In the recently released earnings report for the fourth quarter, Jack Dorsey-led payments firm Block showcased impressive growth in its Bitcoin-related activities. Block, which operates the popular Cash App, disclosed a substantial increase in gross profit from selling bitcoin, reaching $66 million.

Cash App bitcoin sales profit reflects a remarkable 90% surge compared to the previous year. The report unveiled the total sale amount of bitcoin to customers, denoted as Bitcoin revenue, standing at $2.5 billion for the fourth quarter, indicating a robust 37% year-over-year increase.

Cash App Bitcoin Sales: Overall YoY Growth

The company concluded the year 2023 holding around 8,027 bitcoin, worth around $411 million at the current market rate. According to the report:

“For the full year of 2023, Cash App generated $205 million of bitcoin gross profit and $9.50 billion of bitcoin revenue, up 31% and 34% year over year, respectively.”

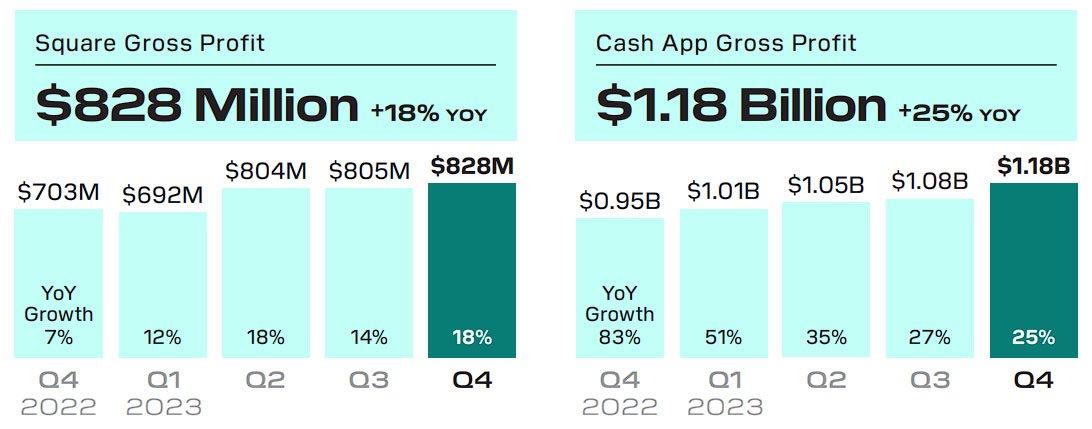

Square, Block’s financial services platform catering to small to medium-sized businesses, achieved a gross profit of $828 million, marking an 18% year-over-year increase. Simultaneously, Cash App generated $1.18 billion in gross profit, reflecting a noteworthy 25% year-over-year growth.

As a consolidated entity, Block reported $2.03 billion in gross profits for the fourth quarter, signifying a robust 22% year-over-year increase. The gross profit for the entire year of 2023 reached $7.5 billion, representing a substantial 25% increase from the previous year.

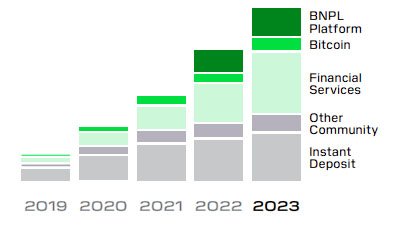

Jack Dorsey, Block’s CEO, outlined Cash App’s ambitious goal of becoming a leading provider of banking services to households in the United States earning up to $150,000 per year. Notably, Cash App, a mobile payment service offered by Block, allows users to seamlessly buy, sell, send, and receive bitcoin through their linked cards or cash balances.

Factors Behind the Surge

Block’s overall financial performance exhibited a remarkable turnaround. Notably, net income attributable to stockholders amounts to $178 million in the fourth quarter of 2023, compared to a net loss of $114 million in the corresponding period of 2022. For the entire year of 2023, Block reported a net income of $10 million, in stark contrast to the net loss of $541 million in 2022.

Block attributed the significant year-over-year growth in bitcoin revenue and gross profit to the rise in the average market price of bitcoin. It stated:

“The year-over-year increase in bitcoin revenue and gross profit was driven by an increase in the average market price of bitcoin as well as a benefit from the price appreciation of our bitcoin inventory during the quarter.”

During the fourth-quarter earnings call, Amrita Ahuja, Block’s Chief Operating Officer and Chief Financial Officer, highlighted the positive factors contributing to the improved performance. These factors included an increase in bitcoin gross profit resulting from pricing changes implemented during the quarter.

The market responded positively to Block’s stellar performance, with shares surging 5.41% after the earnings report exceeded analyst estimates. The strong growth in bitcoin revenue and gross profit positions Block as a key player in the evolving landscape of digital finance.