There is growing concern about the emergence of a deflationary situation driven by a decline in China’s domestic consumption which could potentially lead to expansionary monetary policies to stem the risk of a recession.

This scenario could fuel the next bitcoin price bull run, since it has historically proved to be extremely sensitive to economic stimulus policies.

Related reading : Jamie Dimon Expects “Nothing Like 2008” Recession And Banking Crisis

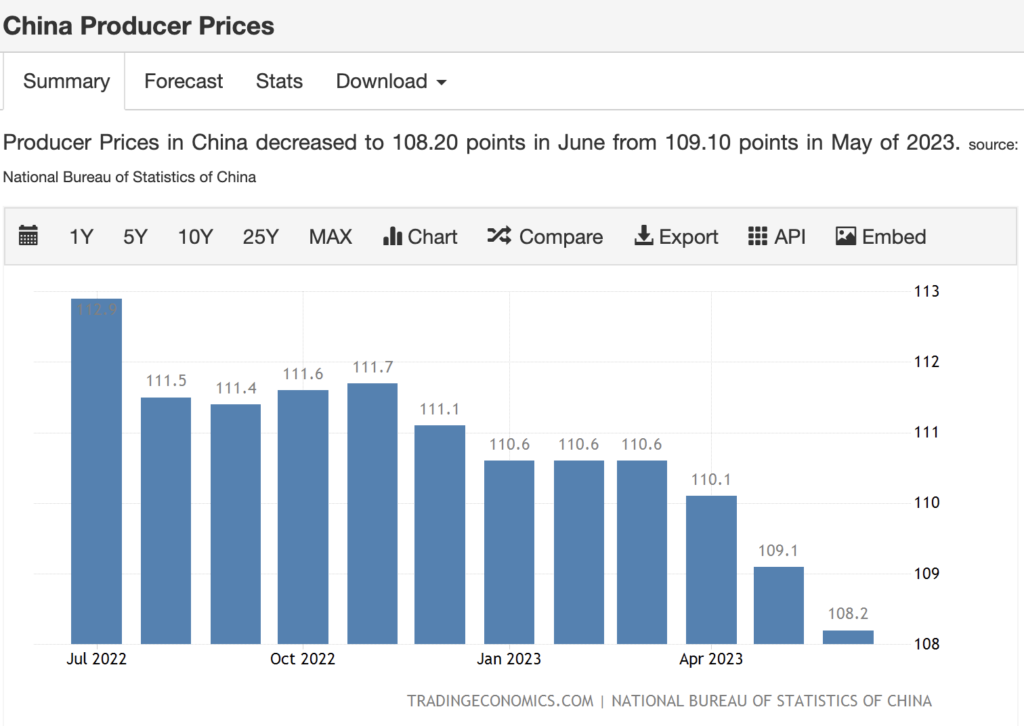

According to the National Bureau of Statistics of China, producer prices in the country dropped to 108.20 points in June from 109.10 points in May of 2023, experiencing a decline for the ninth consecutive month, and recording a 5.4% fall from last year’s levels — the most drastic since December 2015.

In the meantime, the Consumer Price Index (CPI) has remained at the levels of a year ago, rising only by 0.2% in May. Japanese investment firm Nomura’s analysts expects a further 0.5% decline in July compared to the same period of 2022.

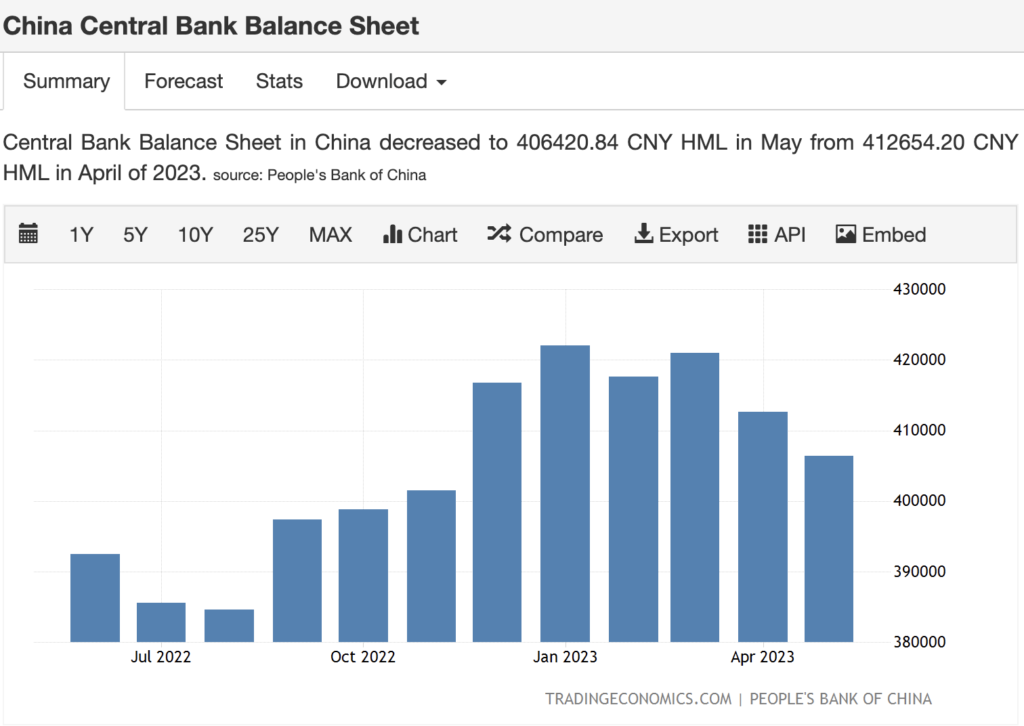

In addition to that, the Chinese central bank balance sheet decreased to 406420.84 CNY HML in May from 412654.20 CNY HML in April of 2023, after creating no money at all in 2020 and just a tiny amount in 2021.

According to Barclays’s economists, “the challenging deflationary environment and a sharp slowdown in growth momentum support our view that the PBOC has entered a rate-cutting cycle.”

The People’s Bank of China already cut policy rates to increase liquidity last month and promised measures to boost household consumption.

As the price of bitcoin has historically proven to be very sensitive to monetary liquidity shocks, any shift towards more expansionary economic policies by the second largest economy in the world could have positive effects on it.

Bitcoin price is +82.71% YTD at the moment of writing, and with the recent ETF applications by some of the largest asset managers in the world, such as Blackrock, Fidelity, and WisdomTree, analysts think we have entered the early stage of the next bull run.

Related reading : U.S. Investors Rush Into Bitcoin As Industry Giants Apply For Bitcoin ETF

International financial company Standard Chartered Bank forecasts bitcoin price to reach $50,000 by the end of this year and $120,000 by the end of 2024 amid the next halving’s impact.

Thanks to the expansive monetary policies and new favorable regulations settled by Hong Kong authorities which allow retail trading in the Chinese territory since second quarter of 2023, Chinese financial markets could play a crucial role in the fulfilling of this prevision.