Renowned digital asset expert and partner at venture capital firm Placeholder, Chris Burniske, has cautioned that the local bottom for bitcoin has yet to be reached. Predicting a possible drop to the $30,000–$36,000 range, Burniske expresses a lack of surprise if the mid-to-high $20,000 area is tested before a potential move towards a new all-time high.

Chris Burniske’s Bold Predictions

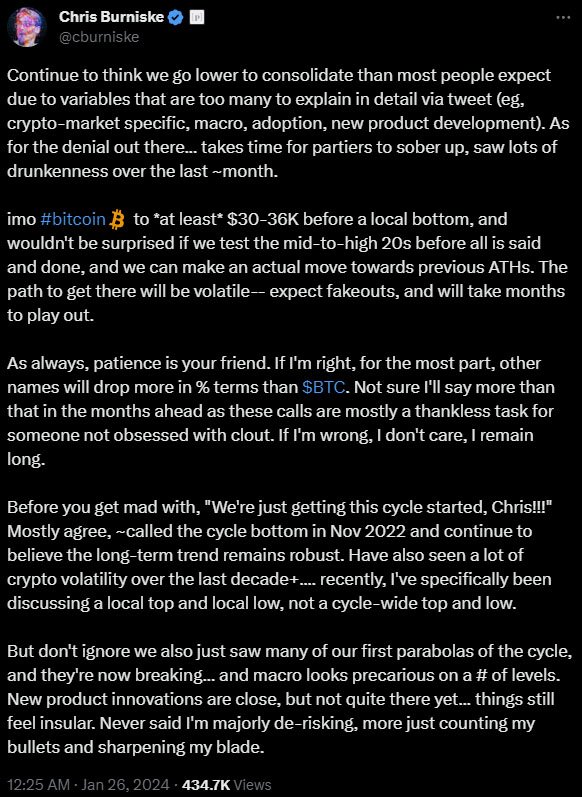

In a detailed tweet on X, Burniske emphasizes the need for patience in navigating the volatile path ahead. He notes that the digital asset market, along with various macroeconomic factors, adoption trends, and new product development, plays a role in the anticipated consolidation.

Burniske suggests that bitcoin could dip to at least $30,000–$36,000 before finding a local bottom, warning of possible tests in the mid-to-high $20,000s. The digital asset expert warns investors to expect fakeouts and believes that this possible journey to the bottom will take months.

Despite potential market challenges, Burniske remains committed to his long position, emphasizing the need for patience amid market fluctuations. He writes:

“As always, patience is your friend. If I’m right, for the most part, other names will drop more in % terms than BTC. Not sure I’ll say more than that in the months ahead as these calls are mostly a thankless task for someone not obsessed with clout. If I’m wrong, I don’t care, I remain long.”

Long-term Trend’s Robustness

Burniske’s analysis extends beyond short-term fluctuations, as he highlights his previous call on the cycle bottom in November 2022. While expressing agreement with the notion that the cycle is just beginning, he emphasizes that recent discussions have focused on local tops and lows rather than cycle-wide trends.

He acknowledges the ongoing robustness of the long-term trend but points out concerns with recent parabolic movements.

Bitcoin’s Recent Performance

Before a 5% rally on Friday, bitcoin had experienced a nearly 20% decline, dropping below $40,000. Interestingly, this happened soon after the highly anticipated approval of spot bitcoin ETFs by the Securities and Exchange Commission (SEC) on January 10.

At the time of reporting, bitcoin was hovering at $42,000. Burniske clarifies that, despite his cautionary stance, he is not undergoing significant de-risking but rather strategizing and preparing for potential market movements.

Notably, Burniske’s commitment to a long-term position reflects his confidence in the underlying strength of bitcoin’s trajectory, despite the complexities and uncertainties in the current market landscape.

Various factors are presently contributing to the anticipation of a continued decline in bitcoin price strength. These encompass macroeconomic influences linked to United States financial policy and global liquidity trends, the latter being a particularly sensitive aspect for the digital asset markets.

Recently, the former CEO of the digital asset exchange BitMEX, Arthur Hayes, made a forecast suggesting that bitcoin might experience a dip to $30,000 before staging a recovery.

On the more tough end of predictions is Il Capo of Crypto, a renowned trader who maintains the belief that a drop to $12,000 remains a plausible scenario. Despite such extreme projections, he currently envisions a temporary relief period for Bitcoin bulls.