The Bitcoin world has been buzzing with recent developments surrounding FTX, one of the major players in the market, and its significant influence on the Grayscale Bitcoin Trust (GBTC).

According to a Bloomberg report on January 22, “two people familiar with the matter” revealed that the estate of the unsuccessful digital asset exchange and Alameda Research hedge fund sold majority of its GBTC shares, potentially raising at least $600 million.

Other sources mention different numbers, some claiming FTX has sold its entire GBTC shares, which accounts for $1 billion of GBTC sales the week after Bitcoin ETF approval.

Massive Sell-Off of Grayscale Bitcoin Trust Shares

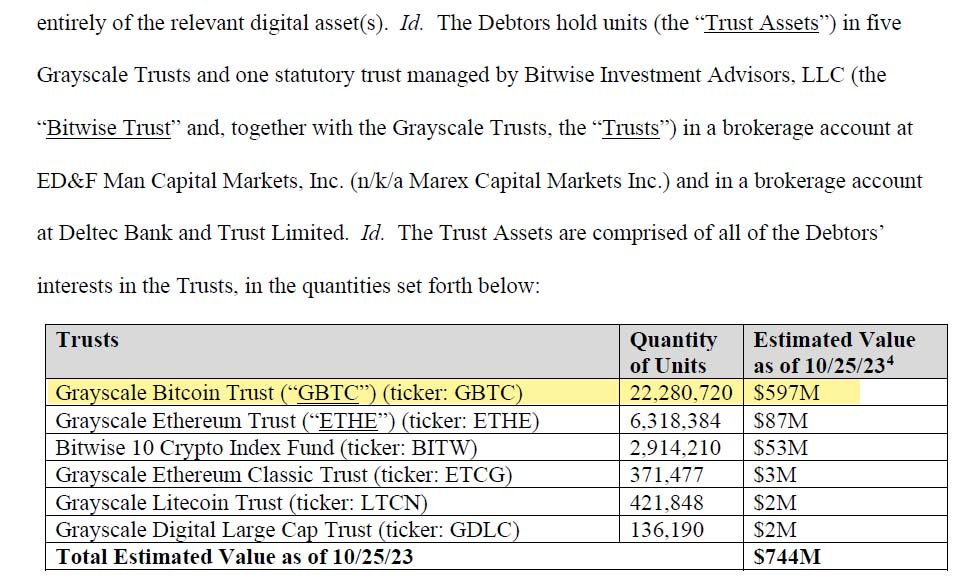

In this surprising turn of events, FTX’s bankruptcy estate executed a substantial sell-off of Grayscale Bitcoin Trust (GBTC) shares. Reports suggest that FTX sold approximately $1 billion worth of GBTC shares, comprising a staggering 22.28 million shares. This move played a pivotal role in the broader context of the digital asset market, especially considering the recent approval and launch of spot Bitcoin ETFs.

Understanding the Background

FTX’s involvement with GBTC dates back to October 25, 2023, when the firm held 22.3 million GBTC shares valued at $597 million. By January 11, 2024, the day spot Bitcoin ETFs commenced trading, FTX’s GBTC holdings had surged in value to around $900 million. However, the subsequent sell-off by the now defunct exchange bankruptcy estate took its GBTC ownership down to zero.

Redemptions for authorized participants opened on January 11, following United States Securities and Exchange Commission (SEC) approval for Grayscale Trust’s ETF conversion. As approval neared, GBTC’s discount narrowed to 1.55%, aligning share prices closely with Bitcoin’s value. GBTC is now just 0.27% below its net asset value.

The Impact on GBTC and Bitcoin’s Price

The mass exodus from GBTC, largely attributed to FTX’s sell-off, has resulted in outflows exceeding $2 billion. The timing of this sell-off coincided with the approval of spot Bitcoin ETFs by the SEC. Contrary to expectations, Bitcoin’s price experienced a decline instead of the anticipated surge triggered by ETF approval.

Price of bitcoin faced a harsh 18% drop since the approval of Bitcoin ETFs on January 10, falling from $49,000 to just below $40,000. Many analysts contributed this fall in price to the outflow of Grayscale Bitcoin Trust bitcoin reserves.

Massive GBTC Sale: Strategic or Unwise?

The exchange’s decision to sell off its substantial GBTC holdings was driven by a strategic move to capitalize on the disparity between the price of Grayscale trust shares and the net asset value of the underlying bitcoin. The sell-off, totaling $1 billion, accounted for nearly 40% of the total $2.5 billion in GBTC outflows since its conversion into an ETF.

With FTX’s holdings exhausted, GBTC may experience a potential easing of selling pressure. However, the aftermath has seen heavy outflows and a mass exodus of investors, challenging the optimistic narrative surrounding Bitcoin ETFs unlocking new inflows and institutional capital. The impact of FTX’s exit plan extends beyond GBTC, raising doubts about the effectiveness of Bitcoin ETFs in spurring adoption.

According to Bloomberg, John Hoffman, who serves as the managing director of sales and distribution at Grayscale, stated:

“It has only been a few days since GBTC launched as the world’s largest spot Bitcoin ETF. GBTC has been dominating trading volume, and has already solidified its role as a true capital markets tool for risk transfer in Bitcoin and has had the best performance of all spot Bitcoin ETFs since its launch. Broadly speaking, large capital markets ETFs are used in a variety of investing strategies, and we anticipate GBTC’s diverse shareholder base will continue to deploy strategies that impact inflows and outflows.”

Lawsuit and Ripple Effects

The exit strategy adopted by FTX prompted Alameda Research, its trading affiliate, to voluntarily dismiss a lawsuit against Grayscale alleging excessive fees. With FTX no longer holding a stake, the dynamics surrounding potential fee reductions and other legal matters have undergone significant changes.

Conclusion

The recent developments surrounding FTX and its role in the GBTC sell-off have added a layer of complexity to the evolving landscape of bitcoin investments. As the market continues to adapt to these shifts, investors and industry experts will closely monitor the repercussions on GBTC, Bitcoin ETFs, and the broader digital asset ecosystem. FTX’s strategic moves and their impact underscore the dynamic nature of the digital asset space, where even established entities can shape the market in unexpected ways.