Can buying bitcoin turn you into a crazy person? In this article I will share some essential lessons from some of the world’s smartest investors. Because sometimes people who seem a little crazy are the ones who really get it.

Being an independent thinker and imagining the world as it may be if a new technology were to be incorporated in the everyday environment are crucial when investing in an uncharted time or idea.

Mindset

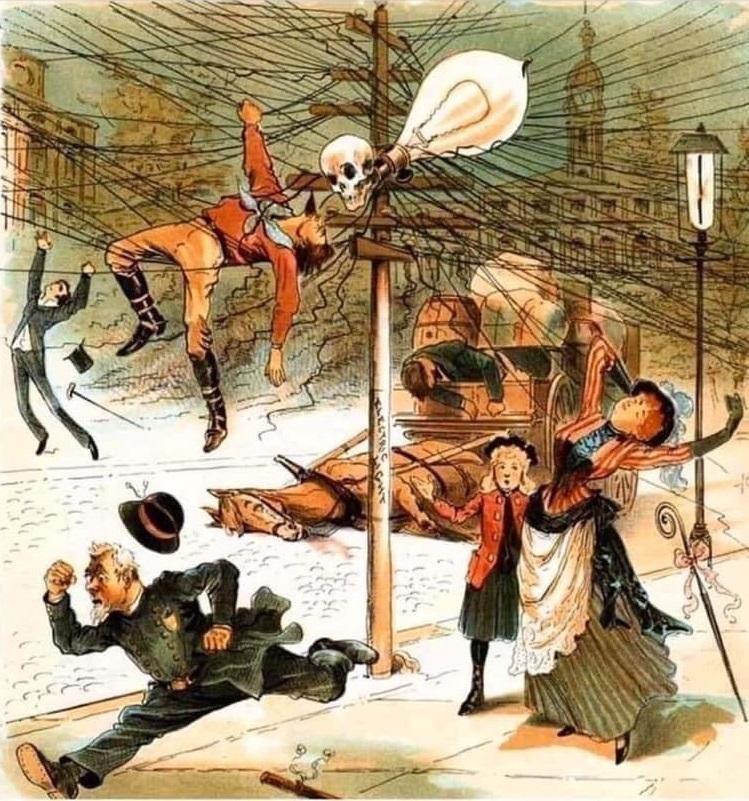

The internet was a widely-used technology in the late 1990s. According to the Newsweek story, which prominently described the Internet as a hoax and fad,

Why the Web Won’t Be Nirvana.

Newsweek

The internet became the cornerstone of our daily existence twenty years later. Nevertheless, a lack of vision could prevent us from benefiting from our wealth or, worse yet, cause it to suffer. Hopefully, the mind can change, through understanding these terms:

- Puck

- Truth

- Change

Puck

The high P/E ratio implied that Coca-Cola’s stock was overvalued when Warren Buffet decided to invest in the company following the 1987 stock market meltdown. Warren Buffet was right on the money because a high P/E can also mean that investors anticipate future growth to be rapid.

Warren Buffet identified Coca-Cola as a distinctive brand since it is a popular, sweet beverage. Coca-Cola is not the healthiest beverage to consume, but when making investments, it’s crucial to maintain objectivity and avoid letting our prejudices cloud our judgment. We need to be analytical rather than emotional if we want to get good results.

Conjecture would involve considering investments at current prices in a hypothetically different state of affairs, such as where the world is headed, and so taking advantage of assets, stocks, etc. that are not yet valued. Previously, Warren Buffet commented,

In the business world, the rearview mirror is always clearer than the windshield.

Warren Buffet

Truth

The pattern which goes along with emerging technologies is the sheer amount of negativity, pessimism, hopelessness, and desperation – profoundly said “you just don’t get it”. However, more often than not, a cessations’ outcome is that people hate the truth – it’s hard to reevaluate and reimagine our life in a different state of the future.

In regards to the internet, Waring Partridge stated in 1995

“Most things that succeed don’t require retraining 250 million people.”

Waring Partridge

It implied that the internet is too complicated for the average person. Contrarily, the bulk of individuals in today’s society use the internet despite still lacking technical knowledge (TCP/IP, SMTP, etc.).

Premature arguments against new technologies (like the internet, Amazon, Apple, Bitcoin, etc.) also include their volatility. The interpretation of macroeconomic data and decades’ worth of patterns demonstrates unequivocally that volatility is a crucial component of early technology adoption. According to Michael Burry’s graduation speech,

Volatility does not define risk.

Michael Burry

Contrary to popular assumption, risk increases when market values rise, such as during tech bubbles (such as those in Theranos, Jawbone, and We Work) or real estate and cryptocurrency bubbles. According to the “Nassim Taleb’s Turkey Problem” theory, up until Thanksgiving, when something unexpected occurs and the turkey experiences a revision in belief, the friendly members of the human race look out for its best interests every day.

“Nobody complains about volatility, when it’s in the uptrend.”

Michael Saylor

Evidently, energy, the internet, Amazon, Apple, Tesla, and other industries were all unstable, frequently described as bubbles or “dead.” But these innovations altered our way of life.

Change

People dislike change, particularly the older generations. The world, however, wants advancement, production, and efficiency. In actuality, technology that improves productivity and efficiency—such as the printing press, telephone, microprocessors, etc.—is disruptive to society.

Humans tend to align our thoughts with those of our social group for reasons of acceptability, comfort, and safety. The disadvantage is that traditional thinkers disparage unconventional ideas as strange, bizarre, or silly for fear of being incorrect.

On the other hand, independent thinkers (open-minded) rethink, reimagine, and reassess the state of our current circumstances and the future of the world – frequently asking unusual questions, and are not frightened of being incorrect.

Normal, Crazed & Rich

Dr. Ignaz Semmeweis, known as the “savior of mothers,” discovered in the 19th century that hand washing and hand disinfection might significantly reduce the prevalence of puerperal fever (also known as “childbed fever”) in obstetrical clinics. He was unable to provide an appropriate scientific justification for his findings, and other medical professionals ridiculed him because they found it offensive. Due to a nervous collapse, Dr. Semmeweis was admitted to an asylum in 1865 by his colleagues.

“Normal’ ‘sane’ people tend to consider ‘smart’ people ‘crazy’ – story as old as humanity.

It’s important to listen to and learn from a crazy person rather than disregarding their ideas and predictions. As history’s inventions serve as a reminder, do not write them off as crazy lunatics.

- “Airplanes are wonderful scientific toys, but they have no military utility,” the saying goes.

- Bicycles – According to experts, “the popularity of the wheel is doomed” and that bicycling is a fading fad.

- Computers on the go: “A troublesome piece of gear.”

- etc.

There is a fine line between crazy and geniuses, but both are visionaries.

Matthew Kratter

Contrary to the cliché, conformity is what people actually prefer, not inventiveness, diverse ideas, or viewpoints. Because innovation is disruptive, people must adjust and reconsider their place in the world if the new ideas or future visions are accurate, which is demanding and unpleasant.

Many of the nation’s issues, including the decline in manufacturing, wage stagnation, and the expansion of the financial sector, can be explained by a lack of imagination. Without imagination, in the words of Peter Thiel,

You have a dizzying change, where there’s no progress.

Peter Thiel

For the benefit of commoners, crazy people frequently have the fish-out-of-water quality, which is when a person feels uncomfortable because they are different from those around them. However, in order to embrace that quality, we must set aside our beliefs and feelings and refrain from being offended by the profound and ominous ideas of the future world (such as cryonics, life in a simulation, the Metaverse, artificial intelligence, etc.).

“Sometimes people who seem a little crazy are the ones who really get it.”

Matthew Kratter