BNY Mellon, the world’s largest custodian bank, has stepped into the world of Bitcoin Exchange-Traded Funds (ETFs), signaling a monumental shift in traditional finance’s approach to Bitcoin.

BNY Mellon was founded in 2007 through the merger of The Bank of New York and Mellon Financial Corporation. It specializes in investment management, investment services, and wealth management, serving institutions, corporations, and individuals worldwide.

BNY Mellon’s Bold Step

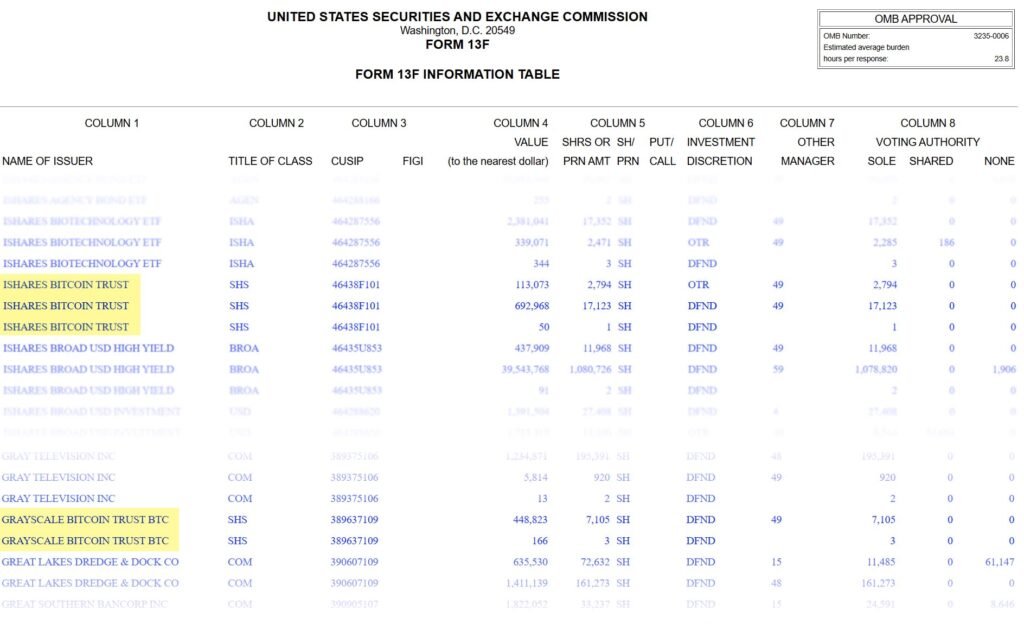

In a recent filing with the Securities and Exchange Commission (SEC), BNY Mellon revealed its exposure to spot Bitcoin ETFs. The bank holds investments in BlackRock’s IBIT and Grayscale’s GBTC, positioning itself at the forefront of the rapidly evolving digital asset space.

This announcement puts BNY Mellon in line with leading financial institutions that are embracing the rapidly growing bitcoin market.

The filing reveals the bank’s strategic moves in the bitcoin market, highlighting three distinct purchases of BlackRock’s Bitcoin ETF, IBIT. These acquisitions comprise 1 share, 17,123 shares, and 2,794 shares respectively, summing up to 19,918 shares. With the current market valuations, this translates to an investment surpassing $720,000.

Additionally, the bank’s involvement with the Grayscale Bitcoin Trust, GBTC, is outlined. It made two notable transactions for GBTC, acquiring 3 shares in one session and 7,105 shares in another, totaling 7,108 shares. At prevailing market rates, this investment stands at approximately $405,000.

The Impact on the Market

The approval of spot Bitcoin ETFs by the SEC earlier this year has catalyzed a surge in institutional interest. BNY Mellon’s entry into the fray further solidifies the legitimacy of Bitcoin as an investment asset class.

The increasing desire for exposure to Bitcoin ETFs reflects the growing curiosity among traditional institutional investors towards this emerging asset category.

Notably, BlackRock’s IBIT and Fidelity’s FBTC have emerged as frontrunners in the spot Bitcoin ETF market. Despite recent outflows, IBIT continues to break records, boasting over $17.5 billion in assets under management.

According to the reports, following an impressive run of 71 consecutive days with increasing inflows, IBIT experienced a pause in its daily inflows. However, the ETF remains on track to set new market records.

Global Ripple Effects and The Road Ahead

While the spotlight shines on the US market, global developments in regions like Hong Kong are set to further propel the Bitcoin rally. The approval of spot Bitcoin ETFs in Hong Kong signals a broader acceptance of digital assets on the international stage.

This introduction of BTC ETFs in Hong Kong could potentially trigger another widespread surge in the market. As traditional financial institutions like BNY Mellon embrace Bitcoin, the industry stands at a crossroads of innovation and adaptation.

Conclusion

BNY Mellon’s foray into Bitcoin ETFs represents a seismic shift in the financial landscape, underscoring the growing acceptance and adoption of Bitcoin by institutional investors. As the market continues to evolve, the effects of this move are poised to reshape the future of finance.

In summary, BNY Mellon’s bold step into Bitcoin ETFs signifies not just a financial maneuver but a paradigm shift in the way traditional institutions perceive and engage with digital assets.