In a recent interview with CNBC, Jay Clayton, the former chairman of the United States Securities and Exchange Commission (SEC), expressed confidence in the imminent approval of a Spot Bitcoin Exchange-Traded Fund (ETF).

Clayton, who served as the SEC chair from May 2017 to December 2020, believes that the Bitcoin Spot ETF approval is now “inevitable,” highlighting the evolution of market dynamics and improved infrastructure supporting Bitcoin.

He stated:

“I think approval is inevitable. There’s nothing left to decide.”

This shift in sentiment comes after a decade of consistent denials by the SEC, citing concerns over market manipulation and fraudster activities.

Market Dynamics Transformation

For the past ten years, the SEC has consistently rejected applications for Spot Bitcoin ETFs, citing various risks associated with the developing market. However, Clayton acknowledged the significant improvements in underlying market dynamics over the last five years. He pointed out that issues like “wash sales and laddering,” which posed risks to the general public, have substantially diminished, paving the way for regulatory approval.

He added:

“Five years ago, there were wash sales, there was laddering, there were all sorts of things that you wouldn’t want to make available to the general public because of that risk.”

Infrastructure Advancements

Clayton commended the progress made in the digital asset space, specifically noting the strides in infrastructure development. He emphasized that until recently, there was a lack of adequate infrastructure for the proper custody and secure trading of bitcoin, especially for traditional financial market participants.

The former SEC chair applauded the regulator for reaching a point where it is comfortable with the disclosure practices of major firms such as BlackRock and Fidelity involved in Bitcoin ETFs.

Beyond the realm of digital asset markets, Clayton highlighted the significance of blockchain technology in tokenizing and trading real-world assets. He emphasized that the approval of a Spot Bitcoin ETF marks a substantial step forward not just for Bitcoin but for the finance industry as a whole.

“This is a big step, not just for Bitcoin, but for finance generally. If you can tokenize underlying assets and trade that way. That’s a potential significant change across finance, not just in the ‘crypto space,’” stated Clayton.

Bitcoin Spot ETF: Amended Filings

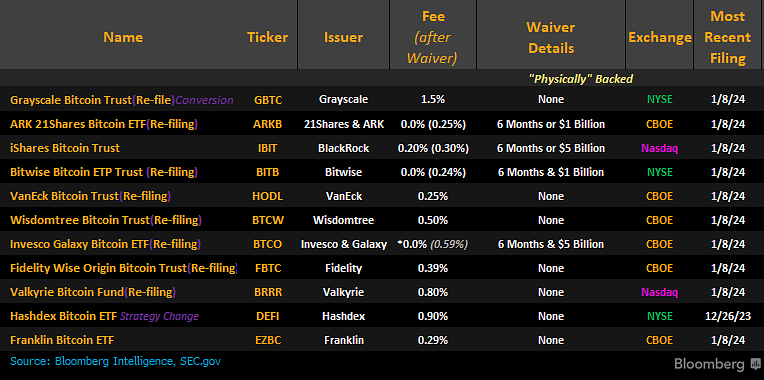

On January 8, a surge of amended S-1 and S-3 filings from prospective Bitcoin ETF issuers flooded the SEC. These filings disclosed the fees that issuers intend to charge upon approval.

Renowned Bloomberg ETF analysts, James Seyffart and Eric Balchunas, interpreted this surge as a sign of the regulator accelerating the approval process, placing the likelihood of a Spot Bitcoin ETF approval at 90% by January 10. Seyffart dismissed any potential delays by stating:

“This is true, comments came back on those S-1 documents with the fees that we all went crazy over this morning (this isn’t out of ordinary). Expect to see more amendments tomorrow because of this. That said — I don’t think this is necessarily a delay signal.”

Conclusion

As the Bitcoin community awaits the SEC’s decision, Jay Clayton’s optimistic stance on the inevitability of a Spot Bitcoin ETF approval signals a significant shift in regulatory sentiment. The evolving market dynamics and improved infrastructure have seemingly convinced the former SEC chair that the time is ripe for embracing a new era in digital asset investment through ETFs.