The Depository Trust and Clearing Corporation (DTCC) has made it clear that it will not assign any collateral value to Exchange-Traded Funds (ETFs) with exposure to Bitcoin or other digital assets. This means that these investment instruments will not be eligible for collateral, impacting their use in financial transactions and credit facilities.

The DTCC is a financial services company that provides clearing and settlement services for the financial markets. It’s essentially a central securities depository and a clearinghouse for various financial transactions, including stocks, bonds, options, and derivatives.

The DTCC’s move concerning Bitcoin-linked ETFs has attracted the attention of the Bitcoin community. This decision, announced recently, has significant implications for investors in the Bitcoin market.

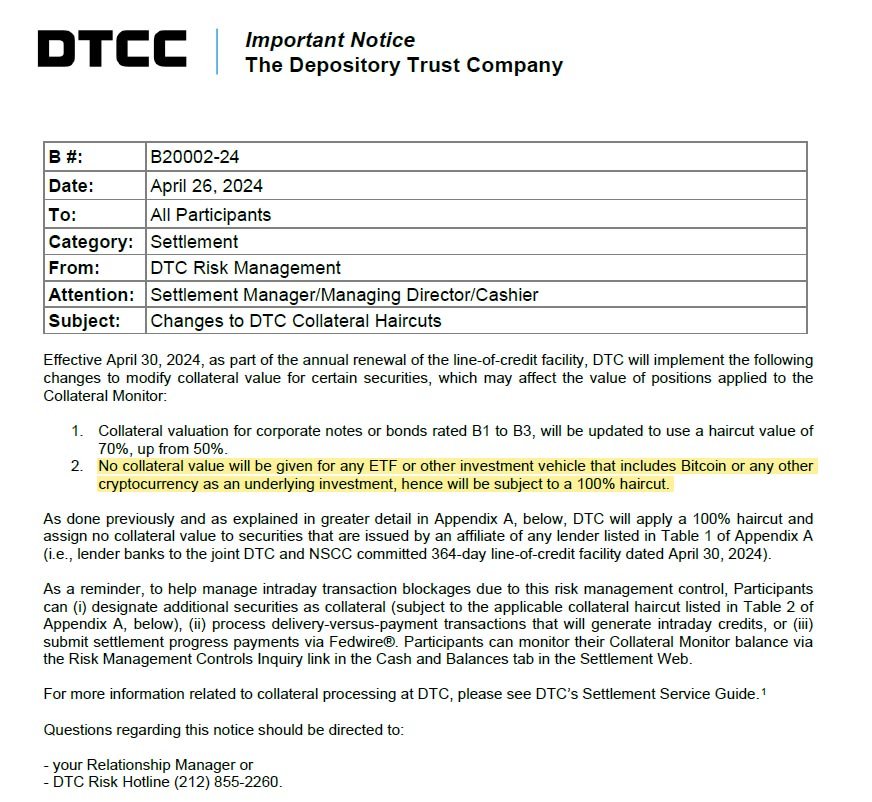

DTCC’s Announcement

According to DTCC’s notice, effective April 30, 2024, ETFs with digital asset exposure will face a 100% reduction in their collateral value. This decision, part of DTCC’s annual review, aims to “mitigate risks” associated with these assets within the financial system.

The announcement declared that ETFs or comparable investment vehicles containing Bitcoin or other digital currencies as underlying assets will not receive any assigned collateral value.

Custodia Bank CEO Caitlin Long, hailed this decision, expressing on platform X:

“I have no problem with this because it reduces the leverage-based financialization games that WallSt could have played (& upon which TPTB would have blamed Bitcoin for the inevitable problems even tho they’d have had nothing to do with Bitcoin itself).”

Bitcoin ETFs’ Collateral Value: Impact on Financial Institutions

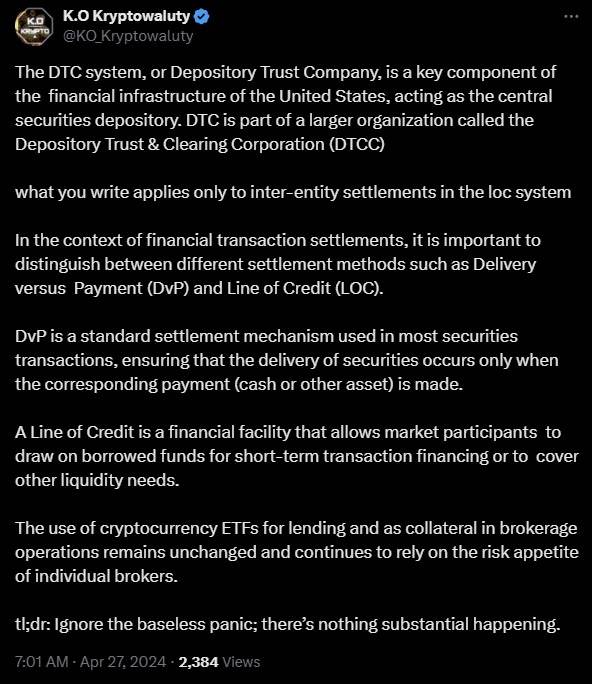

The DTCC’s decision has sparked discussions about its potential impact on financial institutions and brokerage activities. While DTCC’s move restricts the use of digital-asset ETFs as collateral within its system, it does not universally prohibit their use in all financial transactions.

Digital currencies enthusiast K.O. Kryptowaluty emphasized that despite DTCC’s stance, individual brokerage firms may still choose to accept Bitcoin ETFs as collateral based on their risk management strategies.

K.O. Kryptowaluty added that the utilization of Bitcoin ETFs for lending purposes and as collateral in brokerage operations will persist, contingent upon the risk tolerance of each individual broker.

Investor Sentiment and Market Trends

The introduction of spot Bitcoin ETFs in the United States has garnered significant attention from institutional investors. Within just three months of their launch, these ETFs have accumulated over $12.5 billion in funds, indicating a growing acceptance of Bitcoin in traditional financial markets.

The total Assets Under Management (AUM) of all bitcoin ETFs, including Grayscale Bitcoin Trust, currently stand at over $53 billion.

However, recent trends suggest a slowdown in net inflows to Bitcoin ETFs. While the introduction of the ETFs was met with enthusiasm, the overall increase in investments has tapered off in recent times.

Multiple ETF issuers have reported significant outflows, indicating a potential shift in investor sentiment or market conditions.

Expert Analysis and Predictions

Analysts have weighed in on the DTCC’s decision, offering insights into its potential ramifications. Some analysts have raised concerns about liquidity issues that could arise as a result of banks reducing their exposure to bitcoin ETFs.

Bitcoin analyst HodlMagoo, mentioned that the DTCC’s decision may lead to banks backing ETFs and bitcoin to either sell off their assets or decrease their involvement in corporate bonds.

Conclusion

The DTCC’s decision regarding Bitcoin-linked ETFs marks a significant development in the digital assets market. While it may pose challenges for some investors and financial institutions, it also underscores the growing integration of Bitcoin into traditional finance.

As the Bitcoin landscape continues to evolve, it is essential for investors to stay informed and adapt to changing regulations and market dynamics. Despite challenges, the long-term outlook for Bitcoin remains optimistic, driven by increasing institutional interest and adoption.