On August 23, bitcoin experienced a 7% surge, reaching nearly $65,000.

This significant jump, which has sparked widespread interest and speculation, was reportedly driven by two major developments: the U.S. Federal Reserve hinting at possible interest rate cuts and Robert F. Kennedy Jr.’s unexpected endorsement of former President Donald Trump.

Federal Reserve Chair Jerome Powell’s speech at the annual Jackson Hole symposium in Wyoming was the first catalyst for bitcoin’s rise.

Powell hinted that the central bank might soon cut interest rates, a move that many believe would signal the beginning of a more accommodating monetary policy. This possibility immediately caught the attention of investors, leading to a surge in demand for bitcoin.

“The time has come for policy to adjust,” Powell said during his speech, indicating that the Federal Reserve is more confident that inflation is under control and that the economy might soon benefit from lower interest rates.

This statement was music to the ears of bitcoin investors, who have long viewed the digital asset as a hedge against inflation and economic uncertainty.

Powell added:

“The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

He also added that while some believe controlling inflation would require a recession and high unemployment, this scenario now seems unlikely. He noted that the risks of rising inflation have decreased, and the risks to employment have increased.

He highlighted that the Fed does not want or anticipate further weakening of the labor market. Powell emphasized that efforts to manage demand and stabilize expectations have been effective, putting inflation on a sustainable path towards the 2% target.

Interest rate cuts generally lead to a weaker U.S. dollar, making alternative assets like bitcoin more attractive to investors.

When the dollar weakens, assets priced in dollars—like bitcoin—tend to increase in value. Lower interest rates also reduce the yield on traditional savings and bonds, pushing investors to seek higher returns elsewhere, often turning to riskier assets like bitcoin.

Leena ElDeeb, a research associate at 21Shares, explained the relationship between rate cuts and bitcoin, stating: “Generally, a rate cut bodes well for risk-on assets, which have historically enjoyed the expansion of investor appetite as borrowing costs decrease.”

She added that Powell’s remarks “reassured that it’s time for the Fed’s policy to change provided that upcoming economic data comes in about as expected.”

This anticipation of a more favorable economic environment for bitcoin led to a notable increase in its price. On the day of Powell’s speech, bitcoin’s price surged by almost 7%, touching the $65,000 mark for a brief time.

Currently, markets are increasingly optimistic that the Federal Reserve will relax its stance on combating inflation, having maintained its benchmark interest rate unchanged since July 2023.

As it stands, traders estimate a 32% likelihood that the Fed will lower rates by 0.50% in September, with a 67% probability of a 0.25% rate cut, based on data from CME Fedwatch.

While Powell’s speech laid the groundwork for bitcoin’s surge, Robert F. Kennedy Jr.’s sudden political move added fuel to the fire.

On August 23, Kennedy, who had been running an independent campaign for the 2024 U.S. presidential election, announced that he was suspending his campaign and endorsing Donald Trump.

This endorsement came as a surprise to many, given Kennedy’s long-standing association with the Democratic Kennedy family and his earlier critiques of Trump.

However, Kennedy’s decision was strategic. He explained that staying in the race as an independent candidate could split the vote and inadvertently help the Democratic ticket, which he opposes on several key issues.

Kennedy’s endorsement of Trump is significant for the Bitcoin market because both politicians have expressed support for Bitcoin.

Kennedy, during his campaign, was a vocal advocate for Bitcoin, even suggesting that the U.S. Treasury should hold bitcoin as a strategic asset. His alignment with Trump, who has also shown interest in Bitcoin, suggests that a future Trump administration might pursue more pro-Bitcoin policies.

Kennedy noted:

“I’m not terminating my campaign, I’m simply suspending it. Our polling consistently showed by staying on the ballot in the battleground states, I would likely hand the election over to the Democrats, with whom I disagree on the most existential issues.”

Kennedy’s endorsement of Trump had an immediate and noticeable impact on bitcoin. This surge reflects the market’s optimism that a Trump administration, bolstered by Kennedy’s support, could be more favorable towards Bitcoin.

Kennedy’s move was not without controversy. Several members of his family, including five of his siblings, publicly criticized his endorsement of Trump, calling it a betrayal of their father’s values.

Despite this backlash, Kennedy’s decision was welcomed by much of the Bitcoin community, which views his support as a positive development for the industry.

The combined effects of Powell’s speech and Kennedy’s endorsement created a perfect storm that sent bitcoin soaring.

Investors, already buoyed by the prospect of lower interest rates, were further encouraged by the political developments, leading to a sharp increase in demand for bitcoin.

On August 23, the Coinbase Premium Index, which tracks the price difference between bitcoin on Coinbase Pro and Binance, spiked to its highest level since mid-July.

This surge in the index indicates a significant increase in buying pressure from U.S. investors, reflecting growing confidence in bitcoin’s future.

Julio Moreno, a market analyst at CryptoQuant, noted that, this increase in demand was connected to the Federal Reserve’s indications that a period of lower interest rates was about to start.

This optimism was shared by other analysts who pointed to historical patterns where similar shifts in market sentiment have preceded major bitcoin bull runs.

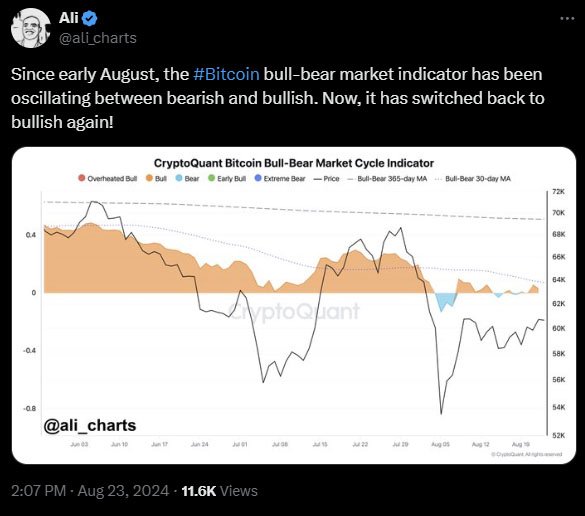

Trader and analyst Ali Martinez also highlighted a key market indicator that recently turned bullish after fluctuating between bearish and bullish zones. Martinez suggested that this shift could signal a potential major breakout for bitcoin, adding to the growing sense of optimism among investors.

As Bitcoin nears the $65,000 mark, the question on everyone’s mind is: What’s next? The combination of economic signals and political developments has created a bullish environment for bitcoin, but the future remains uncertain.

Much will depend on the Federal Reserve’s actions in the coming months.

If the Central Bank follows through on Powell’s hints and begins cutting interest rates, we could see continued upward momentum for bitcoin. However, if the economic data does not support a rate cut, or if inflationary pressures re-emerge, the market could see increased volatility.

Similarly, the political landscape will play a crucial role in Bitcoin’s future.

Kennedy’s endorsement of Trump has injected new energy into the market, but the outcome of the 2024 presidential election will be a critical factor in determining the regulatory environment for Bitcoin in the U.S.