Renowned Bitcoin enthusiast and the editor-in-chief of Adamant Research, Tuur Demeester, has provided insights into the potential dynamics of the upcoming Bitcoin bull market. He cites zombie banks bailouts as the reason behind a potential remarkable surge in bitcoin’s price. He projects it will reach between $200,000 and $600,000 per coin by the year 2026.

Zombie Banks and Retail Investors: Driving Force

Unlike many bitcoin bulls who emphasize institutional involvement, Demeester places significant emphasis on the awakening of retail investors as a driving force behind the anticipated rally. However, his optimistic outlook comes with a cautionary note:

“Keep in mind one of the most important lessons in bitcoin: be careful with debt and potential overexposure, because its volatility will easily give you whiplash.”

According to Demeester, this predicted level is fueled by trillions in cash from various “bailouts and stimulus programs” of “all zombie banks.” He believes that this global bailout would set the stage for an extraordinary 4-12x rally for bitcoin.

Interestingly, Demeester introduces the possibility of the ongoing bull cycle unfolding in two distinct phases, similar to the pattern observed in 2013. This potential dual-phase situation could extend the overall cycle duration, distinguishing it from the comparatively shorter rallies witnessed in 2017 and 2021.

Notably, in December 2023, Demeester, a seasoned figure in the digital asset space with a substantial following of 264,000 on X, projected this bitcoin cycle to conclude at $120,000. The accuracy of his previous forecasts, including foreseeing the end of the 2021 bull rally two years ago prior to bitcoin reaching $69,000, lends credibility to his current projections.

Schiff Cries ‘Pump-and-Dump’ Doubt

As BTC recently surpassed the $50,000 mark, bullish sentiments permeated the entire market. However, not all industry figures share Demeester’s optimism. Prominent Bitcoin critic Peter Schiff dismisses recent price movements as a “pump and dump” scheme, underscoring concerns about bitcoin’s volatility. He states:

“It looks like another classic pump-and-dump is going on with bitcoin and the ETFs. There’s a lot of hype surrounding the newly listed Bitcoin ETFs. I wonder when the massacre will begin.”

This is not the first time the renowned gold lover has spoken against bitcoin. In January, he shared his belief that bitcoin lacks inherent value and described it as a creation with artificial scarcity.

Notably, if bitcoin experiences a downturn but holds above $44,000 support, it may indicate a period of healthy consolidation before another upward movement. Conversely, breaching this support level might lend credence to Schiff’s critique, triggering a broader sell-off in the market.

Bitcoin Market Trends

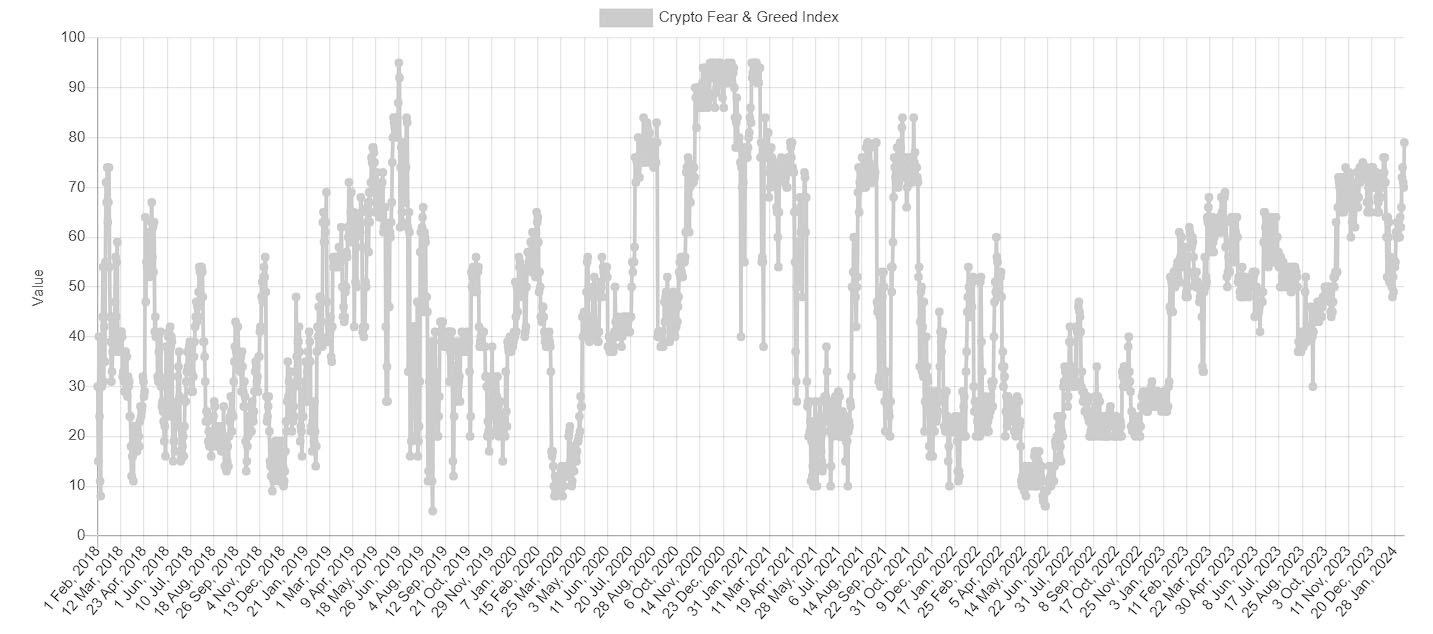

Meanwhile, bitcoin experienced a 1.69% price drop on Tuesday after surpassing the crucial $50,000 level on February 12. This decline coincided with the Fear and Greed Index reaching 79, a level not witnessed since Bitcoin achieved its all-time highs in November 2021.

Despite a slight setback, the digital asset has demonstrated a robust rally in recent months, contributing to a 13% increase in its value year-to-date.