In response to a petition filed by Coinbase in 2022, a U.S. judge has issued an order mandating the SEC to provide an answer within seven days.

The petition sought “regulatory clarity” from the SEC regarding the applicability of existing securities laws to digital assets such as bitcoin and ether. The bitcoin price experienced significant volatility this week, coinciding with the SEC’s legal actions against both Binance and Coinbase.

Read more on the subject : Bitcoin Plunges Below $26,000 As SEC Sues Binance

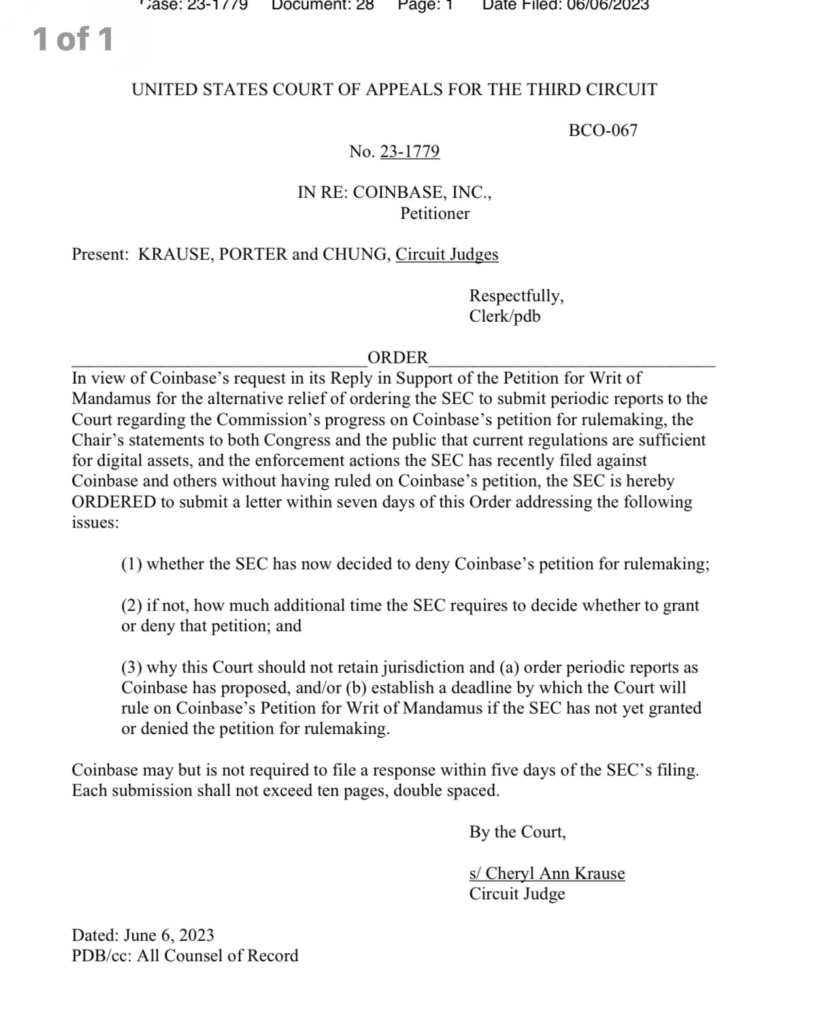

In response to Coinbase’s request, the United States Court of Appeals for the Third Circuit has directed the SEC to clarify whether it plans to reject the request, provide reasons for such a decision, or specify a timeline for reaching a conclusion.

Paul Grewal, the chief legal officer at Coinbase, expressed on Twitter the importance of having rules and regulations established through legislation or rulemaking before enforcing actions, highlighting their initial petition to the SEC for rulemaking nearly a year ago.

he added: “Our firm maintains the belief that the SEC’s decision to initiate legal action against our industry, as evidenced by the case filed against us today, indicates that they have already made up their mind to reject our petition for rulemaking.”

Coinbase initiated a legal challenge in April, aiming to compel the SEC to take action, citing the inadequacy of current regulations for bitcoin, and other digital assets including non-fungible tokens (NFTs).

Read more on the subject : U.S. Chamber of Commerce Slams SEC for Regulatory Uncertainty

Paul Grewal emphasized that if the SEC’s response to their petition for rulemaking is negative, they have a legal entitlement to challenge it in court, raising inquiries that need to be addressed.

During the course of this week, both Coinbase and its competitor Binance encountered legal action from the SEC, as both were sued for allegedly breaching U.S. securities laws.

The SEC contended that Coinbase and Binance had neglected to register as securities exchanges and categorized a significant number of the digital assets accessible for trading on these platforms as securities.