Chicago Board Options Exchange (CBOE) takes a significant step toward expanding the market for bitcoin investment products.

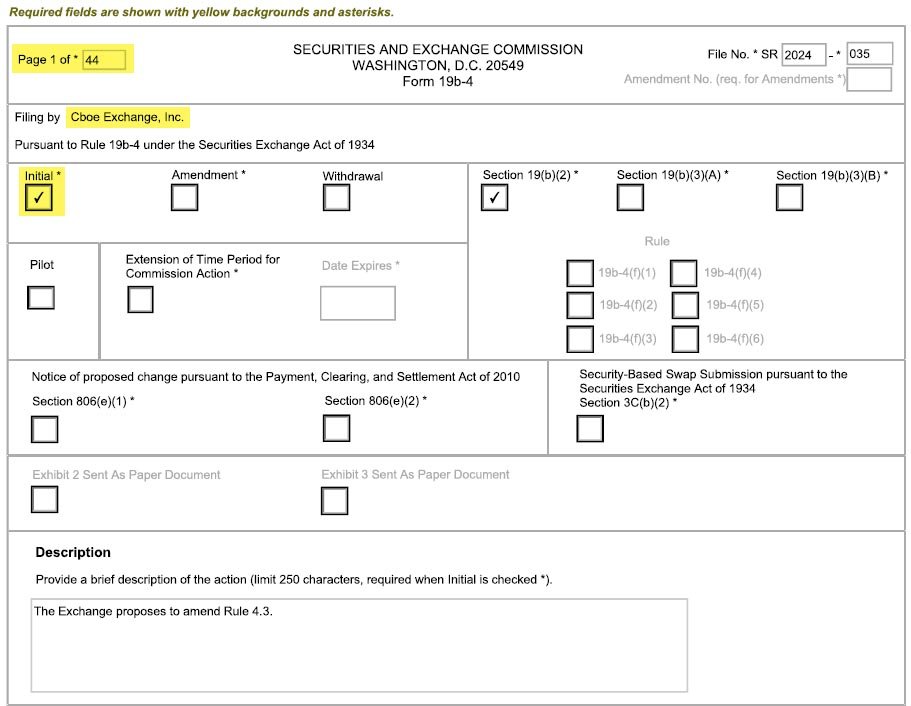

On August 8, 2024, the CBOE withdrew its initial application to list options on spot Bitcoin exchange-traded funds (ETFs) and quickly refiled a more detailed, 44-page application with the U.S. Securities and Exchange Commission (SEC).

This move, while initially raising concerns, is now being interpreted by many analysts as a positive signal that the SEC may be more engaged in the approval process than previously thought.

Before diving into the latest developments, it’s essential to understand what Bitcoin ETF options are and why they matter.

An ETF is a type of investment fund that tracks the price of an asset or a basket of assets, in this case, bitcoin. A spot Bitcoin ETF specifically holds actual bitcoin rather than derivatives or futures contracts.

This makes it a more direct way for investors to gain exposure to bitcoin without having to buy and store the digital asset themselves.

Options, on the other hand, are financial instruments that give investors the right, but not the obligation, to buy or sell an asset at a predetermined price by a specific date.

Options on spot Bitcoin ETFs would allow investors to hedge their bets, speculate on price movements, or generate income through strategies like covered call writing.

The introduction of options on spot Bitcoin ETFs could significantly increase market participation, making bitcoin more accessible to a broader range of investors, including those who may be hesitant to invest directly in this volatile market.

The CBOE’s decision to withdraw and refile its application caught the attention of many in the financial world.

Initially, the move seemed like a setback, raising concerns about potential delays in the approval process. However, industry analysts quickly reassured the market that this might actually be a good sign.

James Seyffart, an ETF analyst at Bloomberg Intelligence, was among the first to weigh in on the development. He noted on X:

“There’s definitely some movement on Bitcoin ETF options. CBOE just withdrew their application for options on spot Bitcoin ETFs. Which sounds like a bad thing at first… But at the same time, they just re-filed a brand new and updated application.”

Seyffart pointed out that the original filing was only 15 pages long, whereas the new filing is a more comprehensive 44-page document. This suggests that the SEC may have provided feedback, leading CBOE to address concerns more thoroughly in the updated application.

The issues likely revolved around position limits—how much of an asset an entity can hold—and potential risks of market manipulation.

Eric Balchunas, another analyst from Bloomberg Intelligence, echoed Seyffart’s sentiments, stating: “Just as ‘comments from the SEC’ was a good sign in our ETF approval odds, we think this is a good sign here too.”

The logic behind this optimism is that if the SEC were inclined to deny the application outright, there would be little point in engaging in further discussions or requesting more information from the CBOE.

Related: SEC Consults on Bitcoin Options Trading as Firms Seek Approval

The approval of options on spot Bitcoin ETFs could be a game-changer for the bitcoin market. It would not only increase market accessibility but also allow investors to use more sophisticated strategies to manage risk and potentially enhance returns.

The availability of options would make bitcoin investments more appealing to traditional investors, particularly those who are familiar with options trading but may be cautious about directly investing in digital assets.

One of the key strategies that could be employed with Bitcoin ETF options is covered call writing. This involves selling a call option (a contract that gives someone else the right to buy bitcoin at a specific price) while holding the underlying asset (in this case, the Bitcoin ETF).

This strategy allows investors to generate income from the option premium while still holding the Bitcoin ETF, thus limiting risks. However, it also caps potential gains if the price of bitcoin rises significantly above the strike price.

While the re-filing of the application is seen as a positive development, it also raises the possibility of delays in the approval process. Seyffart warned that the new filing might restart the approval clock, potentially pushing the SEC’s decision deadline back to late April 2025.

Initially, the final deadline for the SEC’s decision was around September 21, 2024, but the updated filing could mean more time is needed for the SEC to review the additional details.

He stated, “Final deadline for SEC decision is ~Sept. 21 but there’s more steps needed after that from OCC and CFTC.”

However, he also suggested that if the SEC is indeed engaging with the CBOE, the deadline might become less relevant. Ongoing discussions between the SEC and CBOE could influence the timing or outcome of the decision, making the exact deadline less critical.

Despite the potential for delays, there is still a strong sense of optimism among analysts.

The sentiment is shared by many in the industry who see this development as a step closer to the approval of Bitcoin ETF options.

The growing interest in Bitcoin-related investment products, even within traditional financial markets, suggests that demand for these options is high, and regulators may be more open to considering them.

The potential approval of options on spot Bitcoin ETFs is not just about creating new financial products; it’s also about solidifying Bitcoin’s role as a mainstream asset.

Over the past few years, Bitcoin has gained significant traction, moving from the fringes of the financial world to becoming a serious investment vehicle for institutional and retail investors alike.

Related: From 2009 to 2024 | Bitcoin’s 15-Year Evolution

The introduction of Bitcoin ETF options would be another milestone in this journey, providing traditional investors with more tools to manage their exposure to bitcoin.

It would also signal a growing acceptance of Bitcoin within the regulatory framework, further legitimizing it as a financial asset.

CBOE Global Markets’ head of derivatives, Catherine Clay, emphasized the importance of these options, stating earlier this year:

“We believe that the utility of the options, what they provide to the end investor in terms of downside hedging, risk-defined exposures into Bitcoin, really would help the end investor and the ecosystem.”

The approval of these options could also attract new participants to the market, including hedge funds and other institutional players who may have been hesitant to engage with Bitcoin directly.

As Dave Nadig, a financial futurist at VettaFi, pointed out: “You’re going to start seeing all sorts of hedge fund players in the space. Folks who might not have been traditionally speculating on crypto directly in the crypto ecosystem are now going to have something to play with.”

While the outlook is generally positive, there are still challenges that need to be addressed. The SEC has historically been cautious when it comes to approving Bitcoin-related financial products, primarily due to concerns about market manipulation and the potential for investor losses.

These concerns are likely why the CBOE’s updated filing includes more detailed information on position limits and safeguards against market manipulation.

Another consideration is the broader regulatory environment.

The introduction of Bitcoin ETF options would require not just SEC approval but also input from other regulatory bodies like the Office of the Comptroller of the Currency (OCC) and the Commodity Futures Trading Commission (CFTC).

These agencies will need to ensure that the new products align with existing regulations and do not pose undue risks to the financial system.

Moreover, the timing of the approval process could be affected by various factors, including market conditions, political developments, and the SEC’s overall approach to Bitcoin regulation.

As Seyffart noted, “Hard to tell the timing. We’re nosing around now and will update as appropriate.”