Renowned trader Peter Brandt has sparked both excitement and controversy with his dual perspective of bitcoin’s future, both bearish and bullish.

His take on “Exponential Decay Theory” and recent analysis sheds light on potential peaks and pitfalls in bitcoin’s ongoing bull market cycle.

Brandt admits the overall bullish sentiment in the market, but suggests that technical analysis shows a 25% chance that bitcoin has already hit the top of its current cycle.

Diminishing Momentum in Bull Cycles

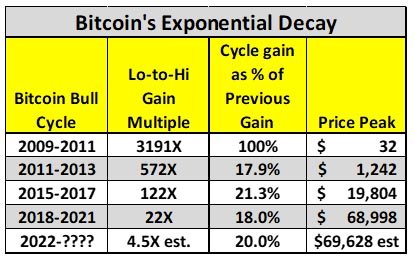

Brandt identifies a concerning trend in Bitcoin’s historical price cycles – diminishing momentum over time. Each successive cycle has witnessed a decrease in exponential advances, losing approximately 80% of the momentum from the previous cycle.

This pattern suggests a potential peak of around $72,723 for the current cycle, a level already attained in March 2024. This sharply differs from his forecast made in February. He predicted back then that this bull cycle will result in a $200,000 price tag for bitcoin in mid 2025.

Brandt emphasizes that this prediction is solely based on technical analysis (TA). It’s worth mentioning that he correctly anticipated Bitcoin’s plunge below $4,000 in 2018.

He expressed:

“Worded another way, 80% of the exponential energy of each successful bull market cycle has been lost.”

Exponential Decay Theory

Brandt’s analysis is grounded in the concept of exponential decay, which describes the process of reducing an amount by a consistent percentage rate over a period.

He highlights the sobering reality of this phenomenon, indicating a 25% chance that bitcoin may have already reached its peak for this cycle. Brandt’s theory challenges the notion of sustained bullish trends, emphasizing the need for caution among investors.

Peter Brandt mentioned:

“Bitcoin has historically traded within an approximately 4yr bull/bear cycle, often associated with the halving events. There have been three major bull market cycles since the initial bull cycle and each cycle has been 80% less powerful than its predecessor in terms of the price multiple gained,”

Brandt suggested that if bitcoin’s historical pattern of an 80% decay continues, then the record high of $73,835 reached on March 14, 2024, might already be consistent with this decay.

Speculations on Market Top

Brandt speculates on potential price retracements in the event of a market top, foreseeing a decline to the mid-$30,000 range per BTC or even revisiting lows from 2021.

However, he views such a correction as potentially bullish in the long term, drawing parallels to similar chart patterns observed in the gold market.

Brandt acknowledges bitcoin’s price fluctuations during halving events but warns of exponential decay, indicating a 25% possibility that bitcoin has already hit its peak this cycle.

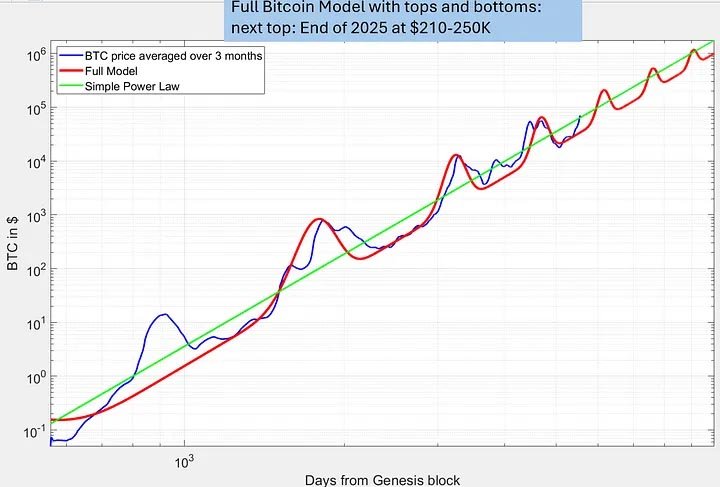

However, Giovanni Santostasi, who serves as the CEO and director of research at Quantonomy, countered the exponential decay theory with his own hypothesis, which draws from the long-term patterns of power law behavior.

In response to Brandt’s theory, he remarked, “We have only 3 data points if we exclude the pre-halving period and actually only 2 data points if we consider the ratios.” He emphasized:

“This is hardly enough data to do any significant statistical analysis.”

Controversial Predictions

Brandt’s analysis has stirred controversy within the Bitcoin community, with some investors eagerly embracing an optimistic outlook while others remain cautious.

The duality of Brandt’s predictions – one projecting a potential peak and another envisioning a bullish market until 2025 – challenges investors to assess the risks and rewards of their positions in the unpredictable Bitcoin market.

He said:

“The fact is that the bull market cycles in Bitcoin have lost a tremendous amount of thrust over the years.”

On the bullish side, Brandt predicts that bitcoin’s current bull trend will peak between $140,000 to $200,000 in late summer or early fall of 2025, based on the ‘Pre/Post Halving’ cycle.

He believes that despite any decay, this won’t affect the bullish trajectory that started in November 2022.

Conclusion

As debates ensue regarding the future of Bitcoin, Brandt’s analyses serve as another lens through which to understand the evolving dynamics of the market cycles.

While uncertainties persist, investors are urged to approach the market with a balanced perspective, considering both the potential for growth and the risks associated with exponential decay.

Bitcoin’s journey remains an intriguing narrative in the world of finance, with each twist and turn offering valuable insights into the complexities of digital assets.