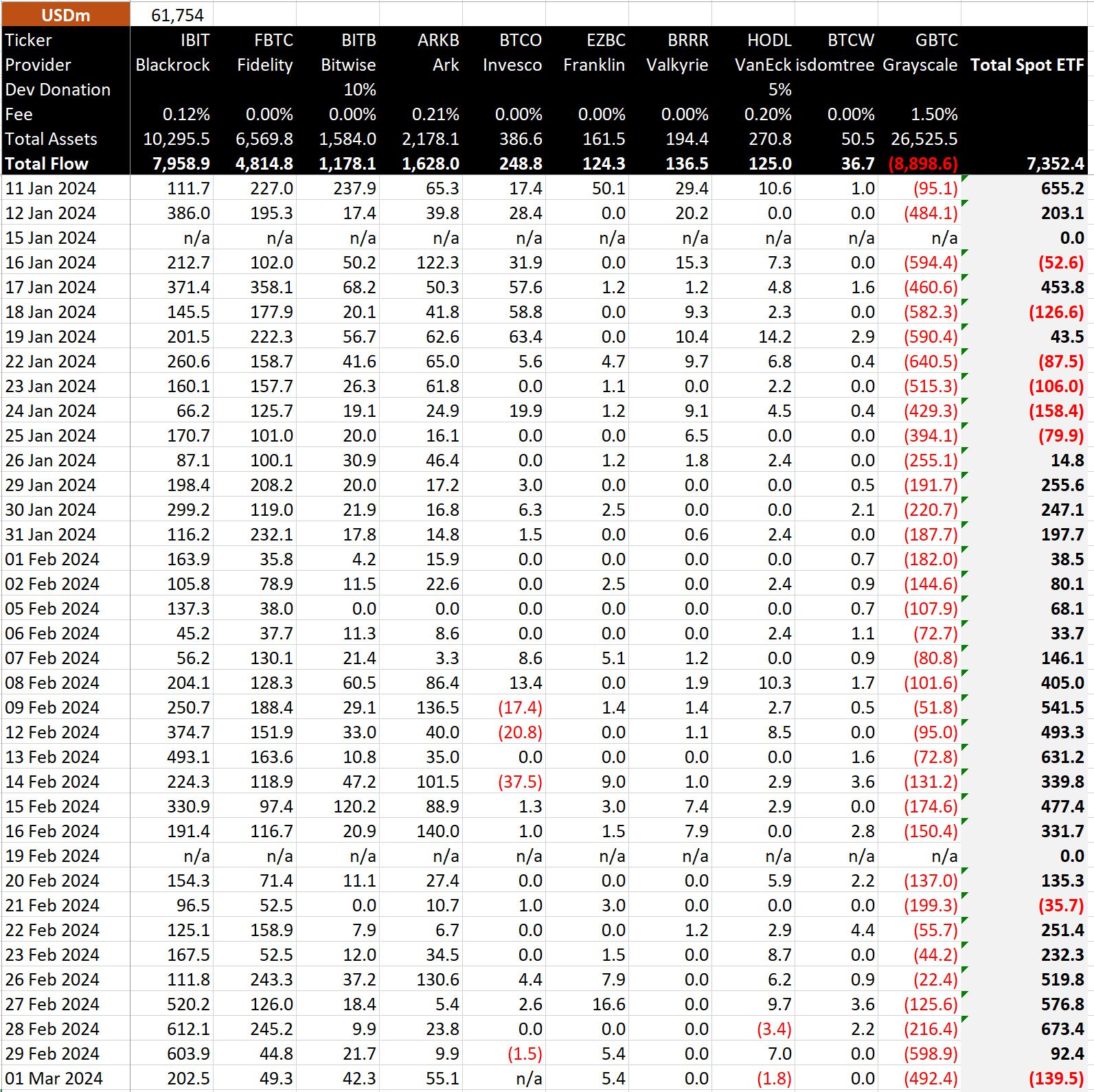

HODL15Capital’s data shows that the peak bitcoin acquisition occurred in week 6 with an inflow of 44,376 BTC. However, according to BitMEX Research, on March 1, all ETFs recorded a $139.5 million net outflow due to large $492 million Grayscale’s GBTC outflow.

Correlation with Bitcoin’s Price Rally

The remarkable activity surrounding spot Bitcoin ETFs has catalyzed substantial profits for leading digital assets, with bitcoin surging by over 150% in the last six months. As of March 5, BTC reached $68,000, just 1.5% shy of its all-time high.

Analyzing the correlation between ETFs’ performance and bitcoin’s price development highlights a significant connection. Bitcoin’s recent rally, starting eight weeks ago, witnessed massive gain for the top digital asset, bouncing from a swing low at $38,505 to its current value of $66,500, as per TradingView data.

As HODL15Capital points, Bitcoin has notably detached itself from the performance of the United States stock market, showcasing a divergence in trends. While the Nasdaq 100 and S&P 500 registered gains of 8.47% and 7.60% year-to-date in 2024, respectively, Bitcoin surged impressively by 58.08% during the same period.

Analysts predict increased capital inflow into ETFs, anticipating a pivotal role in the ongoing bull run, further amplified by the impending Bitcoin halving.