Table of Contents

Introduction

Central banks target inflation and the success of that target is often measured in Consumer Price Index (CPI), which refers to the cost of an arbitrary basket of goods meant to approximate the general cost of living.

But how meaningful is CPI as a benchmark for growing and preserving your standard of living in the face of monetary policy expansion? If the cost of the things you might really want to own, like real estate, increase at a much higher rate, then how useful is CPI? Put another way, which measure is more indicative of the health of your money over time:

a) your ability to buy day to day consumables or

b) your ability to buy long-term desirable assets?

This article seeks to shed light on the substantial difference between official inflation measurements, such as CPI, and the actual depreciation of the U.S. dollar against tangible assets and the implications this distinction has for assessment of investment returns.

The Discrepancy in Inflation Rates

In a keynote address at LaBitConf last November, Microstrategy Chairman Michael Saylor delivered a presentation outlining the thesis that investors seeking to preserve the value of capital should ignore CPI and focus on the long-term appreciation of rare and desirable assets, which are a clearer barometer of currency depreciation.

Using monetary expansion as the measure shows a rate of monetary debasement much higher than the typical inflation target of 2%. The reality is closer to 7% in the US and much higher elsewhere. When thinking about preserving your wealth over time, Saylor argues, what matters is your ability to buy assets that will store value as the value of the monetary unit erodes.

The Dollar Priced in Assets

To comprehend the extent of the dollar’s decline, it’s crucial to assess its performance against various assets. The US dollar has lost 99% of its value against gold since 1932, soaring from $20 an ounce to $2,000 an ounce. Similarly, the S&P index, representing the top companies in the United States, has seen the dollar lose 99.8% of its value in that same timeframe moving from $4.89 per unit to $4850.

International Comparison of Currency Depreciation

As the US dollar depreciates against assets, it is essential to consider its impact on international currencies, which themselves are losing value against the dollar. Despite talk about the world de-dollarizing, foreign currencies have struggled to hold value against the US dollar since 2011.

The Euro and the British Pound have declined more than 20%. The Canadian dollar in that same window is down 26%, while the Australian Dollar is down over 35%. Weaker currencies have fared much worse. The Turkish Lira is down over 94%, while the decline of Argentine peso reaches a staggering 99.8%.

Monetary Policy Expansion: Illustrating the Issue With Real Estate

Examining the rapid depreciation of the dollar against real estate, particularly in ultra-desirable locations like Miami Beach, provides a valuable perspective.

90 years ago, the cost of an acre in Miami Beach was $10,000, and today the value has surged well into eight figures, marking a significant increase of 1,000 to 2,000 times. The fixed nature of beachfront property, coupled with its desirability, makes it immune to human manipulation. Unlike consumer goods that can be mass-produced, beachfront property’s scarcity ensures its value increases proportionally as the money supply expands.

Real estate in general has appreciated much faster than 2%. The median home price in the US was $24,300 in 1971, and peaked in Q4 of 2022 at $479,500.

M2 in Canada has expanded on average 8.5% since 1969. Which, if you follow Saylor’s logic, probably explains why real estate prices north of the border have exploded compared to their American counterparts. As of January 2024, the average home price in Canada is $657,145. The average price of a home in Toronto in 1971, was $30,426. That’s over a 2000% increase over 53 years, at an average of just under 6%.

Investing Misconceptions

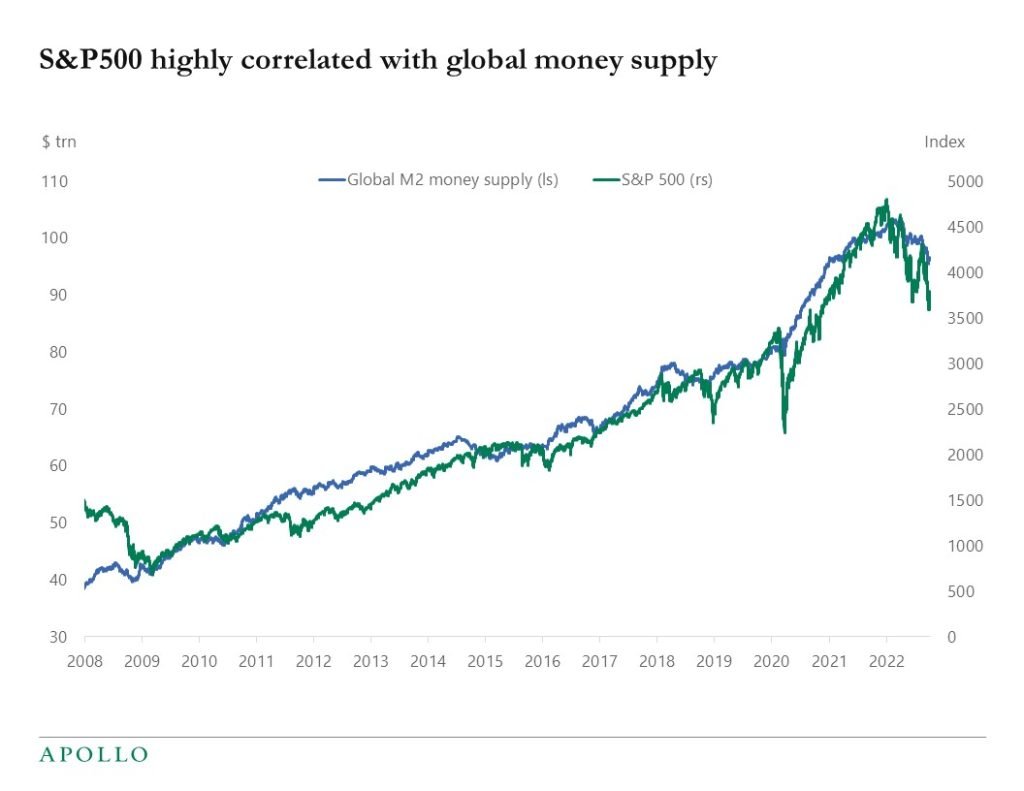

Conventional investing ideas often judge a successful rate of return on the ability to beat CPI. However, in reality, investment gains are often driven by the monetary inflation rate, as illustrated by the correlation between the money supply and the S&P 500.

Over the last 10 years the 60/40 portfolio has returned an average of 7.69%, which is almost identical to the 153 year average return of 7.66%. Effectively the 60/40 has created a real rate of return of zero when compared to monetary inflation.

If you happen to live in a country where the U.S. dollar is not the currency, the chances of outperforming currency depreciation become much smaller. Investors in those countries face dual headwinds of greater monetary expansion, and smaller, less robust capital markets. In Canada, the S&P/TSX has averaged 6.1% return since 1996, the Nikkei returned 4.66% between 1984-2021.

What’s the Difference Between 2% and 7%?

It’s huge. At 2% that 60/40 portfolio is protecting your wealth and even providing some growth. At 7% that same portfolio is a flat or negative return. That comes before considering capital gains taxes. Even allowing for different forms of tax-sheltering depending on the country, there are very few opportunities to invest without paying any tax in the US, Canada, UK, or Australia. Taxes further erode gains.

More importantly is understanding the true rate of monetary decay. At 2% your money loses half its value every 36 years. At 7% it’s every 10 years.

The Rise of Bitcoin as a Monetary Network

Bitcoin inverts the hierarchy of scarce, desirable investments by offering something that, on a per capita basis, is as rare as beachfront land in Miami, that can be purchased fractionally by every person on the planet. Its value proposition lies in being an uncensorable, non-confiscatable currency that cannot be inflated.

Most fiat currencies have lost 98% of their value, priced in bitcoin over the last 10 years. Most indexes and asset classes are down 95% against it, and that includes gold and real estate. Over the last 10 years Bitcoin returned a 49.92% CAGR.

Traditional asset managers often categorize bitcoin as a “speculative” asset but even that term when applied to Bitcoin is almost always applied incorrectly.

One can view Bitcoin as a speculative asset, as long as the understanding is that it is a speculative bet on bitcoin appreciating in fiat currency terms because one currency inflates and the other does not.

Most people who consider bitcoin speculative, apply the term thinking bitcoin risks fades into obscurity or experience a catastrophic technical failure. Neither is impossible, but equally, neither is likely.

Bitcoin provides investors the opportunity to own an asset that can appreciate based on its value proposition, without it having to be a company managing staff and profits, or a property needing managing upkeep.

To use Michael Saylor’s own words “If you took a global technology company offering the most desirable product in history and then stripped away the risks that all companies incur due to their operations and obligations, you would have bitcoin.”

Conclusion

Whether you are measuring CPI or monetary debasement, your money is losing value by design. By continually focusing attention on CPI, which is a manipulated and much lower number than monetary expansion, the real rate of loss of purchasing power is being obfuscated. The challenge of outperforming currency debasement over time is harder than we think and the real rates of return on most investments are also smaller than advertised.

Understanding this distinction is critical for successful long-term investing as the measurement for inflation is also the baseline for success.

Bitcoin presents an alternative to investing. It’s not just a money that cannot be inflated. It is an alternative to gambling your money on companies to try and outrun debasement, by simply owning money that cannot be debased. Bitcoin is the solution to the problem of decaying monetary value.