As the competition among spot Bitcoin ETF issuers rises, California-based investment management firm Franklin Templeton has slashed the fees for its Bitcoin Exchange-Traded Fund (ETF).

This reduction in Franklin Templeton Bitcoin ETF fees, from 0.29% to 0.19%, positions the asset manager’s ETF as the most cost-effective among the slew of new investment products introduced on U.S. exchange platforms.

Franklin Templeton Bitcoin ETF Beats Bitwise

The decision to lower the fees was announced in a filing with the Securities and Exchange Commission (SEC) on Friday, showcasing the company’s proactive approach to staying ahead in the dynamic world of digital asset investments. With this 10 basis-point reduction, Franklin Templeton’s Bitcoin ETF now outshines Bitwise, the previous holder of the lowest fee title, with a fee of 0.2%.

Recognizing the significance of every basis point in this highly competitive space, providers are gearing up for fierce competition, as the ETFs received approval from the SEC on January 10. Notably, the second-place holder, Bitwise, also recently reduced its fees from 0.24% to 0.2%. In comparison, other major players like ARK Invest charge 0.21%, while VanEck, Fidelity, BlackRock, and Valkyrie all charge 0.25% fees.

Additional Fee Waiver

Adding to its appeal, Franklin Templeton has announced a fee waiver for its ETF until August 2, 2024, or until the fund achieves assets under management (AUM) of $10 billion, whichever comes first. This move enhances the fund’s attractiveness to potential investors and could potentially expedite its growth in the market. The introduction of Bitcoin ETFs has sparked significant investor interest, leading to substantial trading volumes.

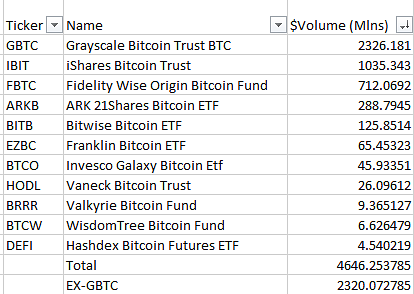

On the debut day of these funds, they collectively generated an impressive $4.6 billion in trading volume, indicating a robust appetite for digital assets within the investment community. Notably, spot Bitcoin ETFs contributed around $721 million to this overall trading volume.

Increasing Competition

The move by Franklin Templeton to lower fees and provide a fee waiver underscores the intense competition in the spot Bitcoin ETF market. As more providers enter the space with their offerings, the battle for market share is expected to intensify, resulting in further fee reductions and the introduction of innovative features aimed at attracting investors.

Bitcoin investor Pomp recently predicted massive PR wars, TV commercials, newspaper takeovers, Super Bowl ads, and CEO appearances in the media.

On a similar note, Bloomberg’s ETF analyst Eric Balchunas recently highlighted the cost factor, stating that spot Bitcoin ETFs would incur much lower trading costs compared to major digital asset exchanges like Coinbase, which charge significantly higher trading costs, reaching up to 0.6%, depending on factors such as transaction size and trading pairs.

The fee reductions by Franklin Templeton and other providers reflect their confidence in the digital asset market’s long-term viability and potential for growth. The resulting competitive landscape not only benefits investors by encouraging providers to improve their products and services continuously, but also puts pressure on them to differentiate themselves and deliver value to their clients.