According to a report by Coinbase, the popular exchange, the upcoming halving which reduces miners’ block rewards from 6.25 BTC to 3.125 BTC, is set to have profound effects on the market. The report compares previous bitcoin halving charts to the one that is scheduled for next month, indicating massive upward potential for the digital asset.

Understanding the Bitcoin Halving

Bitcoin, the world’s leading digital asset, is set for its next halving event in mid-April 2024. This event, which occurs roughly every four years, has garnered significant attention from investors worldwide. The Bitcoin halving is a fundamental aspect of the revolutionary digital asset’s protocol, designed to control its supply and, consequently, its inflation rate. This event occurs every 210,000 blocks, which at median time of 10 minutes per block, translates to roughly every 4 years. When the halving takes place, the reward for miners who validate transactions on the network is cut in half.

Related reading: Bitcoin Shortage Looms Post-Halving as ETFs Eat Up Mined Supply

Coinbase Report

A recent report by Coinbase, titled “Bitcoin halving handbook: A primer for institutional investors” delves into the details of this event, and the impacts it might have on the digital asset’s price.

Historical Precedent and Performance

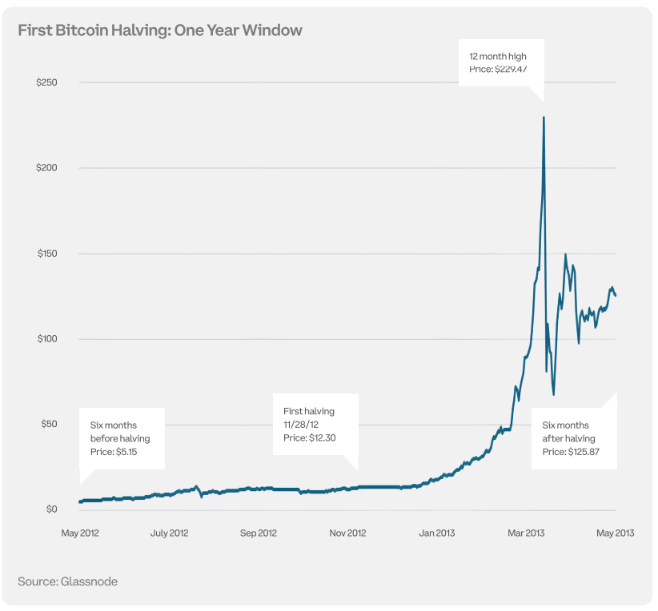

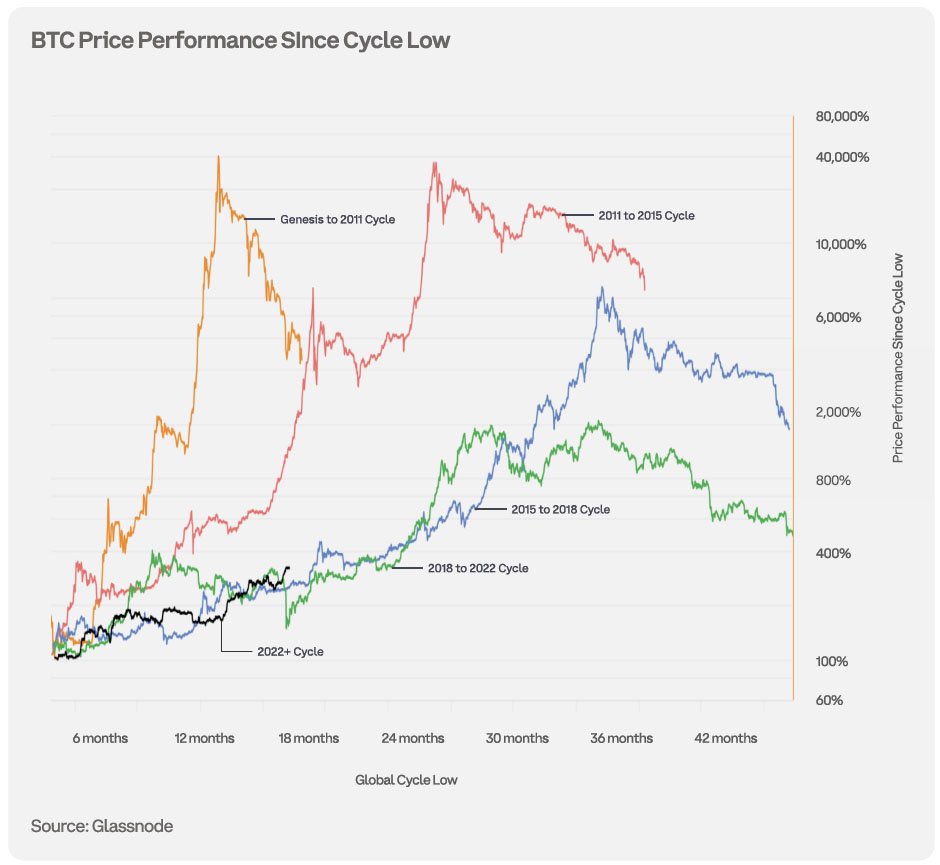

According to the report, historical data suggests that Bitcoin’s previous halving events have had a significant impact on its price. Coinbase’s report highlights that bitcoin experienced an average price increase of 61% in the six months leading up to prior halvings and a staggering average increase of 348% in the six months following the halving.

The report states:

“While it’s possible that the halving could have a positive impact on bitcoin’s performance, there’s still only limited historical evidence about this relationship, making it somewhat speculative.”

However, it’s essential to note that not all halving events have had the same effect on bitcoin’s price. The report points out that while the first halving in 2012 saw a remarkable price surge, subsequent halvings resulted in more moderate yet still notable increases.

Consideration of External Factors

Despite the historical correlation between halving events and price increases, Coinbase warns investors against solely relying on this relationship to predict bitcoin’s future performance. The report emphasizes that Bitcoin operates within a broader economic context and is influenced by various external factors.

For instance, the rally following the previous halving in May 2020 was attributed more to loose monetary policies and fiscal stimulus in response to the COVID-19 pandemic than the halving itself. Additionally, factors such as macroeconomic influences and investor sentiment play significant roles in determining bitcoin’s price trajectory.

Long-Term Holder Behavior

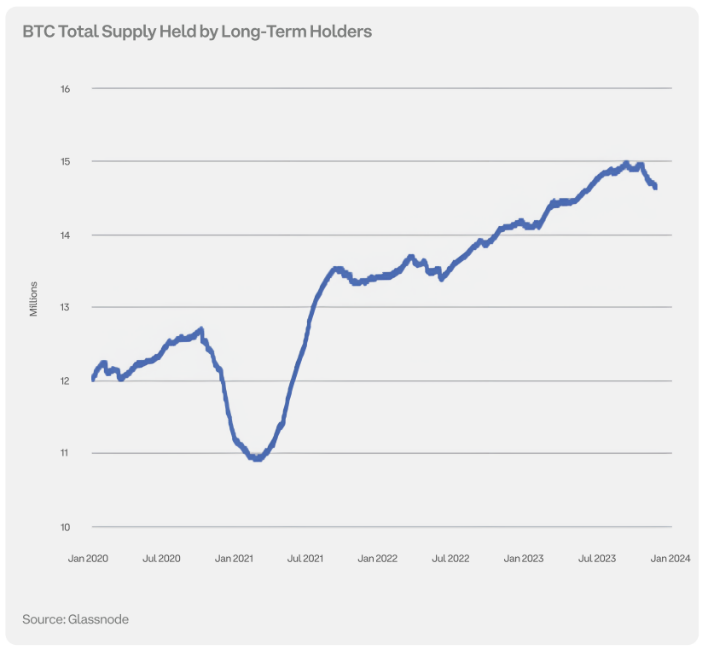

Another crucial aspect highlighted in Coinbase’s report is the behavior of long-term holders during halving events. These investors, who possess substantial amounts of bitcoin, are less likely to sell their holdings during halvings. Instead, they view the event as an opportunity to strengthen their positions in the market.

The report suggests that long-term holders’ reluctance to sell into strength contributes to bitcoin’s resilience during halving periods. This behavior underscores the belief in Bitcoin as a solid long-term investment rather than a speculative asset.

Coinbase adds:

“long-term holders should be less likely than short-term holders to view halving as an opportunity to sell into strength.”

Bitcoin Halving Chart: Current Market Dynamics

As the date of the upcoming halving approaches, the bitcoin market is witnessing notable developments. Bitcoin’s recent performance, up 157% since mid-October, has sparked optimism among investors. However, Coinbase urges caution in extrapolating this trend to predict post-halving performance.

The report emphasizes the importance of considering macroeconomic factors such as monetary policy and fiscal stimulus in assessing bitcoin’s future trajectory. The expected actions of the U.S. Federal Reserve, including potential interest rate cuts and quantitative easing tapering and more selling from miners and bankrupt digital asset lenders like Celsius Network and Genesis Global, could significantly impact bitcoin prices in the coming months.

Conclusion

While the Bitcoin halving holds historical significance and is anticipated to have a positive impact on prices, investors must exercise caution and consider various factors beyond the halving itself. Understanding the complex interplay between macroeconomic conditions, investor behavior, and long-term market dynamics is essential for making informed investment decisions in the bitcoin space.

As Coinbase’s report suggests, halvings are just one of the many factors influencing bitcoin’s price trajectory. By staying informed and adopting a holistic approach to investment analysis, investors can navigate the volatility of the market with greater confidence and clarity.