Digital asset exchange Binance and its CEO Changpeng Zhao are now trapped in a class-action lawsuit.

According to the filings on October 2 with the District Court of Northern California, a class-action lawsuit targets Binance and its CEO, claiming they have allegedly monopolized the market by hurting its rival exchange FTX.

The lawsuit led by Nir Lahav, a California resident, lists competitive detrimental corporate strategies and X (former Twitter) posts that purportedly aimed at undermining FTX.

Plaintiffs Unhappy With Zhao’s Tweets

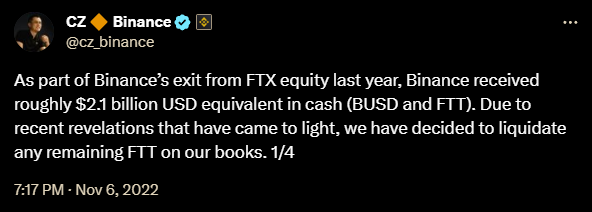

The plaintiffs mainly mention Zhao’s statements on X, especially during the critical time leading up to FTX’s meltdown in early November 2022. For instance, on November 6, he posted, “Due to recent revelations that have come to light, we have decided to liquidate any remaining FTT on our books.”

According to the filing, this tweet was deceptive because Binance had already sold its FTT holdings. Moreover, the plaintiffs accused CZ of intentionally plunging the price of FTT with such tweets.

They also pointed to a part of a tweet by Zhao on November 7 where he stated:

“We are not against anyone… But we won’t support people who lobby against other industry players behind their backs.”

Lahav believes this statement shows the Binance CEO’s opposition to FTX former CEO Sam Bankman-Fried’s regulatory initiatives. After Zhao’s tweet, there was a significant drop in FTT price, slipping from $23.1510 to $3.1468. The lawsuit emphasizes this occurrence and states:

“Zhao’s tweet resulted in FTT price declining […] This significant drop plummeted FTX Entities into bankruptcy without giving FTX Entities’ executives and board of directors a chance to salvage the situation and put in safe guards to protect its clients and end-users.”

Notably, on the same day, Zhao announced on X that his exchange had initiated a non-binding letter of intent to acquire FTX. However, the plan was reversed just one day later. The lawsuit filing states that the Binance CEO never had a good faith intention to actually acquire FTX:

“Zhao publicly disseminated this [acquisition withdrawal] information on Twitter and other social media platforms to hurt FTX Entities that ultimately lead to a rushed and unprecedented collapse of FTX Entities.”

Given the high stakes involved, the lawsuit is seeking monetary damages, coverage for legal expenses, and the return of profits acquired through seven distinct claims. Interestingly, Lahav believes that thousands of individuals are potentially involved in the proposed class action.

Lawsuit Targets Binance Among It’s Other Problems

Meanwhile, both Binance and now-defunct FTX find themselves embroiled in separate lawsuits filed by the U.S. Securities and Exchange Commission (SEC), suggesting potentially broader regulatory challenges in the industry.