In a groundbreaking move that has sent ripples through the financial and Bitcoin sectors, Senator Cynthia Lummis of Wyoming has proposed an unconventional strategy to address the U.S. national debt: selling some of the Federal Reserve’s gold reserves to purchase bitcoin.

The plan, which the senator shared in interviews and public statements, aims to establish a national bitcoin reserve as a hedge against inflation and a tool to bolster the dollar’s global dominance.

Senator Lummis, a long-time Bitcoin advocate, believes that the flagship digital asset holds immense potential to stabilize the U.S. economy. During an interview with CNBC, she stated:

“Americans are still grappling with inflation and high prices. They want to see the national debt reduced. Bitcoin is an asset that is immutable and easily stored in federal vaults, making it an ideal tool for this purpose.”

She further explained that bitcoin’s significant appreciation over the years could help reduce the national debt and counter the declining purchasing power of the U.S. dollar.

According to Lummis, the Federal Reserve could begin by selling some of its gold reserves, particularly those valued at outdated 1970s-era prices on the books. By converting these into bitcoin at current market rates, the government could avoid the need to allocate new taxpayer dollars.

Senator Lummis believes by converting these certificates to fair market value and then into bitcoin, the U.S. could establish the reserve without impacting the balance sheet or using new dollars.

Lummis noted that this idea aligns with discussions involving President-elect Donald Trump. She also highlighted the increasing presence of policymakers, like Bernie Moreno and Tim Sheehy, who are knowledgeable about digital assets, signaling growing support in Washington for such initiatives.

Lummis proposes acquiring around 200,000 bitcoin initially, with a long-term goal of accumulating 1 million BTC over 20 years. This would align with the U.S. government’s existing bitcoin holdings of approximately 208,000 BTC, mostly obtained through asset forfeitures.

The senator likened the idea to holding traditional assets like gold or oil in national reserves. “This is the gold standard digital asset, and a strategic Bitcoin reserve is the way to embed it,” she said, emphasizing bitcoin’s deflationary nature and its role as a store of value.

The timing of Lummis’ proposal coincides with bitcoin nearing the $100,000 mark, a historic milestone.

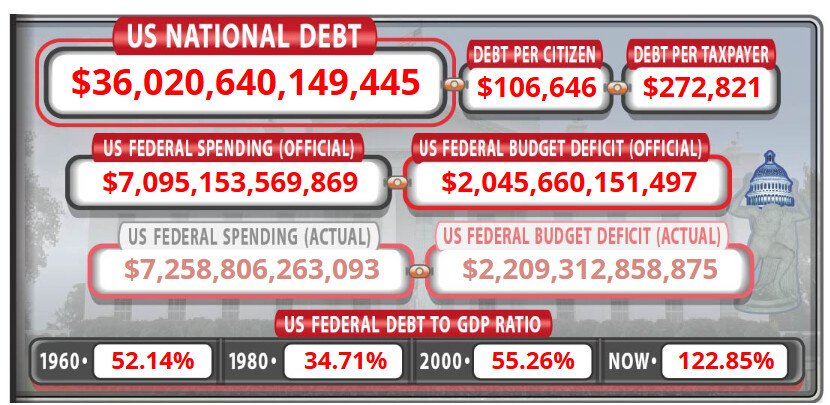

Bitcoin’s recent all-time high of $99,600 has fueled optimism about its long-term potential. The senator and other advocates believe these gains make bitcoin an ideal asset to offset the U.S.’s staggering $36 trillion debt.

Lummis remarked that this proposal isn’t just about reducing debt; it’s about securing America’s financial future.

Lummis’ bold idea has garnered support from prominent figures in the Bitcoin space. MicroStrategy Executive Chairman Michael Saylor endorsed the concept, stating:

“Sell the past, buy the future.”

Robert Kiyosaki, author of Rich Dad Poor Dad, also chimed in with bullish predictions about bitcoin, echoing the senator’s sentiment that it could serve as a hedge against inflation and economic uncertainty.

Lummis’ proposal aligns closely with President-elect Donald Trump’s vision for Bitcoin in America. During his campaign, Trump pledged to make the U.S. the “crypto capital of the planet” and establish a “Bitcoin national stockpile.”

With the incoming administration, there is growing anticipation for Bitcoin-friendly policies. Lummis has collaborated with New York Senator Kirsten Gillibrand to draft legislation that would create a regulatory framework for digital assets, potentially rolling out in 2025.

While the proposal has sparked enthusiasm, some experts remain skeptical. Critics point out that bitcoin’s price volatility could pose risks to national reserves. Others argue that relying on an unregulated digital asset as a strategic reserve might not align with traditional financial principles.

Jennifer J. Schulp, who leads financial regulation research at the Cato Institute’s Center for Monetary and Financial Alternatives, expressed confusion and doubt.

She stated, “It’s still putting government money on the line, and bitcoin has not shown itself to be a particularly stable asset. The bill asks senators and members of Congress, who may not understand crypto that well, to make a much bigger leap of faith in terms of its long-term viability.”

Moreover, transitioning from gold to bitcoin would mark a significant shift in the government’s approach to asset management, requiring careful planning and execution.

Investor and asset manager Anthony Pompliano recently claimed that sovereign governments worldwide are competing to acquire bitcoin, viewing the multi-billion-dollar cost as a relatively minor expense.

He said, “The national debt increased by $850 billion in the last 90 days. If we were to try to put that same $850 billion into Bitcoin, that is about half of the current market cap. So, we’re talking about 50-100 billion dollars. And I think that it is well worth the risk-reward.”

In addition to her reserve proposal, Lummis is championing legislation to protect Bitcoin users’ property rights.

She advocates for self-custody and wallet security, ensuring individuals maintain control over their assets. she emphasized that Bitcoin’s strength lies in its decentralization and accessibility, opposing any form of government monopolization.

Lummis’ proposal has sparked a heated debate about the role of Bitcoin in national financial strategies. Whether the U.S. government adopts her plan remains to be seen, but it undeniably marks a turning point in how policymakers view digital assets.

She highlighted that it’s time to explore innovative solutions, and Bitcoin is one of them.

As the bitcoin market continues to evolve, Lummis’ vision represents a bold step into a digital future that could reshape the global financial landscape.