In a recent analysis, VanEck adviser Gabor Gurbacs shared insights into the potential impact of Spot Bitcoin Exchange-Traded Funds (ETFs). He emphasized that while the initial market reaction might be modest, the long-term implications could lead to trillions of dollars flowing into the Bitcoin sector.

On December 31, Gurbacs highlighted the historical precedent set by gold ETFs and suggested that Bitcoin’s journey could be even more accelerated due to its unique characteristics.

Gabor Gurbacs Talks About Initial Impact and Historical Parallels

Gurbacs acknowledged that the initial impact of a Bitcoin ETF launch might be overestimated, anticipating net inflows of around $100 million, primarily sourced from “mostly recycled” funds of large institutional investors.

Related reading: 97% of Institutional Investors Optimistic About Bitcoin

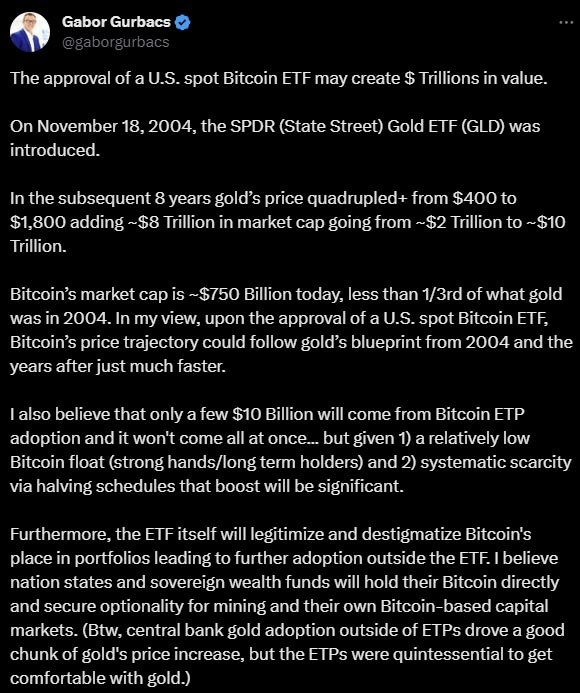

Drawing a parallel to the launch of gold ETFs on November 18, 2004, he pointed out that the eight years following the introduction of gold ETFs witnessed a more than fourfold increase in the price of gold, from $400 to $1,800. This surge propelled the total market capitalization of gold from $2 trillion to an astonishing $10 trillion within the same period.

Bitcoin, with its current market cap of $834 billion, represents around 41% of gold’s market capitalization in 2004, setting the stage for potential exponential growth if a similar trajectory unfolds. Gurbacs stated in a December 6 tweet:

“Bitcoin’s market cap is ~$750 billion today, less than 1/3rd of what gold was in 2004. In my view, upon the approval of a U.S. spot Bitcoin ETF, Bitcoin’s price trajectory could follow gold’s blueprint from 2004 and the years after just much faster.”

The capped supply of Bitcoin and scarcity-increasing events, such as the halving, contribute to its unique value proposition. This, coupled with institutional adoption, could send Bitcoin into a new realm of legitimacy and mainstream acceptance. The VanEck adviser writes:

“I also believe that only a few $10 Billion will come from Bitcoin ETP adoption and it won’t come all at once… but given 1) a relatively low Bitcoin float (strong hands/long term holders) and 2) systematic scarcity via halving schedules that boost will be significant.”

Analysts Agree with Gurbacs

Key industry figures, including Bloomberg ETF analysts Eric Balchunas and James Seyffart, concurred with Gurbacs. Seyffart highlighted the significance of looking beyond short-term metrics, urging a broader perspective to fully appreciate the long-term impact of such a groundbreaking financial product.

Joe Ayoub, co-founder of Rug.ai, echoed Seyffart’s sentiments, stating, “This phenomenon is much akin to tech bubbles. Overestimation of short-term impact, and underestimation of long-term impact. This inefficiency is a function of humans being myopic.”

Market commentators are actively discussing the potential outcomes of the anticipated SEC approval of a Spot Bitcoin ETF, with contrasting opinions on whether it will lead to a significant and lasting uptick in price or if it will result in a “sell the news” event.

Whether the initial influx is modest or substantial, the long-term legitimization and mainstream acceptance of Bitcoin appear to be the real driving forces behind the enthusiasm surrounding this imminent development.