The Federal Reserve’s plans for interest rate cuts are facing uncertainty amidst stubborn inflation, as recent data challenges initial expectations. Bitcoin analysts and investors are closely watching the evolving economic landscape around Fed rate cuts 2024, pondering the implications for the market. This article analyzes different narratives about the inflation and the anticipated rate cuts, hoping to bring to light what lies ahead in the current complex economic landscape.

Fed Rate Cut 2024: Challenging Persistent Inflation

Recent reports reveal a persistent challenge to the Federal Reserve’s anticipated rate-cut plans. The U.S. Consumer Price Index (CPI) surged unexpectedly, climbing to 3.5% in March, unsettling financial markets. This unexpected rise as highlighted by the Bureau of Labor Statistics, was primarily driven by increases in housing and fuel costs, prompting concerns about prolonged high interest rates.

Evan Brown, who serves as the portfolio manager and oversees multi-asset strategy at UBS Asset Management, expressed:

“We’re having a number of clients ask us, ‘why is the Fed going to cut rates at all?’ That’s really picked up over the last month or so.”

Brown emphasized Jerome Powell’s consistency in prioritizing inflation over growth and a strong labor market when considering rate cuts. As long as Powell maintains this stance, Brown suggests that rate cuts should still be anticipated.

Jon Day, who serves as a portfolio manager at Newton Investment Management, stated, “The vast majority of people I speak to don’t think inflation will come back to 2 percent sustainably, we think central banks are being too dovish.”

Lara Rhame, a US economist at FS Investments, stated:

“Ten-year yields are drifting higher. I think they’ll retest 5% over the course of the year, I don’t think we’ll see a program of rate cuts — say, once a quarter — but a more surgical, nip-and-tuck approach,”

Mike Riddell, who serves as a bond fund portfolio manager at Allianz Global Investors, said, “If the recent trend of higher energy and commodity prices continues, then it has the potential to cause a rerun of the 2022 financial market environment, which was a grim time for bonds and risk assets alike.”

The “bear market of 2022” was a specifically hard time for bitcoin investors. The effects of stimulus just became realized, and it was coupled with bankruptcy of several digital asset exchanges and lenders like FTX and 3 Arrows Capital. Those effects brought bitcoin price from the highs of $69,000 to around $16,000.

Market Reaction Reflects Concerns

The release of the CPI data triggered a notable market reaction, with equity futures and digital assets values experiencing downturns. Bitcoin plummeted around 4% to $67,527, while precious metals also saw declines. This reaction underscores market apprehensions regarding the potential impact of heightened inflation on monetary policy.

Market analysts and economists are carefully assessing the implications of the CPI data on the Federal Reserve’s rate-cut plans. George Lagarias, chief economist at Mazars, highlighted the uncertainty, stating:

“Personally, I wouldn’t be surprised if we saw less rate cuts and pushed more towards the end of the year. This is a strong economy. Make no mistake, it is backed by debt and somewhat by overburdened credit cards, but it is a strong economy. So the Fed will struggle to find the case to cut rates soon.”

Fed Officials Reevaluate Rate-Cut Expectations

Federal Reserve officials are reevaluating their expectations for rate cuts in light of the persistent inflationary pressures. Minneapolis Fed President Neel Kashkari acknowledged the possibility of no rate cuts if inflation continues to remain elevated. This sentiment aligns with a growing skepticism among Fed officials regarding the feasibility of rate cuts in the current economic environment.

Richmond Fed President Thomas Barkin told Reuters that continued poor data after strong January and February results could prompt significant changes.

Barkin said:

“I don’t think any one month should make that much of a difference. if you get another month that looks like January or February, that takes you in a very different direction in terms of how forward-leaning you are.”

It’s worth mentioning that in a November speech, Fed Governor Christopher Waller hinted that the Central Bank might soon cut rates to address declining inflation, possibly within months. He stated, “Something appears to be giving, and it’s the pace of the economy.”

He emphasized the slowing pace of economic growth as a significant factor. However, Waller also emphasized that there is no immediate need to lower interest rates and advocated for maintaining the current rate for a longer period to support sustainable inflation towards the target of 2%.

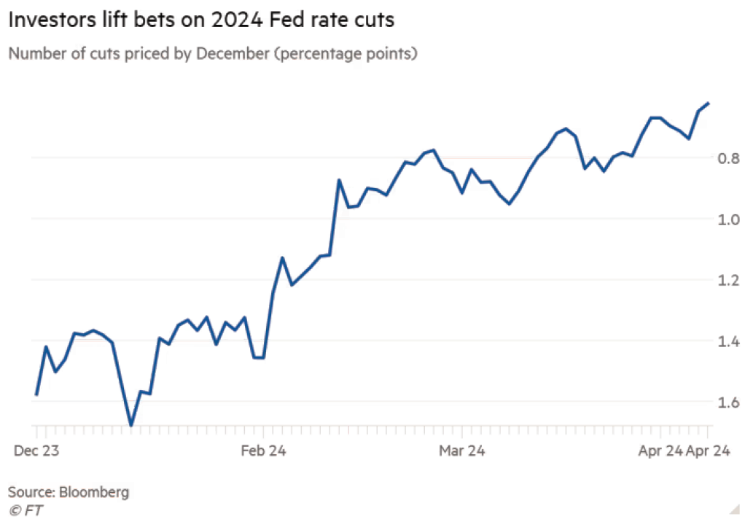

Shift in Market Sentiment

Market sentiment has shifted in response to the evolving economic landscape. Investors have adjusted their expectations, with the probability of rate cuts in June and July dropping below 50% according to the CME’s FedWatch tool. This shift reflects growing uncertainty regarding the timing and magnitude of potential rate cuts.

George Lagarias highlights the current precarious position of the Fed, emphasizing:

“The Fed has been punishing itself ever since 2021 when ‘team transitory’ ostensibly got it wrong. What they feel is that they can’t get it wrong again, which means that they’re more likely to err on the side of caution […] They do have some room to cut, but they don’t want to get it wrong. They do not want to be the Fed that cut rates as inflation kept beating expectations. So they want to see more data toward the right direction and they are willing to wait.”

Karen Dynan, a Harvard economics professor and non-resident fellow at the Peterson Institute for International Economics, highlights the changes in inflation, stating:

“When you start to see month after month of inflation not falling, and tipping up if you look at the six-month changes, I think that has given the Fed pause […] There has been a change in sentiment […] when you rely on a whole bunch of special stories breaking your way, it is not a comfortable place.”

Economists Divided on Rate-Cut Outlook

Economists remain divided on the outlook for rate cuts, with speculation ranging from no cuts to expectations of multiple cuts. Torsten Slok, chief economist at Apollo Global Management, expressed skepticism, stating:

“The Fed is not done fighting inflation and rates will stay higher for longer. We are sticking to our view that the Fed will not cut rates in 2024.”

However, others, like Goldman Sachs Chief Economist Jan Hatzius, anticipate rate cuts based on the Fed’s previous signals, stating, he would “expect some rate cuts based on what Chair Powell and other Fed officials have said.” He indicated that the likelihood of rate cuts this year depends on upcoming data and the Federal Reserve’s response. However, based on their forecast, he would be very surprised if rate cuts didn’t occur.

Fed Chair Jerome Powell said last week that “it is too soon to say whether the recent readings represent more than just a bump”. Last week, Roger Ferguson, the former Vice Chairman of the Federal Reserve, shared with CNBC his perspective, suggesting a 10%-15% likelihood of interest rates remaining unchanged throughout the year.

Impact on Monetary Policy

The unexpected rise in inflation has significant implications for monetary policy decisions. David Russell, Global Head of Market Strategy at Tradestation, highlighted the challenge, stating:

“Everyone was looking for shelter costs to come down but they’re not cooperating, we have a strong economy, with tight inventories and pricing power for companies. That’s now turning into a double-edged sword, making inflation stickier than we hoped. Rate cuts could be out the window.”

All these narratives paint an uncertain picture, with the Federal Reserve facing the delicate task of balancing economic growth with inflationary pressures, and navigating a complex and uncertain economic landscape.

Conclusion

As inflation continues to defy expectations, uncertainty looms over the Federal Reserve’s rate-cut plans. Market analysts, economists, and policymakers are closely monitoring economic indicators, assessing the potential impact on monetary policy decisions. The evolving situation underscores the importance of data-driven decision-making in navigating the complexities of the current economic environment.