Financial services giant Fidelity Investments’ digital asset arm, Fidelity Digital Assets, has recently released a comprehensive report aimed at debunking common misconceptions around Bitcoin.

The report, titled “Revisiting Persistent Bitcoin Criticisms,” underscores the growing acceptance and institutional interest in digital assets, particularly Bitcoin. It takes on various criticisms and misconceptions that have persisted in the community, providing detailed explanations and data to counter these concerns.

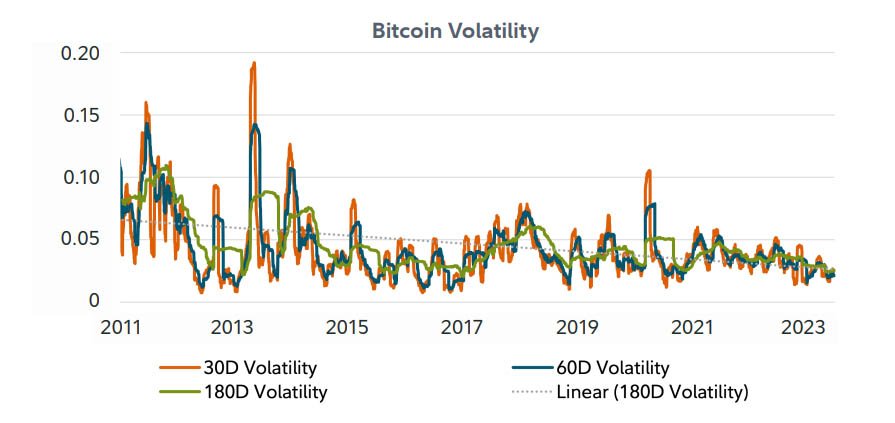

Fidelity Digital Assets on Bitcoin’s Volatility

Responding to bitcoin’s volatility concern, Fidelity stated that the high volatility is a “trade-off for perfect supply inelasticity and an intervention-free market.” The report explains that as the adoption of bitcoin-related derivatives and investment products increases, its volatility will continue to decrease. It reads:

“The day-to-day volatility could decline over time with increasing spot and derivative market liquidity and the development of products that allow investors to express interest in bitcoin in different ways, leading to greater ownership and participation.”

Bitcoin Shouldn’t Be Compared to Legacy Payment Processors: Fidelity

Interestingly, Fidelity also responded to the criticism that Bitcoin has failed as a means of payment. Generally, critics argue that Bitcoin’s base layer currently lacks the transaction throughput of traditional payment systems like Visa, Mastercard, or PayPal. However, Fidelity points out that comparing Bitcoin to legacy processors isn’t a fair comparison.

The report pointed out that traditional payment systems may take days to provide a final settlement. On the other hand, Bitcoin, which indeed has a lower transaction speed of five to seven transactions per second (TPS), provides immediate and final settlement.

Fidelity Digital Assets cited data from Coin Metrics, which demonstrates substantial transaction volume on the Bitcoin network, with over $3.1 trillion in settled transactions. This is an impressive 40% of what Mastercard processed in the last year.

Bitcoin’s Environmental Impact: Is It Really a Concern?

Commenting on Bitcoin mining’s environmental impact, the report stated that most of the mining activities are powered by renewable energy or energy that would otherwise be wasted.

Notably, a 3rd Global Cryptoasset Benchmarking Study conducted by the Cambridge Center for Alternative Finance (CCAF) highlights that around 76% of Bitcoin miners use renewable energy sources in their energy mix.

Similarly, a report by CoinShares estimates that as of Q4 2022, around 58.9% of the Bitcoin mining energy mix constitutes renewable energy sources. Fidelity underscored the noteworthy presence of renewable energy within the Bitcoin mining sector, reinforcing its commitment to sustainable and environmentally responsible practices.

Regulatory Developments in the Bitcoin Space

The financial giant also reacted to the growing regulatory scrutiny in the Bitcoin industry. It believes that the increased regulation can actually be a positive sign of adoption and value for Bitcoin. Fidelity argues:

“If bitcoin did not have any value and was destined to fade into obscurity, then there would be no need to regulate it.”

The report states that Bitcoin’s technology, much like the Internet and other decentralized technologies, is resilient and cannot be easily stopped. Nevertheless, the lack of clear regulations could significantly impede adoption and development, which is a concern for investors.

Bitcoin Community’s Reaction

The release of Fidelity’s report has not gone unnoticed by the Bitcoin community. A Reddit thread discussing the report has garnered significant attention and appreciation.

Reddit users pointed out that a financial giant of Fidelity’s stature dedicating a separate arm to digital assets and solely supporting Bitcoin signifies its strong commitment to the digital money. This institutional support and endorsement is seen as a bullish sign for Bitcoin’s future.

Related reading: