The Chicago Mercantile Exchange (CME), a renowned global derivatives marketplace headquartered in Chicago, has recently witnessed a dramatic surge in open interest in Bitcoin (BTC) futures.

The increasing open interest in CME Bitcoin futures indicates that market participants are actively positioning themselves for potential price movements. As a result, this could act as a catalyst for increased activity in Bitcoin futures.

Open Interest in CME Bitcoin Futures Rose 500% in Last Week

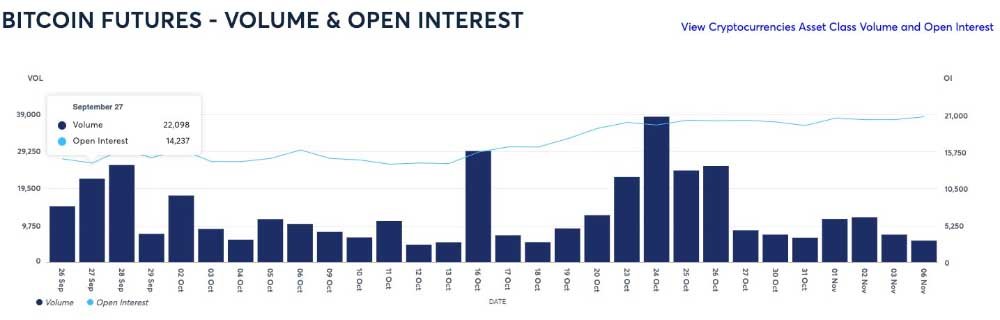

According to data provided by blockchain analysis platform Glassnode, the open interest in CME Bitcoin futures rose by 1.30% within the past 24 hours. Notably, at the time of writing, the value stands at $16.57 billion, or 467.08K BTC. Multiple members of the Bitcoin community on social media platform X pointed out the surge in open interest.

An X user pointed out that rising open interest rates on CME Bitcoin futures suggest that there is a lot of money betting on Bitcoin’s future price movements. Asset management and blockchain research firm Galaxy Research pointed out on November 3 that by the time October ended, the open interest had tripled.

As per Galaxy, the total open interest for Bitcoin futures amounted to $3 billion on November 3. However, the number jumped to $16 billion on November 8, suggesting a jump of more than 500%.

The surge in volume confirms that either the market is moving towards a positive change or investors are more cautious about their investments and are trying to hedge against potential price drops. The skyrocketing open interest might indicate a higher risk of sudden price swings or market manipulation.

Notably, open interest, a metric that reflects the total number of open futures contracts in a market, serves as an essential indicator of market liquidity. A higher open interest typically points to increased capital inflow, which in turn, potentially signals bullish sentiment. Conversely, declining open interest may indicate bearish sentiment. High open interest can contribute to increased price volatility.

Bitcoin Spot ETF Approval: A Major Driving Factor

The increasing interest in Bitcoin futures has been caused by recent rumors that the United States Securities and Exchange Commission (SEC) is considering the approval of a Bitcoin Spot Exchange-Traded Fund (ETF) in the United States.

Steven McClurg, the Chief Investment Officer at Valkyrie, an asset management firm with a heavy presence in the digital asset sector, recently stated that in the upcoming weeks, the SEC will request a second round of comments on all the Bitcoin Spot ETF applications, adding that an approval can come this month.

On the other hand, Invesco Galaxy Digital Bitcoin Spot ETF has been listed on the DTCC website under the ticker ‘BTCO’ along with BlackRock’s iShares Bitcoin spot ETF (IBTC).

The surge in open interest at CME has captivated the attention of the Bitcoin community, sparking speculation about potential price movements and exciting opportunities for investors in the Bitcoin market.